Narrower price gap to LCD underpins OLED TV market

By Apr 19, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

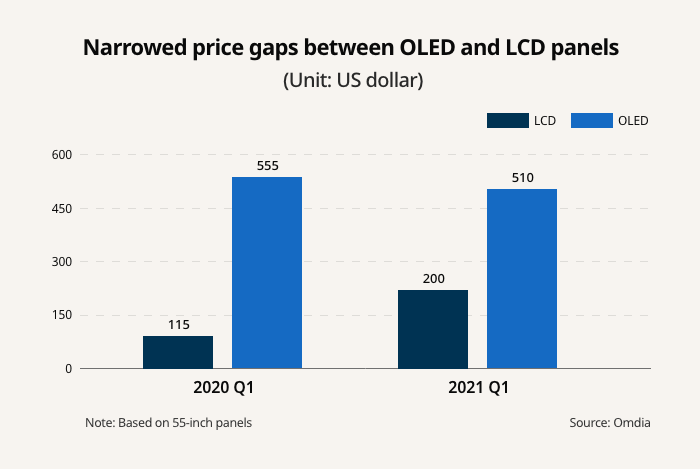

A rapid increase in liquid crystal display (LCD) panel prices has sharply narrowed the price gap between LCD panels and organic light-emitting diode (OLED) displays – the latter showing a downward trend due to increased supply.

According to market researcher Omdia on Apr. 19, the average price of the industry-standard 55-inch OLED panel dropped to $510 in the first quarter of this year, compared to $200 for LCD panels. Year on year, OLED panel prices declined 8.1% on average, whereas LCD panel prices spiked 73.9%. As a result, the price gap between the two has narrowed to $310 from $440.

Since the beginning of this month, LCD panel prices increased further to hit $206 on average, their highest level in three years and 10 months. It marked the first time for the average LCD panel price to top $200 since July 2017.

"TV makers have a shortage of LCD panel supplies, with their inventory falling to 60% of normal levels," said KB Securities analyst Kim Dong-won. "They will also continue to suffer supply shortages of other major components such as glass substrates and ICs (integrated circuits) through the second half of this year."

Since South Korean panel makers led by Samsung Display Co. and LG Display pulled out of the low-margin TV LCD market from the second half of last year, Chinese manufacturers led by BOE and CSOT have filled the void. They had rapidly expanded their presence in the LCD market, flooding the market with cheaper products such as 10th-generation panels measuring 2,900mm in width and 3,100mm in length. Chinese manufacturers are now scaling back on LCD panel production to bolster margins.

In the OLED market, by contrast, LG Display has been stepping up supply. Since its Guangzhou plant started operation in the second half of last year, LG's glass substrate production for OLED panels has more than doubled to 130,000 units a month from 60,000 units. That led to the price cut of OLED TV panels.

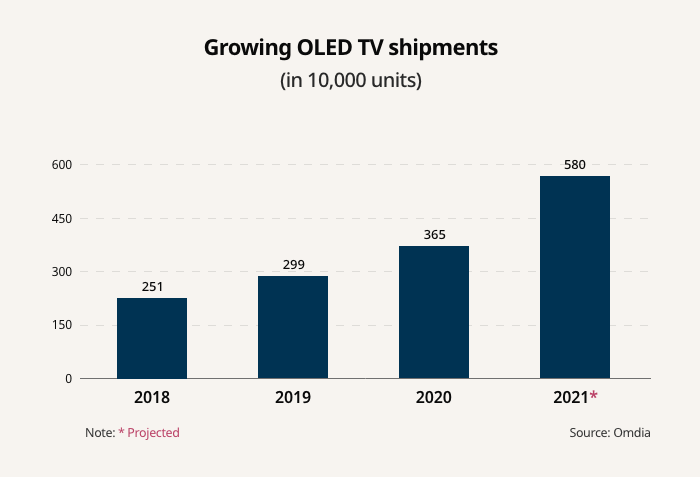

Thanks to the reduced price gap with LCD panels, Omdia forecasts that global shipments of OLED TVs will climb to 5.80 million units this year, up 59% from 3.65 million in 2020.

LG Display plans to boost its OLED TV panel shipments to as many as 8 million units this year from 4.5 million units in 2020. Based on its shipment goal, analysts expect global OLED TV sales in 2021 to double from last year's number, with more than a 10% share in global TV sales.

Amid the rosy OLED TV market outlook, the focus is now on whether Samsung Electronics Co. and China's TCL and Haier will make their forays into the market.

Write to Jeong-Su Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

Corporate split-offLG Corp shares surge ahead of relisting after LX Holdings split-off

Corporate split-offLG Corp shares surge ahead of relisting after LX Holdings split-offApr 15, 2021 (Gmt+09:00)

2 Min read -

Foldable displaysGlobal folding screen market to explode as Samsung set to supply to China

Foldable displaysGlobal folding screen market to explode as Samsung set to supply to ChinaFeb 15, 2021 (Gmt+09:00)

1 Min read -

Industry trendsSurvival of the fittest for Korean firms in COVID-19 era

Industry trendsSurvival of the fittest for Korean firms in COVID-19 eraFeb 15, 2021 (Gmt+09:00)

5 Min read -

-

CES 2021Samsung, LG vie for top spot as premium TV players at CES 2021

CES 2021Samsung, LG vie for top spot as premium TV players at CES 2021Jan 10, 2021 (Gmt+09:00)

2 Min read