Food & Beverage

Ediya to re-enter global café market with first branch in Guam

Korea's largest coffee chain is aiming to expand its business in Southeast Asia and North America

By Aug 24, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

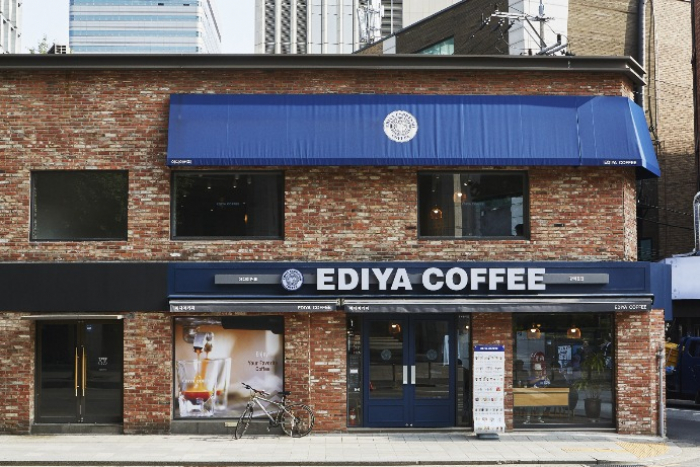

South Korea’s homegrown coffee chain Ediya Coffee is ready for re-entry into the global café market after the failure of its Chinese business 13 years ago.

The firm said on Tuesday it will open a café in Guam by the end of this year, aiming for eventual expansion into other Southeast Asian countries and North America.

Ediya is the largest coffee chain in Korea in terms of the number of stores, with 3,000 cafés nationwide. It opened its first overseas store in Beijing in 2005 but closed it in four years due to cumulative losses.

“The Korean coffee market is saturated. We have long prepared for the global café business and are ready to serve overseas customers with our best coffee,” said Ediya CEO Moon Chang-ki on Tuesday during a press visit to the firm’s coffee factory in Pyeongtaek, about 80 kilometers from Seoul.

The coffeehouse chose Guam as a test bed for its global café business expansion.

“Guam has around 1.5 million foreign visitors annually, of which half are South Koreans. It is the best market to mitigate business risk and monitor local consumption trends,” the company said.

Founded in 2001, Ediya started selling its instant coffee brand Vinist in the US in last year. The coffee chain has expanded exports to China, Mongolia, Australia and New Zealand.

The company sees its instant coffee as having a competitive edge in taste and convenience for global consumers.

Ediya is mass-producing its coffee at a plant in Pyeongtaek, Gyeonggi Province in Korea. Set up two years ago, the factory is using the most up-to-date equipment from Switzerland’s Bühler Group and Germany’s Probat, leading coffee roasting machinery makers. The plant can process up to 60 million tons of coffee beans a year.

The coffeehouse logged 243.3 billion won ($181.2 million) in revenue last year, up 8.6% from 2020. The operating profit reached 19 billion won in 2022, up 35.7%.

Write to Soo-Jung Ha at agatha77@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Mergers & AcquisitionsCarlyle buys coffee franchise A Twosome Place for over $800 mn

Mergers & AcquisitionsCarlyle buys coffee franchise A Twosome Place for over $800 mnNov 19, 2021 (Gmt+09:00)

3 Min read -

Korean startupsSpecialty coffee brand Terarosa raises $60 mn from Unison Capital

Korean startupsSpecialty coffee brand Terarosa raises $60 mn from Unison CapitalNov 02, 2021 (Gmt+09:00)

1 Min read -

-

Mergers & AcquisitionsCoffee Bean Korea seeks 100% stake sell-off

Mergers & AcquisitionsCoffee Bean Korea seeks 100% stake sell-offOct 19, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN