Energy

China’s Mingyang to foray into Korean wind turbine market with Unison

The two firms have agreed to set up the JV on the condition that the Chinese firm transfers its turbine tech to the Korean partner

By Dec 11, 2024 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

China’s Mingyang Smart Energy, one of the top five global wind turbine suppliers, is gearing up for its advance into South Korea’s wind turbine market, set to grow to 100 trillion won ($70 billion) by 2030, with local wind power leader Unison Co. through its first-ever technology handover to a Korean firm.

According to sources in the wind power industry on Tuesday, the Korea Fair Trade Commission (FTC) is expected to decide whether to approve a 45-55 joint venture set up by Mingyang and Unison as early as this month.

In September, the two companies signed an agreement to establish the JV to build and operate a wind turbine nacelle assembly plant and a blade manufacturing facility in Korea, as well as to jointly develop and invest in onshore and offshore wind farms.

Once they get the nod from the FTC, the JV will immediately inject 150 billion won to build a plant in Sacheon, South Gyeongsang Province, from which they will manufacture wind turbines with a single capacity of 15 megawatts (MW). The plant is expected to be completed in 2026.

Under the agreement, Mingyang will transfer its 15-MW wind turbine manufacturing technology and design to Unison, which would mark the Chinese wind turbine giant’s first turbine technology handover to a Korean peer.

But because Mingyang will keep its intellectual property rights over the technology, Unison must pay royalties to its Chinese partner each time it builds a wind turbine using Mingyang’s technology.

TO CRACK THE GOVERNMENT-PROTECTED MARKET

Mingyang teamed up with Unison to win the wind energy bid from the Korean government, which is largely limited to Korean players under a new bidding rule designed to protect local companies from the potential tsunami of China’s cheaper options into Korea.

Chinese wind turbines are about 40% cheaper than Korean turbines but their quality meets or even exceeds the international standard.

Starting this month, bidders’ contribution to Korea’s economic security and supply chain has become a major consideration for the Korean government when choosing winners for state wind power projects, on top of bidding prices.

Under the new rule, Korean players have the upper hand in state wind power bids, and the best way for a foreign player to win a Korean government wind energy bid is to form a joint venture with a Korean peer.

As Unison has a bigger 55% stake than Mingyang in their JV, the Unison-Mingyang JV is considered a local player, meaning the JV will receive the same score as a pure Korean bidder in economic security and supply chain contribution criteria.

CHINA, A MATURED WIND ENERGY MARKET

Mingyang is making a big bet on the Korean wind power market poised to burgeon in the next few years under the government’s ambitious green energy policy.

China is the world’s largest wind power-producing market with many globally renowned wind turbine and power companies.

But the market has rapidly matured, with China’s total wind turbine installation volume in 2023 standing at 75 gigawatts (GW), which fell short of the country’s top four wind turbine players’ annual production capacity of 82 GW.

To find new growth markets, Chinese wind turbine makers have shifted their attention to other countries.

Following their aggressive global push into Europe with almost 50% cheaper turbines than their European counterparts, Chinese wind turbines quickly penetrated that market.

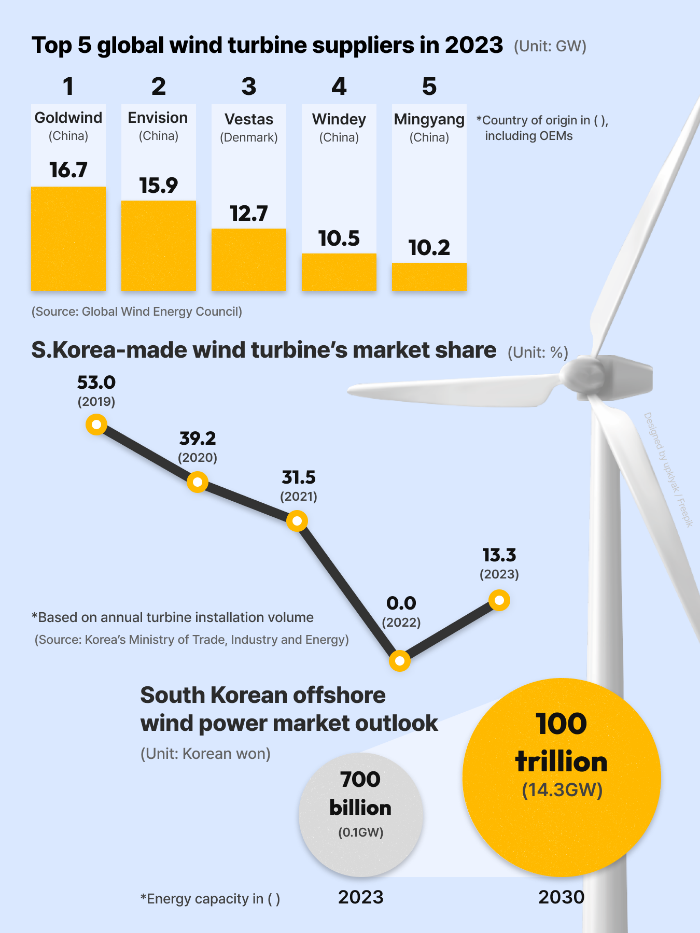

According to Global Wind Energy Council Market Intelligence, four of the top five global wind turbine suppliers last year were Chinese.

Beijing-based Goldwind Science & Technology topped the list, elbowing out long-time incumbent leader Vestas Wind Systems from Denmark with 125 years of history, which fell to third place.

China’s fast ascent raised the alarm in the European wind power market, leading European countries to raise the bar for Chinese wind turbines’ advance into the region.

Chinese wind turbine makers have thus shifted their attention to Asia, especially Korea with great growth potential.

GREAT ROOM FOR GROWTH

The Korean government is expected to open offshore wind farm bids with 7-8 GW capacity, equivalent to power produced by eight nuclear reactors, in the next two years as part of its green energy transition policy. These projects are expected to be worth about 50 trillion won.

If the Korean government proceeds with its initial plan to expand the country’s offshore wind power to 14.3 GW by 2030, the market will double to 100 trillion won.

Turbines account for 35% of total wind power farm construction costs.

But Korea has no major wind turbine maker that can produce turbines with a capacity above 8 MW so many turbine orders have been awarded to makers from China, Denmark and Germany.

Unison is the leading player in Korea, capable of building 8-MW wind turbines.

With Mingyang’s technology, the Korean wind energy company plans to develop its proprietary turbine technology to build higher-capacity turbines by 2028.

Mingyang is the world’s first to commercialize wind turbines with a single capacity of 18 MW and has completed the development of 20-MW turbines.

Mingyang’s successful landing in Korea is expected to intensify competition further among global turbine players to win bids in the Korean wind energy market.

Vestas has already announced to build a turbine plant in Korea, while German offshore wind power company Siemens Gamesa has joined hands with Korean power plant builder Doosan Enerbility Co. for Korean offshore wind power farm bids.

HD Hyundai Electric Co. has also forged a strategic partnership agreement with GE Renewable Energy from the US to foster the growth of the Korean offshore wind power industry.

Following the Unison-Mingyang cooperation, foreign wind energy firms are expected to consider handing over their technology to Korean partners to expand their presence in Korea, industry observers said.

Write to Hyeon-woo Oh and Woo-Sub Kim at ohw@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

EnergyS. Korea may join offshore wind alliance to take on China

EnergyS. Korea may join offshore wind alliance to take on ChinaJul 08, 2024 (Gmt+09:00)

4 Min read -

EnergyGrowing controversy over call to share profits for using wind energy

EnergyGrowing controversy over call to share profits for using wind energyApr 16, 2024 (Gmt+09:00)

4 Min read -

ConstructionDaewoo E&C teams up with Chinese company on wind power generation

ConstructionDaewoo E&C teams up with Chinese company on wind power generationFeb 01, 2024 (Gmt+09:00)

1 Min read -

-

EnergyKorean wind power companies foresee tailwind from Taiwan, US

EnergyKorean wind power companies foresee tailwind from Taiwan, USJan 16, 2024 (Gmt+09:00)

2 Min read -

EnergyOrsted wins 1.6 GW offshore wind power license from Korea

EnergyOrsted wins 1.6 GW offshore wind power license from KoreaDec 01, 2023 (Gmt+09:00)

2 Min read -

EnergyDoosan Enerbility, Siemens Gamesa join forces for offshore wind power

EnergyDoosan Enerbility, Siemens Gamesa join forces for offshore wind powerFeb 07, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN