Studio Dragon turns heads on promising outlook

By Nov 27, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

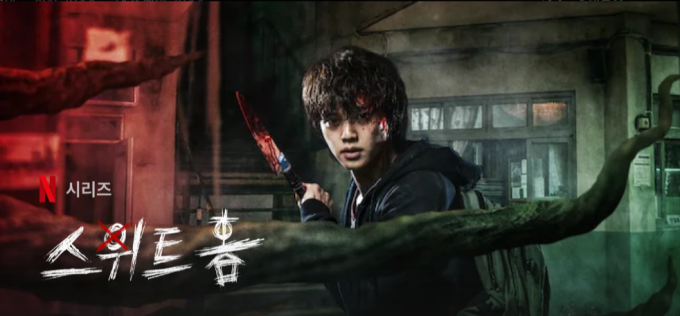

South Korea’s leading drama production house Studio Dragon Corp. is in the market limelight as it readies to reenter the Chinese market alongside the upcoming release of its latest drama series Sweet Home.

On Nov. 26, Studio Dragon closed at 80,800 won ($73), up 0.62% on the junior bourse Kosdaq. This month alone, the company's share price has climbed by 3.32%.

The stock market has been on a rollercoaster ride this year due to the impact of the COVID-19 crisis. Meanwhile, Studio Dragon has been relatively less volatile as the range between its lowest price (69,300 won) and its highest price (92,500 won) so far this year has hovered around 34 percent.

The market has credited the low volatility to the nature of drama production. Unlike movie theaters or concerts in which audience numbers are directly tied to number of performances, Studio Dragon’s revenue mostly stems from production programming for broadcasting companies (45%) and content sales to both domestic and overseas distributors (47%).

“Studio Dragon sold two dramas to China in the third quarter, of which some 6 billion won were counted as revenue,” said Kim Hoi-jae, an analyst at Daishin Securities Co. He emphasized that this marked the first time that the studio sold content to China since the ban on the Korean wave (hallyu: global popularity of Korean culture, media, entertainment).

The securities industry also expects the Netflix release of Sweet Home, a drama series based on a popular webtoon of the same name, to be another turning point. Studio Dragon has injected around 25 billion won into production costs for the show, the highest amount for this year. The series is set to air in December.

In recent years, the rise in over-the-top (OTT) services has lifted global popularity of Korean dramas, which have become a worldwide phenomenon amid the coronavirus pandemic. The increased appetite for Korean content has nudged overseas studios to reach out to domestic production companies for potential collaboration.

“Instead of just relying on Netflix to sell its dramas to overseas markets, Studio Dragon now has the bargaining power to negotiate businesses with other global OTT players,” said Choi Min-ha, an analyst at Samsung Securities Co.

According to financial data provider FnGuide, around 20 domestic securities firms have set the company’s average price target at 108,900 won ($99), about 34.77% higher than the current share price.

Market consensus for the company’s operating profit in 2021 stands at 69.2 billion won ($63 million), up 23.38% from this year.

In the third quarter, the company posted 106.3 billion won in revenue and 16 billion won ($14.5 million) in operating profit, up 46.8%.

Write to Bum-jin Chun at forward@hankyung.com

Danbee Lee edited this article.

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-