Electronics

Supply crisis dwarfs S.Korean display equipment makers

Heavy reliance on foreign parts exacerbates damages from component shortage; hurting display makers’ facility expansion

By Jun 27, 2022 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

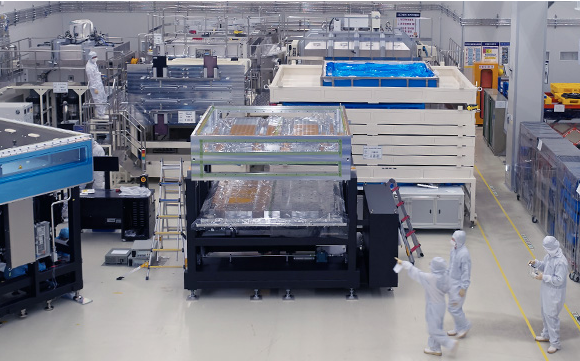

South Korea’s display equipment makers are suffering from the global supply disruption with forced delayed shipments of products to clients, interrupting facility expansions of local panel producers such as the world leader LG Display Co.

Domestic display equipment makers have been unable to keep delivery dates as they could not procure key components from other countries on time due to the supply crisis, according to the Korea Display Industry Association (KDIA) on Tuesday.

It was known for the delivery of core parts of organic light-emitting diode (OLED) panels to take more than six months after orders, far longer than two to three months in the past, according to industry sources. Display makers have to wait about one year to procure filters, which had been delivered in about two and half months.

A South Korean equipment producer had no choice but to inform its key customer that it will have to delay the delivery of a machine to year-end from this month due to a severe disruption of parts procurements. The display maker had to postpone its plan to replace and expand production facilities.

“An unprecedented series of collapses is destructing South Korea’s display industry,” said a source in the sector.

Key equipment manufacturers such as Wonik IPS Co., Jusung Engineering Co. and Sunic System Ltd. failed to find substitutes within the country as foreign companies supply most components.

Some equipment makers had to buy used parts from China for more than double the prices.

“The global supply chain disruption revealed the disastrous reality of the local display equipment sector,” said another industry source said.

ONLY 9% OF PARTS MADE IN KOREA

South Korean display equipment makers lack both the technology and capabilities to produce their own parts to cope with the global supply disruption.

Components made in the country accounted for only 9% of the domestic display equipment industry in 2021, showed a KDIA report obtained by The Korea Economic Daily. Parts from the US, Japan and Europe made up 37%, 29% and 19%, respectively, according to the first analysis of market share by country in the country’s display equipment sector. South Korea wholly relied on Taiwan for industrial PCs.

Such heavy reliance on foreign components made the domestic equipment industry more vulnerable to the global supply chain disruption.

“It is impossible to meet deadlines with deliveries of a single core part delayed,” said a source from an equipment maker. “We are in an emergency situation since the procurement of some parts is postponed by up to one year.”

The industry sees the disruption hurting exports of display equipment as it became hard to deliver products by the due dates.

HARD TO MAKE MONEY

Parts for display equipment normally need to be replaced every six to 12 months, sometimes up to five years. It is essential for equipment makers to stably procure high-quality components as they also provide after-sale services such as replacement parts.

Equipment makers, as well as display producers, have been seeking competitive local part manufacturers, but it was not easy as the parts sector is in dire straits, industry sources said.

Many component makers changed their business models as it was hard to make money in the local industry, according to the sources.

That raised equipment makers’ dependence on foreign parts.

Turbo pumps, key components for the major five facilities producing OLED displays, are not locally manufactured. South Korean equipment makers buy 40% of the pumps they need each from the UK and Japan, as well as 20% from Germany. The UK’s Edwards and Japan’s ULVAC Inc. are major suppliers to Wonik, Jusung and H&iruja Co.

It takes six months to receive them after orders, nearly double the three and half months it took in the past.

South Korea imports gas filters, which help gas flow smoothly by collecting alien substances running through pipes – 80% from the US and 20% from Japan. Their deliveries are now delayed by eight and a half months to 11 months from the prior two and half months.

O-rings, round-shaped rings that prevent gas leakage, are all supplied by the US. Equipment makers have to wait one year to receive them, which took about six months for delivery before.

COOPERATION

Concerns deepened over the intensifying parts shortage as it was uncertain to predict when the global supply disruption will ease, while shipping costs surged.

The KDIA is seeking cooperation between the equipment makers and parts producers by setting up a body to discuss development plans for the sectors. About 40 equipment and parts makers including Sunic and Enjet Inc. were known to plan to join the body.

“No matter what the global supply chain situation is, it is urgent to improve parts competitiveness to minimize damage to the industry,” said a KDIA official said. “Some urge to seek joint technology development and other efficiency measures as it needs a lot of time and money to develop equipment parts.”

The improvement in parts competitiveness is expected to enhance the business of not only equipment makers but also display manufacturers, industry sources said.

South Korean display equipment makers’ global sales shrank to $233 million last year, merely a tenth of $2.3 billion in 2020, according to market research firm Omdia. That was almost nothing compared to their Chinese competitors' $10.5 billion.

Write to Ji-Eun Jeong at jeong@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN