Compelling investment opportunity in US data center market: Principal

Demand is growing at a faster rate than ever in the US, which makes up 50% of the global market

Nov 23, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Current tenant demand for data centers has never been stronger and is growing at an unprecedented rate. Investors have started to take notice and many are either doing their due diligence on the sector or have begun to find ways to increase their allocation to the data center space.

DEMAND OUTPACING SUPPLY

The unique phenomenon in the data center sector is that the demand driver is unlike any other.

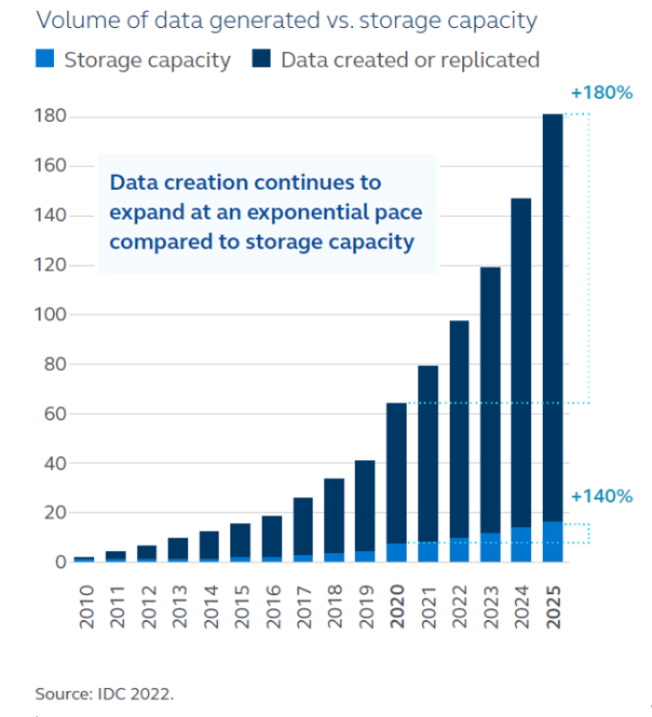

People and companies are requiring more data whether it be online activities like gaming or streaming, cloud computing or artificial intelligence. The portion of daily life that is data center-dependent is at an all-time high and is expected to grow.

The North American data center market has seen substantial growth in the past several years. In looking at the US, which makes up over half of the global data center market, supply has nearly doubled since the third quarter of 2020 while at the same time vacancy has dropped from over 10% to below 3%, as demand for this asset class remains very strong.

The figures show vacancy at 3-3.3%, depending on the source, and if you isolate the top 10 markets this quarter, that dips to 2.7%. At the same time, power growth has been at 11% in the top markets and absorption even hit a record 934 megawatts (MW).

Since 2015, the amount of commissioned data center space has grown by double digits every year. According to real estate market research firm Datacenterhawk, the market today stands at roughly 7,700 MW, whereas at year-end 2015, it was slightly more than 2,000 MW.

Additionally, it is projected that the amount of data created to date will be doubled within the next few years, which will continue to increase data center demand.

With the shortage of supply, many tenants are focused on how quickly they can deploy additional servers to provide data services to their customers.

As part of this, they are looking for larger lease requirements that will allow for the expected future growth in data storage and processing needs.

Additionally, in years past, data centers were often constructed as “powered shells” where the tenant completed all the associated build-out of the building.

With time-to-market being paramount, today’s market demand is focused on “turn-key” solutions, which allow the tenant to effectively roll in their racks of servers and begin operations.

In conjunction, both of these factors are creating significantly larger investments by the landlord into the data centers. However, the funding still pales in comparison to the investment the tenant is making into the networking and servers that will occupy the data center.

We are still in the early stages of the data center market. We expect to see a substantial increase in supply but also expect demand to continue to grow at an even faster rate. Data creates data and that has never been stronger than it is today.

By Casey Miller

He joined the firm in 1999. Previously, he was an assistant manager at Wells Fargo Financial. Casey received an MBA in business administration from Drake University and a bachelor's degree in business management from Waldorf College.

Jihyun Kim edited this article.

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)