Energy

Hanwha expects high-stakes US solar projects to pay off

With a spate of US projects, Hanwha SolutionsŌĆÖ enterprise value is expected to more than double this year

By Feb 20, 2023 (Gmt+09:00)

3

Min read

Most Read

NPS to hike risky asset purchases under simplified allocation system

UAE to invest up to $1 bn in S.Korean ventures

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

US multifamily market challenges create investment opportunities

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

South KoreaŌĆÖs chemicals-to-construction conglomerate Hanwha Group expects its high-stakes solar energy business to pay off amid industry forecasts that solar energy will account for half the new US power generation scheduled for this year.

The conglomerate said on Monday it will hire at least 300 new employees for its solar and defense businesses, the groupŌĆÖs two growth engines, in the first half of this year.

The recruitment comes as solar and other renewable energy sources are emerging as key alternatives to fossil fuels such as coal and gas, prices of which are rising amid the protracted Russia-Ukraine war and strengthened energy security and resource nationalism.

According to the Export-Import Bank of Korea (KEXIM), 300 gigawatts (GW) of solar panels and related facilities, enough to power 50 million homes, will be newly installed worldwide this year, up from an estimated 260-280 GW in 2022.

Solar energy generation capacity has steadily increased from 100 GW in 2017 to more than 200 GW in 2021.

The US and China account for nearly half of new solar energy demand while developing countries in Latin America, the Middle East and Africa are also witnessing significant demand growth for solar energy, analysts said.

The US Energy Information Administration (EIA) predicts that more than half the 54.5 GW of new power generation slated for this year in the country will be solar.

ŌĆ£Demand for a stable energy supply has become more important than ever. Solar energy is a key energy source in that regard,ŌĆØ said Kang Jung-hwa, a senior researcher at the KEXIMŌĆÖs Overseas Economic Research Institute.

SOLAR HUB IN THE US

Hanwha Solutions Corp., the energy business unit of Hanwha Group, is building a $3.2 billion solar energy production facility in Georgia, the largest of its kind in the US.

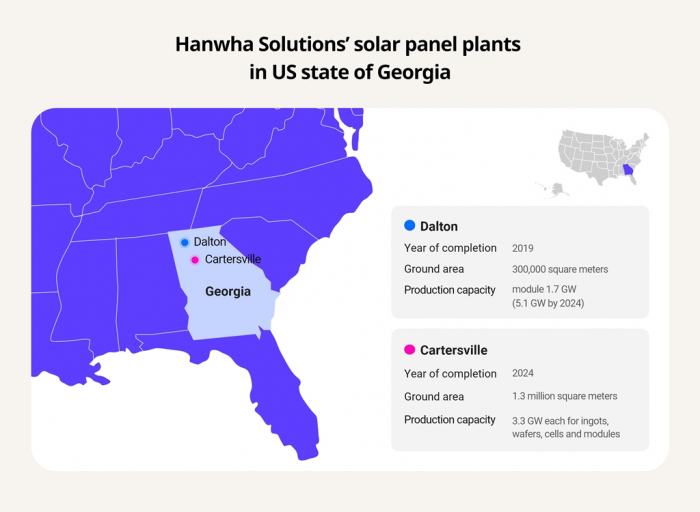

With the construction of the plant, Hanwha expects to boost the capacity of its solar module facilities in Dalton, Georgia from 1.7 GW of electricity to 5.1 GW by 2024.

It also plans to spend $3 billion to build a new production complex in Cartersville, about an hour's drive south of Dalton. The new complex will cast ingots and manufacture wafers, cells and modules.

In total, Hanwha will have the capacity to generate 8.4 GW of electricity, enough to power 1.3 million households in the US for a year, by 2024.

The investments are in response to the US Inflation Reduction Act (IRA), which includes tax credit provisions for clean energy production. Hanwha expects as much as 1 trillion won in tax benefits from the US government.

US PROJECTS TO DRIVE UP CORPORATE VALUE

Last month, Hanwha Q Cells Co., a US subsidiary of Hanwha Solutions, said it has formed a strategic alliance with Microsoft Corp. to curb carbon emissions through their joint solar energy supply projects.

Under the partnership, Hanwha Q Cells will be supplying more than 2.5 GW ┬Āof solar panel modules ŌĆō enough to power at least 400,000 homes ŌĆō for such projects.

Analysts said HanwhaŌĆÖs US projects will significantly increase its solar energy revenue and profits.

Last year, Hanwha Solutions posted a record 13.65 trillion won in sales on a consolidated basis, up 27.3% from the previous year. Its operating profit rose 30.9% to an all-time high of 966.2 billion won.

IBK Securities said Hanwha SolutionsŌĆÖ corporate value could reach 20 trillion won by the end of next year, up from the current 8.17 trillion won.

Write to Seo-Woo Jang at suwu@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EnergyKorea's Hanwha Q Cells halts litigation against Chinese module maker

EnergyKorea's Hanwha Q Cells halts litigation against Chinese module makerFeb 17, 2023 (Gmt+09:00)

1 Min read -

EnergyHanwha Solutions, Microsoft sign solar energy partnership in US

EnergyHanwha Solutions, Microsoft sign solar energy partnership in USJan 26, 2023 (Gmt+09:00)

2 Min read -

-

EnergyHanwha Solutions, OCI to benefit from US push for solar energy

EnergyHanwha Solutions, OCI to benefit from US push for solar energyAug 04, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN