Hyundai Heavy, Aramco form global hydrogen partnership

By Mar 03, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

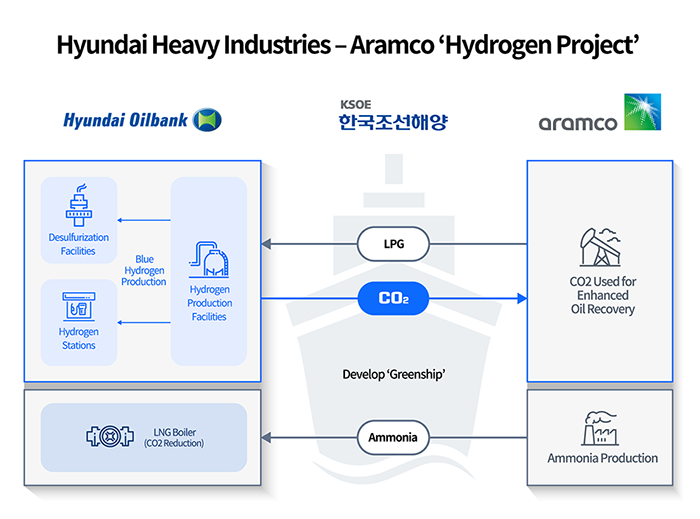

South Korea’s Hyundai Heavy Industries Holdings Co. and Saudi Aramco have agreed to launch a hydrogen partnership in a step toward building a greener business model.

The holding company of the world’s largest shipbuilder announced on Mar. 3 that the two companies signed an MOU to initiate a global project to produce hydrogen.

Under the agreement, Hyundai Heavy and Aramco will set up a series of business initiatives using hydrogen and ammonia, a compound of hydrogen and nitrogen that can be combusted without carbon dioxide emission, and jointly conduct relevant research in the area.

GROUP-WIDE TRANSITION TO GREENER FUTURE

Signed by Chung Ki-sun, senior vice president of Hyundai Heavy and Ahmad A. Al-Sa’adi, senior vice president of technical services at Aramco, the memorandum mobilizes key business segments of both companies.

First, Hyundai Heavy’s refining unit Hyundai Oilbank will import liquefied petroleum gas (LPG) from Aramco to produce blue hydrogen, a type of hydrogen with significantly reduced carbon emission using carbon capture and storage (CCS) technology.

Blue hydrogen can be used in desulfurization facilities for air pollution control, or as fuel for vehicles and power plants.

In turn, Hyundai Oilbank will supply CO2 generated in the production process to Aramco, which will utilize it for enhanced oil recovery (EOR) in Saudi oil fields. EOR is a practice that inserts CO2 to depleted oil fields to extract the remaining oil by storing the CO2 underground, thereby improving oil production.

Hyundai Heavy and Aramco also joined hands to develop an ammonia-fueled ship as well as a carrier that can simultaneously transport both LPG and CO2. Hyundai Heavy’s shipbuilding arm, Korea Shipbuilding & Offshore Engineering Co. (KSOE), will be in charge of building these two special vessels.

At the closer end of the supply chain, Hyundai Oilbank will create 300 hydrogen fueling stations across South Korea by 2040. Aramco will also provide blue ammonia to be used for Hyundai Oilbank’s LNG boiler to be established by 2024.

Aside from renewable energy, Hyundai Heavy has also been diversifying into other business sectors, including robotics and AI, steered by its Future Committee chaired by Chung and composed of approximately 30 young employees in their 30s.

CHUNG TIGHTENS HYUNDAI HEAVY’S STRONG TIES WITH ARAMCO

The new agreement marks another milestone in the long-standing partnership between the two global giants. The two companies kicked off a large-scale partnership in 2015 when they signed an MOU to cooperate in the shipbuilding and plant sectors, also driven by heir apparent Chung.

Chung received industry attention when he held a one-on-one business meeting with Saudi Arabian Prince Mohammed bin Salman during his visit to South Korea in 2019.

He commented that “this MOU is our first step toward the hydrogen dream both companies are imagining for the future. Hyundai Heavy Industries is set to become a leading group in the green energy sector using hydrogen and ammonia.”

Write to Man-Su Choe at bebop@hankyung.com

Daniel Cho edited this article.

-

Hydrogen tie-upHyundai, SK in hydrogen tie-up as part of $38 bn industry cooperation

Hydrogen tie-upHyundai, SK in hydrogen tie-up as part of $38 bn industry cooperationMar 02, 2021 (Gmt+09:00)

3 Min read -

IPO managersHyundai Heavy hires Korea Investment, 4 others as IPO managers

IPO managersHyundai Heavy hires Korea Investment, 4 others as IPO managersMar 02, 2021 (Gmt+09:00)

1 Min read -

Hydrogen tie-upHyundai Motor, POSCO steelmaking tie-up to develop hydrogen tech

Hydrogen tie-upHyundai Motor, POSCO steelmaking tie-up to develop hydrogen techFeb 23, 2021 (Gmt+09:00)

2 Min read -

Hydrogen energyHyosung, Linde to create world's largest liquid hydrogen plant

Hydrogen energyHyosung, Linde to create world's largest liquid hydrogen plantFeb 05, 2021 (Gmt+09:00)

1 Min read -

Hydrogen economySK Group inks $1.5 bn deal to acquire US hydrogen fuel cell maker Plug Power

Hydrogen economySK Group inks $1.5 bn deal to acquire US hydrogen fuel cell maker Plug PowerJan 07, 2021 (Gmt+09:00)

2 Min read