Electronics

LG Innotek hastens to lead autonomous driving solution

The S.Korean camera module major has developed an advanced ADAS camera module fitted with a direct heating system ┬Ā

By Feb 20, 2024 (Gmt+09:00)

3

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

S.Korea's LS Materials set to boost earnings ahead of IPO process

NPS to hike risky asset purchases under simplified allocation system

Aman, Rosewood, Banyan, IHG rush to open luxury hotels in Seoul

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

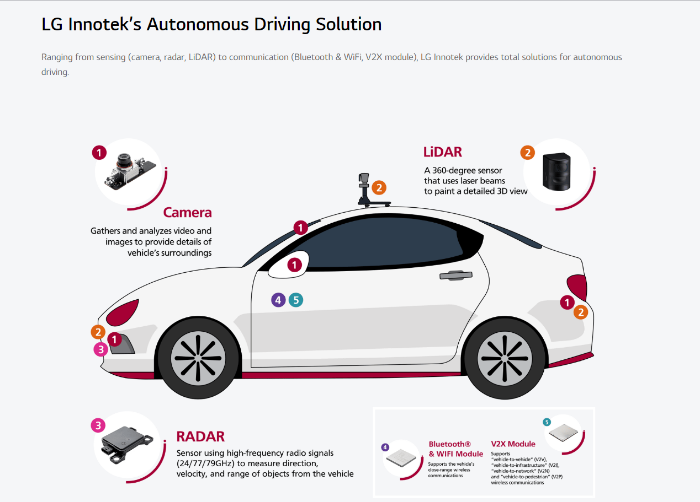

LG Innotek Co., South KoreaŌĆÖs major camera module supplier seeking to reduce its hefty reliance on Apple Inc. for earnings, has unveiled its latest technology expected to help it expand its presence in the growing autonomous driving technology market. ┬Ā

The company announced on Tuesday, its new invention is a camera module fitted with a direct heating system for an advanced driver assistant system (ADAS), which unthaws frost, snow or ice significantly faster than existing products while consuming much less power. ┬Ā

Camera modules and sensors are key components of a self-driving car, and the technology to guarantee the reliable performance of ADAS cameras, which create a continuous video stream of the environment, is critical. ┬Ā

The company said its direct heating technology will ensure the reliability of ADAS camera modules by keeping the camera lens clear in any hazardous cold weather conditions without overheating.

With the latest development combined with a slew of its other autonomous driving solutions, the Korean camera module major will accelerate its drive to lead the self-driving camera module market, which is forecast to grow rapidly, the company said.

S&P Global recently forecast that thanks to fast advancement in autonomous driving technology, the global vehicle camera module market will expand at a compound annual growth rate of 7% to $10.03 billion in 2030 from $6.43 billion in 2023.

SELF-REGULATING HEATING TECHNOLOGY

LG Innotek said its camera module heater is energy efficient as it uses energy of only up to 4 watts (W) but it takes about half the usual time to unthaw ice and snow on the lens. It takes about 8 minutes to fully recover the frozen lens at a temperature of minus 18 degrees Celsius with conventional products, the company said.

The company attributed positive temperature coefficient (PTC) materials to the latest advancement in its camera module heating system.

PTC is a tendency capable of self-regulating temperature to prevent overheat. It lets resistance increase in line with higher temperatures, and the high resistance reduces the current flow, thus limiting heat generation.

LG Innotek uses PTC materials for the heater, which allows it to be placed directly below the lens of ADAS camera modules so it can remove vision obstructors faster without overheating, the company said.

The all-in-one camera module heater also allows a high level of design freedom with vehicle integration, according to the company.

LG Innotek aims to mass-produce the new heater-integrated camera module in 2027.

DIVERSIFICATION TO REDUCE RELIANCE ON APPLE

The electronic components-producing unit of LG Group has been seeking to reduce its reliance on Apple.

It is a major supplier of mobile camera modules and 3D sensing modules for AppleŌĆÖs iPhones and other devices, but the US customer is said to plan to diversify its sensor suppliers.

LG remains the dominant supplier of camera modules to AppleŌĆÖs iPhones, accounting for 70% of Apple's supplies, up slightly from 65% in 2022. 3D sensing modules make up 20% of LG InnotekŌĆÖs sales, or about 4 trillion won ($3 billion) of its 20 trillion won in revenue in 2023.

The company pins high hopes on camera modules for vehicles and extended reality (XR) gears for compensating the anticipated fall in its supply to Apple.

To ensure its leadership in the new growth-driving sectors, the company invested 1.4 trillion won from 2022 to 2023 in expanding facilities for semiconductor substrates and camera modules.

Last year, the company also announced it would spend $1 billion to build a new camera module factory at its production complex in Hai Phong, Vietnam to more than double its production capacity in the Southeast Asian country.

Last month, it agreed to acquire stakes in AOE Optronics Co., an automotive lens-making subsidiary of Taiwan-based Asia Optical, to enhance their partnership to widen the technological gap with rivals in the global automotive camera module market.

Write to Ye-Rin Choi at rambutan@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

ElectronicsLG Innotek, AOE join hands to lead vehicle, XR camera module markets

ElectronicsLG Innotek, AOE join hands to lead vehicle, XR camera module marketsJan 18, 2024 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomLG Innotek targets XR device market with new substrate

Tech, Media & TelecomLG Innotek targets XR device market with new substrateFeb 15, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersLG Innotek to invest $1.1 bn to ramp up substrate, camera module output

Korean chipmakersLG Innotek to invest $1.1 bn to ramp up substrate, camera module outputJul 06, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN