POSCO Int’l to build permanent magnet factory in US with Star Group

The upcoming investment will enable S.Korean steel giant POSCO Holdings to foray deeper into the EV sector

By Oct 03, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s steel giant POSCO Holdings Inc. is expediting its push to expand its presence in the electric vehicle supply chain, one of seven growth drivers tapped to diversify its business portfolio beyond steel.

Its general trading and energy exploration unit POSCO International Corp. is said to be seeking to build a factory to produce permanent magnets, an essential part of an EV drive motor core, in the US jointly with Korean rare earth permanent magnet hidden champion Star Group Industrial Co., according to sources in the related industries on Tuesday.

The two parties are currently in negotiations with the state governments of Texas, Tennessee and Arizona to decide the location of their joint permanent magnet manufacturing factory with an initial production capacity of 3,000 tons a year, which would be later expanded to 5,000 tons a year, enough to power 2.5 million electric vehicles, sources said.

They are said to be investing up to 300 billion won ($147 million) to build the factory.

They are expected to supply permanent magnets from the factory to the top three US automakers -- General Motors Co., Ford Motor Co. and Stellantis NV -- and plan to secure orders from Hyundai Motor Co. and Kia Corp.'s US plants, according to sources.

POSCO International and Star Group aim to set up a joint venture for the US permanent magnet factory within this year. They are still in talks to determine each party’s stake in the JV.

Their US permanent magnet-manufacturing JV is expected to allow POSCO Holdings to foray deeper into the EV sector, one of the seven mainstay growth engines the Korean steel giant has been actively nurturing.

These industries are steel, hydrogen, rechargeable battery materials, lithium and nickel, energy, construction and food industries -- and the steel group has ventured into the EV business through the production of key EV battery materials such as lithium, cathodes and anodes, as well as waste battery recycling.

POSCO International supplies key EV component drive motor cores, which are produced by its subsidiary POSCO Mobility Solution.

CHINA’S DOMINATION

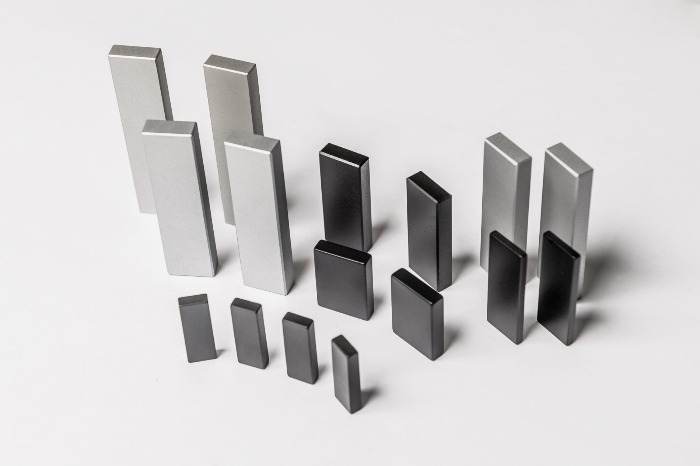

Permanent magnets have recently emerged as an essential automotive part amid the fast EV transition. They are also called rare earth permanent magnets because they contain rare earth materials and have permanent magnetic fields.

An electric vehicle needs a drive motor to run, like a powertrain in a combustion engine car, and motor cores to convert electric power into kinetic energy for motion.

Without permanent magnets, motor cores cannot function properly, and their quality affects an EV's efficiency.

The battery pack and drive motor system make up 52% of the total raw material cost to build an electric vehicle.

Permanent magnets are currently used mainly in home electronics, including mobile phones, and industrial motors, such as those for wind turbines, but as the global EV market is set to burgeon, their demand from the EV sector is expected to rise rapidly.

According to the Korea International Trade Association, permanent magnet demand is forecast to zoom 225% from 2020 to 387,000 tons in 2030, of which about 30%, or 114,100 tons, are expected to be used by the EV sector.

As of 2020, permanent magnet consumption by the EV sector accounted for a mere 6% of the entire market.

However, the global rare earth permanent magnet market is conquered by Chinese players.

In particular, a majority of the US permanent magnet market is commanded by leading Chinese companies, such as Zhongke Sanhuan, China’s largest rare earth magnet producer, and Yantai Dongxing Magnetic Materials Inc, previously named Yantai Shougang Magnetic Materials Inc. (YSM), which is a China-Japan joint venture.

To reduce the country’s reliance on Chinese magnet imports, the US Congress is seeking to pass a bill to give a $30 dollar tax break per 1 kilogram of permanent magnets made from the country’s own rare earth.

To benefit from the tax incentives, rare earth permanent magnet producers from China and Japan are expected to make fast advances into the US market.

STAR GROUP, KOREA'S SOLE PERMANENT MAGNET PRODUCER

Against China’s dominance, POSCO International has teamed up with Korea’s sole rare earth permanent magnet producer Star Group, which is a patent-rich company with extensive know-how in producing permanent magnets.

Star Group is expected to take charge of rare earth permanent magnet production at the joint US factory, while POSCO International with a massive global network is projected to lead their sale and distribution in the US.

The factory is also expected to create high synergy with POSCO Mobility Solution, POSCO International’s drive motor core-manufacturing subsidiary that is also expected to complete its motor core plant in Mexico this month.

The subsidiary last month bagged a 900 billion won contract from Hyundai Motor Group, the parent of Hyundai Motor and Kia, to supply its drive motor cores.

Star Group founded in 1994 operates a factory in North Gyeongsang Province to produce permanent magnets for autos, information technology devices and industrial motors.

It has been a permanent magnet supplier of Hyundai Motor Group for a decade, while it has been working with POSCO International for the global distribution of its magnets.

Star Group's operating profit amounted to 11.4 billion won in 2022 on sales of 169.7 billion won, more than double that of a year ago.

Texas, Tennessee and Arizona are floated as strong candidates as sites of the POSCO International-Star Group permanent magnet factory JV in the US because those states have either rare earth mines or auto factory clusters.

POSCO’S FAST MIGRATION TO EV

With the addition of the rare earth permanent magnet business, POSCO Holdings is expected to further enhance its own EV ecosystem, encompassing the production of automotive steel, EV battery materials, EV parts and waste battery recycling.

Automotive steel products account for about 30% of POSCO Holdings’ entire sales.

The steel giant develops and produces lithium and nickel in Argentina and Australia, and its EV battery material maker POSCO Future M Co. produces cathodes and precursors, using those materials.

POSCO Holdings also runs facilities to recycle waste secondary batteries in Korea and Poland to collect lithium, nickel and other raw materials.

The company in July revised its sales target for rechargeable battery materials by 51% from the previous goal to 62 trillion won in 2030 to join the global top three secondary battery materials producer club by that year.

The steel group is now involved in most facets of the EV business, except EV assembly and battery pack production, underscoring its aggressive push to diversify beyond steel making.

Write to Jae-Fu Kim, Hyung-Kyu Kim and Mi-Sun Kang at hu@hankyung.com

Sookyung Seo edited this article.

-

AutomobilesPOSCO Int'l to supply EV motor cores to Hyundai Motor Group

AutomobilesPOSCO Int'l to supply EV motor cores to Hyundai Motor GroupSep 15, 2023 (Gmt+09:00)

1 Min read -

Hydrogen economyPOSCO to lead Korea-Australia hydrogen, minerals partnership

Hydrogen economyPOSCO to lead Korea-Australia hydrogen, minerals partnershipSep 08, 2023 (Gmt+09:00)

2 Min read -

-

BatteriesPOSCO Future M to produce nickel for cathodes in the Philippines

BatteriesPOSCO Future M to produce nickel for cathodes in the PhilippinesAug 18, 2023 (Gmt+09:00)

1 Min read -

Korean stock marketPOSCO affiliates’ shares surge; market cap rises threefold in 5 years

Korean stock marketPOSCO affiliates’ shares surge; market cap rises threefold in 5 yearsJul 24, 2023 (Gmt+09:00)

3 Min read -

BatteriesPOSCO Future M spurs single-crystal cathode production

BatteriesPOSCO Future M spurs single-crystal cathode productionJul 23, 2023 (Gmt+09:00)

3 Min read -

BatteriesPOSCO sharply lifts 2030 battery materials sales targets

BatteriesPOSCO sharply lifts 2030 battery materials sales targetsJul 11, 2023 (Gmt+09:00)

4 Min read