Energy

S.Korea to up the ante on small modular reactor foundry business

The government has boosted the 2024 budget on i-SMR development and exports ninefold versus 2023 to $49 bn

By Feb 22, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea will nurture the small modular reactor (SMR) foundry business to revive the country’s nuclear power industry by rolling back the previous government’s nuclear phase-out policy.

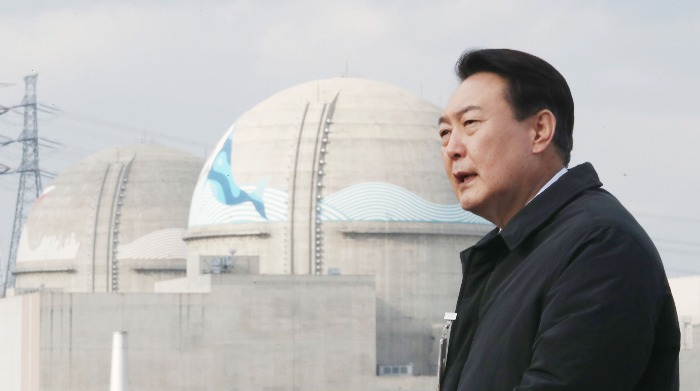

President Yoon Suk Yeol said at a New Year's town hall meeting in Changwon on Thursday that the government will develop the southeastern city of Changwon and its surrounding area South Gyeongsang Province into an SMR manufacturing hub.

SMRs are touted as game-changers in the nuclear power industry. They can generate electricity of up to 300 megawatts in just one-third the space needed to produce the same amount at a conventional nuclear power plant.

Since SMRs are manufactured and installed in modular forms, they can be produced at factories, like semiconductor chips fabricated by foundry companies for fabless chip designers.

Given the limited number of countries with nuclear reactor manufacturing technology, the Ministry of Trade, Industry and Energy said the government will step up policy efforts to take the lead in the SMR market. The US, China, France and Russia have also jumped into the market.

The government jacked up the budget to develop and export innovative small modular reactors (i-SMRs) by 2028 by more than nine times to about 65 billion won ($49 billion) this year from about 7 billion won in 2023. It plans to launch i-SMRs in the global market.

Yoon also unveiled a comprehensive policy package aimed at rebooting the country’s nuclear energy industry.

Ahn Dukgeun, minister of trade, industry and energy, said at the meeting that the ministry will introduce a special law for the nuclear power industry to ensure policy consistency.

TAX BENEFITS

The government will also offer tax benefits to SMR and nuclear power plant manufacturers.

The trade ministry estimates that such tax benefits will lead to an increase in R&D spending and facility investment in the sector by more than 1 trillion won this year alone.

The government has earmarked 4 trillion won for next-generation nuclear power plant R&D through 2027 when President Yoon’s five-year term ends.

This year, the government also plans to draw up a “mid- to long-term policy roadmap” to support the nuclear energy sector, upon legislation of the special act for the nuclear power industry.

The policies to be introduced range from nuclear power plant construction to operation, related industry support, R&D and human resources training.

Nuclear power company sales in South Korea decreased to 21.6 trillion won in 2021, compared to 23.8 trillion won in 2017, when Yoon’s predecessor Moon Jae-in took office as president.

Their revenue rebounded to 25.4 trillion won in 2022.

South Korea’s exports of nuclear power plant equipment increased to 4.01 trillion won in the past two years, versus 590 billion won from 2017 to 2021.

Write to Han-Shin Park and Sul-Gi Lee at phs@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

-

-

EnergyNuScale in talks to build SMR plant in S.Korea: NuScale CEO

EnergyNuScale in talks to build SMR plant in S.Korea: NuScale CEOMay 01, 2023 (Gmt+09:00)

5 Min read -

EnergyNuScale to build Korea’s first SMR in Uljin, home to native Korean reactors

EnergyNuScale to build Korea’s first SMR in Uljin, home to native Korean reactorsMay 04, 2023 (Gmt+09:00)

4 Min read -

-

EnergyDL E&C, Doosan to invest $25 mn in SMR developer X-Energy

EnergyDL E&C, Doosan to invest $25 mn in SMR developer X-EnergyJan 18, 2023 (Gmt+09:00)

2 Min read -

Carbon neutralityHyundai Heavy to invest $30 million in TerraPower for SMR business

Carbon neutralityHyundai Heavy to invest $30 million in TerraPower for SMR businessNov 04, 2022 (Gmt+09:00)

2 Min read -

-

Comment 0

LOG IN