Indonesia’s slashed EV tax to boost Hyundai’s IONIQ 5 sales

The Korean carmaker will ramp up its drive to crack the Japanese dominance in Southeast Asia's top car market

By Apr 13, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s top automaker Hyundai Motor Co. is expected to enhance its presence in Indonesia, which has drastically reduced its value-added tax on electric vehicles to encourage the adoption of EVs and attract foreign investment.

Hyundai, which is enjoying the growing popularity of its flagship EV crossover, the IONIQ 5, across Southeast Asia, will ramp up its offensive to crack the Japanese dominance in one of the fastest-growing car markets in the region, company officials said.

Earlier this week, Indonesia said it is lowering its VAT on battery-based electric vehicle sales to 1% from 11% amid efforts to lure investment to domestic production.

The incentive will remain in place until the end of the year.

The tax cut will benefit EV makers operating in Indonesia, with Hyundai Motor poised to leverage the reduced rate to widen its growing presence there, analysts said.

In Indonesia, Southeast Asia’s top car-selling market, Japanese automakers, led by Toyota Motor Corp., have long reigned as undisputed champions with their names on nine out of every 10 passenger cars sold there.

In the country’s EV market, however, Hyundai is the top player with a 55% market share as of February.

Hyundai’s IONIQ 5, launched last April in Indonesia, sells at 748 million rupiah ($50,728) for its basic model. That’s triple the price of the runner-up Wuling Motors’ Air EV and double the average car sales price in Indonesia.

With the tax cut, Hyundai is expected to lower its IONIQ 5 prices by nearly 9%, depending on different models, industry watchers said.

IONIQ 5, FIRST PURE EV IN ASEAN

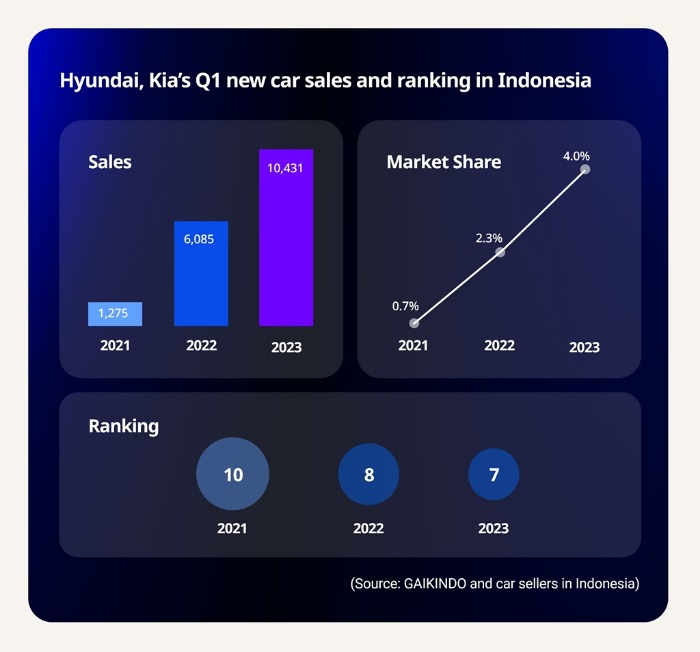

In the first quarter, Hyundai Motor and its affiliate Kia Corp. sold 10,431 vehicles, including electric models, in Indonesia, to rank seventh. The Korean carmakers, combined, have steadily climbed the ladder from eighth position in the first quarter of 2022 and 10th in the same period of 2021.

Still, Hyundai has some catching up to do in Indonesia. Japanese carmakers, including Toyota, Daihatsu Motor Co., Mitsubishi Motors Corp. and Honda Motor Co., are all ahead of Hyundai in rankings.

Hyundai plans to challenge them with its IONIQ 5, the first pure electric vehicle produced across the Association of Southeast Asian Nations market. For Hyundai, the car is its first all-electric model produced outside Korea.

Hyundai mounted an offensive against rivals with the kickoff of its Indonesian manufacturing plant last year.

In May, Hyundai began mass producing its iconic IONIQ 5 at its newly built plant in the Deltamas industrial complex in Bekasi Regency, about 40 km east of Jakarta.

Hyundai said at the time it would spend $1.55 billion to increase its annual production capacity to 150,000 units by the end of 2022, and further expand to 250,000 cars in the long run.

According to Hyundai Motor Indonesia (HMID), some 4,000 customers are waiting to receive their IONIQ 5 cars.

HMID Chief Operating Officer Makmur said in a recent interview that Hyundai plans to expand its Indonesian car production by up to threefold over the next few years.

Vehicles made at the plant are sold in Indonesia and exported to neighboring countries, targeting the ASEAN market.

INDONESIA SEEKS LIMITED EV MINERALS FTA WITH US

Hyundai is focusing on Southeast Asia, given the strong growth potential in the region. Indonesia is the world's fourth-most populous country with 280 million people.

While the Indonesian EV market is still in its infancy, the country is young and its per capita GDP has grown 10% annually over the past couple of years.

Indonesia also has ample mineral resources such as nickel and cobalt, key raw materials for EV battery production. The country is the world’s top nickel producer with the largest reserves.

To secure a stable supply of battery cells, Hyundai has forged a partnership with LG Energy Solution Ltd. to build a battery plant in Karawang, Indonesia.

Last September, the two companies began construction of the $1.1 billion battery cell plant with an aim to begin commercial production in the first half of 2024.

Indonesia is seeking to forge a limited free trade agreement with the US so that its minerals shipped to the US can be used by companies in the EV battery supply chain to benefit from US tax credits.

The Indonesian government has been offering generous tax incentives for global automakers to expand the country’s EV penetration rates, with at least one in five vehicles running on its roads to be electric by 2025.

Write to Nan-Sae Bin at binthere@hankyung.com

In-Soo Nam edited this article.

-

AutomobilesBangladesh: Hyundai’s next target for partially assembled Tucson SUV

AutomobilesBangladesh: Hyundai’s next target for partially assembled Tucson SUVFeb 27, 2023 (Gmt+09:00)

3 Min read -

AutomobilesHyundai, Kia vow to crack Japan-dominated SE Asian market with EVs

AutomobilesHyundai, Kia vow to crack Japan-dominated SE Asian market with EVsJan 21, 2023 (Gmt+09:00)

4 Min read -

Future mobilityHyundai Motor, Indonesia to jointly enter ASEAN air mobility market

Future mobilityHyundai Motor, Indonesia to jointly enter ASEAN air mobility marketNov 14, 2022 (Gmt+09:00)

2 Min read -

BatteriesHyundai Motor, LG Energy secure $710 mn for battery JV in Indonesia

BatteriesHyundai Motor, LG Energy secure $710 mn for battery JV in IndonesiaAug 22, 2022 (Gmt+09:00)

2 Min read -

Business & PoliticsIndonesian president to visit Hyundai Motor during Korea visit

Business & PoliticsIndonesian president to visit Hyundai Motor during Korea visitJul 26, 2022 (Gmt+09:00)

3 Min read -

AutomobilesHyundai to make IONIQ 5 in Indonesia, EV hub for ASEAN market

AutomobilesHyundai to make IONIQ 5 in Indonesia, EV hub for ASEAN marketMar 16, 2022 (Gmt+09:00)

3 Min read