Korean indie fashion brands spread wings to Japan, China

Kolon FnC, a Korean distributor of G/FORE, will build the US golf apparel company as a premium brand in North Asia

By Nov 13, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

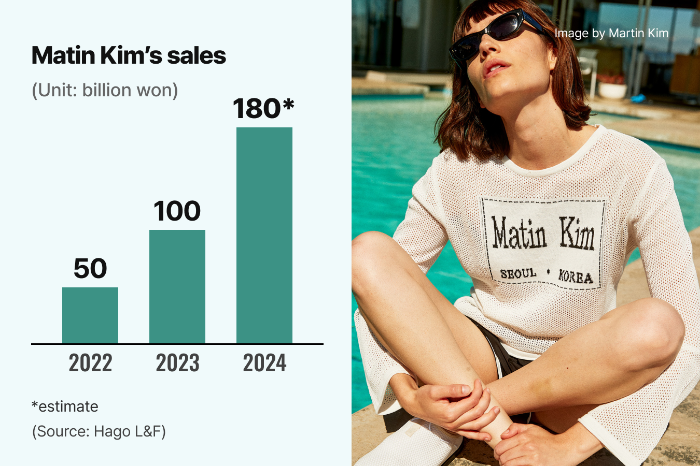

Matin Kim, a rising designer brand in South Korea, will open its first offline store in Japan in the first half of next year, joining other Korean indie fashion brands that have made inroads into the neighboring country.

For its venture into Japan, it signed a five-year partnership agreement with Musinsa, South Korea’s largest online fashion platform, which will oversee Matin Kim’s distribution and online sales in Japan.

Matin Kim plans to open as many as 15 stores across Japan within the next five years, its parent company Hago L&F Inc. said on Tuesday.

During their partnership that runs through 2029, Matin Kim and Musinsa target 250 billion won ($178 million) in combined sales in Japan.

Matin Kim is an affordable and trendy designer brand. Musinsa has been in charge of its online sales since November 2022.

It has operated offline pop-up stores in Japan in collaboration with Musinsa and was convinced of its global potential from the operations, said Hago L&F, a unit of Dae Myung Chemical Group.

That's why it chose the online fashion platform as its partner in Japan, instead of teaming up with a local company there.

Matin Kim has already entered China and Hong Kong in collaboration with local companies.

“We highly regard Musinsa’s (sales) network and performance in Japan and its capabilities,” said a Matin Kim official.

Since establishing a Japanese subsidiary in 2021, Musinsa has introduced a slew of lesser-known Korean indie brands such as Mardi Mercredi, Stand Oil and GLOWNY to Japan.

KOLONG FNC FOR GFORE

Kolon FnC, a unit of textile manufacturer Kolon Industries Inc. in 2021 introduced G/FORE to South Korea and positioned it as a luxury golf wear brand, targeting young, affluent golfers in the 35-44 age group. Its South Korean sales exceeded 100 billion won in 2022.

It directly imports G/FORE's golf shoes and gloves, while responsible for designing its clothes tailored to Korean golfers.

Under the license agreement, from next year it will directly manage G/FORE’s Chinese and Japanese operations. Positioning it as a luxury golf apparel brand, it plans to open 30 stores in China and 12 outlets in Japan over the next five years.

In 2017, Kolon FnC forayed into China for its outdoor clothing brand Kolon Sport in partnership with Chinese sportswear company Anta Group.

In 2023, Kolon Sport’s sales in China soared 54% to 400.0 billion won, compared with the year prior. Its sales are forecast to grow at almost the same rate this year.

Write to Hyung-Joo Oh at ohj@hankyung.com

Yeonhee Kim edited this article.

-

-

FashionKorea's golf apparel market shrinks as golf boom fizzles

FashionKorea's golf apparel market shrinks as golf boom fizzlesMay 29, 2024 (Gmt+09:00)

2 Min read -

-

FashionKorea's National Geographic Apparel steps up push into China

FashionKorea's National Geographic Apparel steps up push into ChinaSep 06, 2023 (Gmt+09:00)

2 Min read -

FashionMusinsa opens showroom in Tokyo for S.Korean designers’ brands

FashionMusinsa opens showroom in Tokyo for S.Korean designers’ brandsJul 21, 2023 (Gmt+09:00)

1 Min read -

RetailKorean golf club, apparel markets face decline in post-pandemic era

RetailKorean golf club, apparel markets face decline in post-pandemic eraJun 09, 2023 (Gmt+09:00)

2 Min read -

-

RetailS.Korea's Musinsa promotes domestic fashion brands in Tokyo

RetailS.Korea's Musinsa promotes domestic fashion brands in TokyoApr 07, 2023 (Gmt+09:00)

1 Min read -

Culture & TrendsGolf apparel goes trendy and upmarket in Korea on rise of young golfers

Culture & TrendsGolf apparel goes trendy and upmarket in Korea on rise of young golfersAug 09, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsMusinsa drops plan to buy Japan-focused rival fashion platform

Mergers & AcquisitionsMusinsa drops plan to buy Japan-focused rival fashion platformMay 25, 2022 (Gmt+09:00)

2 Min read