Naver, techfins poised to spark Korean loan market's Big Bang

S.Korea's three Big Tech players set to jump into personal loan refinancing market

Jun 16, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea's online giant Naver Corp. is preparing to join a government-initiated fintech platform, on which individual borrowers can directly search and compare loan products from various lenders to switch to cheaper loans.

Naver Financial, the portal's fintech arm, recently expressed its intention to regulators to participate in the public fintech platform, set to be launched in October of this year, according to financial industry sources on June 15.

The open platform's design makes it easier to compare borrowing terms and also facilitates personal loan refinancing. The move comes as the government will be instructing lending institutions to lower their maximum interest rate to 20% a year from the current 24%, starting next month.

Naver's participation in the loan refinancing platform would signal fiercer competition and a shake-up in the country's $1.5 trillion personal loan market.

Two other Big Tech companies -- Kakao Corp. and Toss -- are set to join the government-led platform. In return for arranging loan refinancing services, they will receive commissions.

FAR-REACHING IMPACT

Regulators welcome Naver's interest in the open platform.

"Dominant platforms' participation, like Naver's, will make it much easier for consumers to switch to a new lender," said an official of the Financial Services Commission.

"We expect financial services companies will engage in fair competition with Big Tech, eventually benefiting financial consumers."

Originally, banks, non-banking financial institutions and 13 fintech startups, including Toss, Kakao Pay, Finda and Payco, were supposed to operate on the public lending platform. Those Korean fintech companies have already been allowed to provide lending products.

In comparison, Naver is not a licensed lender, but regulatory officials see no problem with its entrance into the refinancing arrangement services.

South Korea's household debts, including loans and credit card bills, reached 1,726 trillion won ($1.5 trillion) as of the end of 2020. Banks made up 84.9 trillion won.

Naver is the country's most popular online platform with 40 million users. It has built experience in offering customized advertisements and recommendations for a range of services such as real estate, web content and shopping.

In particular, Naver Financial is well-versed in online payment platforms and the domestic payment landscape thanks to its fintech operations such as mobile payment services Naver Pay. Naver Pay has secured over 10 million users.

"Naver boasts a high frequency of user visits for its searching and shopping services," said a financial industry source, adding that its entrance into the personal loans service market should have a far-reaching impact on the financial services sector.

"All financial industry circles are paying close attention to Naver, which has been expanding its financial territory even without financial licenses," he said.

Big Tech and internet-only banks have been rapidly penetrating into the market for borrowers with lower credit ratings.

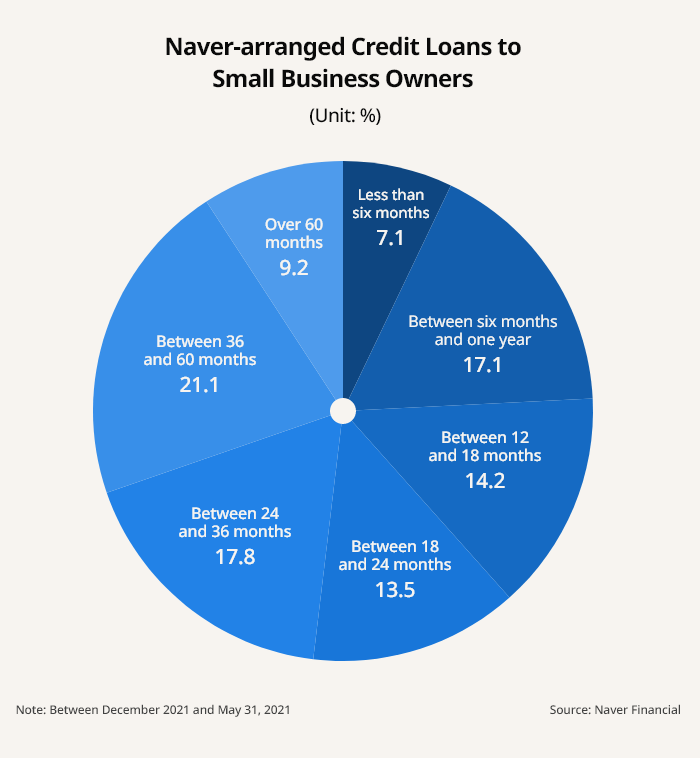

In December 2020, Naver Financial launched a small loan service for startups and online retailers, together with Mirae Asset Capital Co. Over the past six months, Naver has arranged over 50 billion won worth of loans to small business owners registered on its shopping platform.

Mirae Asset Capital provided loans of up to 50 million won per borrower at an annual rate of between 3.2% and 9.9%. The borrowers took out an average of 27 million won at an average rate of 5.7% per year.

The online titan claimed that the loan service did not constitute an encroachment on the traditional banking territory because the borrowers did not qualify for loans from established lending institutions.

By So-ram Jung, Dae-hun Kim and Hyun-woo Lim

ram@hankyung.com

Yeonhee Kim edited this article.

-

Banking and financeNaver's Line Bank expands in Asia with Indonesian venture

Banking and financeNaver's Line Bank expands in Asia with Indonesian ventureJun 13, 2021 (Gmt+09:00)

3 Min read -

Banking and financeToss Bank to compete with K Bank, Kakao Bank from September

Banking and financeToss Bank to compete with K Bank, Kakao Bank from SeptemberJun 11, 2021 (Gmt+09:00)

4 Min read -

[Exclusive] Digital currencyNaver joins Korean central bank's digital currency initiative

[Exclusive] Digital currencyNaver joins Korean central bank's digital currency initiativeMay 14, 2021 (Gmt+09:00)

3 Min read