Foreign exchange

S.Korea plans $1.2 bn forex bond issue after presidential election

The issuance will likely serve as a bellwether for the country’s sovereign credibility under its new administration

By Apr 21, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea plans to issue up to $1.2 billion in foreign exchange stabilization bonds as early as June, in what would mark the new administration’s first foray into international capital markets following the country’s snap presidential election on June 3.

According to government officials and investment banking sources, the Ministry of Economy and Finance on Sunday distributed a request for proposal (RFP) to over 20 global investment banks, seeking lead managers for the upcoming foreign currency-denominated issue.

Commonly known as “forex stabilization bonds,” these instruments are used to raise funds for the country’s Foreign Exchange Equalization Fund, which is designed to support stability in the currency market.

The planned issuance – Korea’s first foreign currency fundraising this year – is expected to reach up to $1.2 billion, the current annual limit set for such bonds.

Proceeds will be used to refinance maturing debt: €800 million in euro-denominated bonds due in September and $400 million in dollar bonds maturing in November.

ISSUANCE LIKELY IN JUNE

The issuance is likely to take place in June or July, with market watchers speculating that the government will move quickly to issue the bonds soon after the early presidential vote.

Korea is set for an early presidential election, after former President Yoon Suk Yeol’s impeachment stemming from his short-lived martial law declaration on Dec. 3.

Analysts said the timing of the forex stabilization bond issue would provide a window to signal international confidence in the incoming administration.

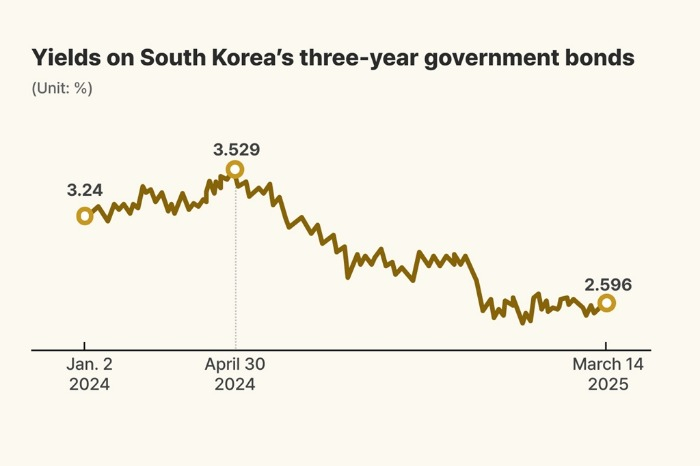

Dollar-denominated Korean forex stabilization bonds typically price over US Treasury yields of the same tenor, with the final spread determined largely by perceptions of sovereign credit risk.

South Korea holds a long-term foreign currency credit rating of AA from S&P Global Ratings – higher than those of Japan and China.

Last week, S&P reaffirmed Korea’s sovereign credit rating at AA, the third-highest on its sovereign ratings table, with a stable outlook, citing the country’s resilient economic fundamentals and prudent fiscal management despite global uncertainties.

Moody's Ratings has kept its sovereign credit rating of Korea at Aa2, its third-highest, while Fitch Ratings has Korea's rating at AA-, its fourth-highest.

BELLWETHER FOR INCOMING GOVERNMENT

Given its status as the first international bond sale under the incoming government, the planned forex bond issue is widely seen as a bellwether for the country’s sovereign credibility under its new leadership.

It is also expected to serve as a pricing benchmark for upcoming offshore issuances by Korean corporates and public institutions, amplifying its importance among global investors.

Market participants will be closely watching not only for pricing signals but also for how the deal is received amid volatile global markets and shifting risk appetites.

For the new administration, a smooth execution could bolster investor confidence and set the tone for future external financing, analysts said.

Write to Ik-Hwan Kim at lovepen@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Central bankBOK stands pat; rate cut likely within 3 months as economic growth slows

Central bankBOK stands pat; rate cut likely within 3 months as economic growth slowsApr 17, 2025 (Gmt+09:00)

4 Min read -

EconomyS&P reaffirms South Korea’s AA credit rating with stable outlook

EconomyS&P reaffirms South Korea’s AA credit rating with stable outlookApr 15, 2025 (Gmt+09:00)

1 Min read -

Sovereign wealth fundsKorea’s WGBI inclusion moved to next April; Seoul works on policy steps

Sovereign wealth fundsKorea’s WGBI inclusion moved to next April; Seoul works on policy stepsApr 09, 2025 (Gmt+09:00)

4 Min read -

Sovereign bondsForeigners return to Korean debt market; Korea on course to join WGBI

Sovereign bondsForeigners return to Korean debt market; Korea on course to join WGBIFeb 13, 2025 (Gmt+09:00)

3 Min read -

Debt financingKorea debt financing faces woes as $34 bn in corporate bonds mature in H1

Debt financingKorea debt financing faces woes as $34 bn in corporate bonds mature in H1Dec 25, 2024 (Gmt+09:00)

3 Min read -

Business & PoliticsSouth Korea’s sovereign credit rating stable: S&P, Moody's, Fitch

Business & PoliticsSouth Korea’s sovereign credit rating stable: S&P, Moody's, FitchDec 13, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN