Energy

Seesawing refining margins cloud Korean refiners’ earnings

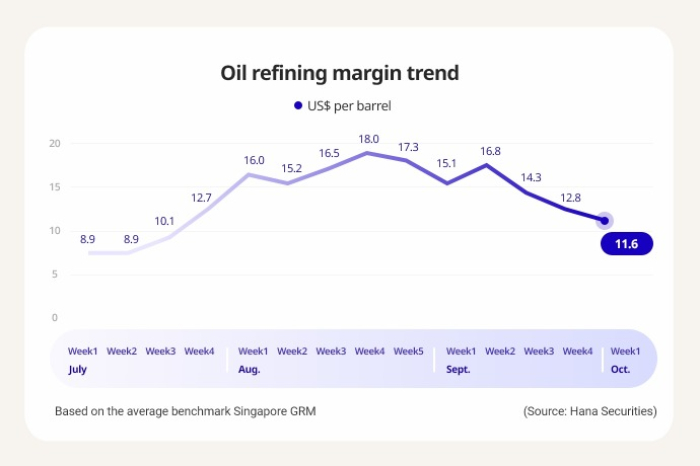

The benchmark Singapore refining margins have reversed their course after a rise in Q3

By Oct 12, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

According to data from Hana Securities Co., benchmark Singapore gross refining margins (GRM) recorded $11.6 per barrel in the first week of October, extending its losing streak for three weeks in a row after hitting $16.8 in the second week of September.

Oil refineries’ profit margins averaged $7.4 per barrel in the second quarter of this year but recovered to $13.7 in the following quarter, raising hope for Korean oil refiners' rosy earnings in the third quarter.

But as the margins reversed direction in mid-September, the outlook on the fourth-quarter earnings of Korea’s four major oil refiners – SK Innovation Co., GS Caltex Corp., S-Oil Corp. and HD Hyundai Oilbank Co. – has turned grim.

Refining margins are the difference between the value of the products produced by a refinery and the value of the crude oil used to produce them. They serve as a measure of oil refineries’ profits.

SLOWDOWN IN OIL DEMAND

A slowdown in oil demand is largely blamed for the retreat in refining margins, according to market analysts.

In general, the higher the oil prices, the higher the margins because refineries produce oil products with crude purchased before oil price hikes.

But the recent surge in international oil prices to nearly $100 per barrel has dampened global oil demand, dragging down refining margins.

After Russia lifted its diesel export ban last week, diesel supply is set to increase rapidly, which also could weigh on the diesel refining margin that has remained higher than that of petrol.

The slow recovery in China’s economy, coupled with the country’s real estate crisis, is adding to worries at a time when the cracking margins of naphtha, the feedstock of petroleum products, show no sign of recovery.

Worse yet, the ongoing deadly clashes between Israel and Hamas after the latter’s ambush attacks on civilians in the former’s territory over the weekend are swaying oil prices, increasing uncertainty in the global oil market.

Against the current backdrop, refining margins are expected to remain under pressure in October.

“Amid increasing uncertainty about oil prices in the aftermath of the wars, companies are cutting their purchases,” said an official in the Korean refining industry, projecting refining margins would fall further based on their trend in the second week of October.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

EarningsKorea refiners swing to Q4 loss amid windfall tax calls

EarningsKorea refiners swing to Q4 loss amid windfall tax callsFeb 07, 2023 (Gmt+09:00)

2 Min read -

EnergyKorean refiners lift runs to 3-year high on record exports

EnergyKorean refiners lift runs to 3-year high on record exportsJan 29, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN