Electric vehicles

Kia to break ground on new Korean EV plant in March

Kia and its union agree to employ more staff at the factory than the company’s initial plan, double output and produce PE modules

By Jan 16, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

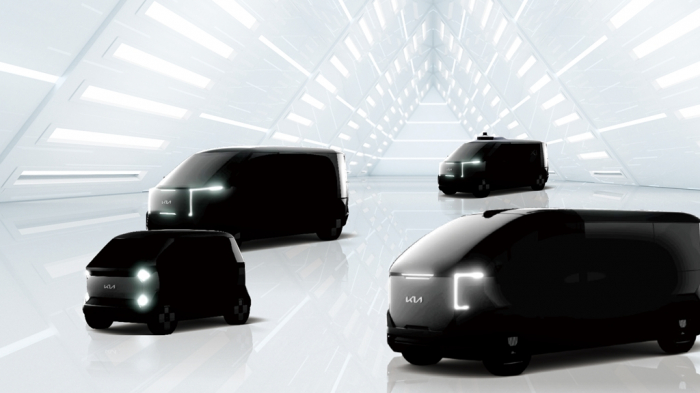

Kia Corp., South Korea’s No. 2 automaker, is set to break ground in March on a domestic factory to produce electric purpose-built vehicles (PBVs), a booster for future growth, as it reached a critical agreement with unionized workers on maintaining employment and raising the plant's output.

Kia, a carmaker within the country’s leading carmaker Hyundai Motor Group, and its unionized workers agreed on a plan to start mass production in July 2025 of the company’s first new plant in Korea in 25 years.

They signed a deal to deploy more staff than the automaker had planned, more than double the PBV output and manufacture components such as power electric (PE) modules at the factory.

“It was agreed to create a production base of more than 200,000 units by building more facilities after establishing a stable market with a plant of 100,000 units,” they said.

Kia has aimed to sell 1.5 million of PBVs around the world as it expected the global market of the segment to grow to 20 million units in 2030, accounting for about 25% of new vehicle sales globally.

CONTROVERSIAL AGREEMENT

The agreement has sparked controversy as global automakers are cutting jobs for electric vehicle production, which needs fewer workers than manufacturing for internal combustion engine cars. Kia and its union fixed the production volume although demand may be volatile despite strong growth in the global EV market. That could put pressure on the company’s profitability, industry sources said.

“We could face the same situation for Hyundai’s new local plant scheduled in 2025,” said one of the sources in Seoul. “Talks with unionized workers on employment will become a hurdle for future investment.”

Hyundai Motor Co., Kia’s larger affiliate, agreed with its unionized workers in July last year to build an EV plant at its Ulsan complex, about 370 kilometers southeast of Seoul, in its first domestic production investment in 29 years. But Hyundai and its union need to discuss the details further.

The two automakers need consent from their unions on key decisions such as new projects and factory consolidation.

UNIONIZED WORKERS’ VICTORY

Kia agreed to operate the new factory with 759 employees, 31% higher than its initial plan, to reach an agreement with unionized workers as quickly as possible.

The company had planned to run the plant to be built at its Hwaseong complex, about 80 km south of Seoul, with 578 staff as the head of the complex Song Min-soo said “about 30% of jobs will disappear in an era of EVs that don't need 37% of auto parts.”

Talks with the unionized workers have dragged on with 17 negotiation sessions over about the last year as the workers demanded measures to maintain employment, requesting 838 staff to be allocated to the factory.

Management had to partially accept the request as a delay in the plant's construction is expected to keep the company from starting production of the new future mobility segment.

“The union appeared to have won the industry’s first talks on the employment at an EV plant, a hot potato for the sector,” said an executive of a local automaker.

The agreement is expected to mean that local automakers will have to secure price competitiveness and profitability while maintaining a larger workforce than those of global carmakers, industry sources in Seoul said.

Automakers across the world such as German Mercedes Benz, Dutch-domiciled multinational automaker Stellantis N.V., US Ford Motor Co. and French Groupe Renault already cut jobs. Ford reduced 3,000 employees from its Michigan Assembly Plant last August and Renault axed 2,000 staff in France in 2021.

Kia’s unionized workers hailed the agreement.

“The company selected a transition to EVs that stabilizes employment, not a transition that reduces jobs,” the union said. “We will keep and develop the agreement.”

TO MAKE ITS OWN PE MODULES

Kia and unionized workers also agreed to produce the company’s own PE modules for the PBVs.

That could cause competition within the group as Hyundai Mobis Co., an auto parts maker of Hyundai Motor Group, has been producing and supplying PE modules to automakers including Kia.

The world’s sixth-largest automotive component supplier unveiled two PBV concept models – M Vision TO and M Vision HI, self-driving futuristic electric vehicles, at CES 2023, the largest global tech show, earlier this month.

Write to Han-Shin Park, Il-Gue Kim and Hyung-Kyu Kim at phs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

ElectronicsKorean firms head to CES 2023 to showcase innovative technologies

ElectronicsKorean firms head to CES 2023 to showcase innovative technologiesJan 02, 2023 (Gmt+09:00)

3 Min read -

Electric vehiclesHyundai Motor to build 1st Korea plant in 29 years

Electric vehiclesHyundai Motor to build 1st Korea plant in 29 yearsJul 12, 2022 (Gmt+09:00)

4 Min read -

AutomobilesKia set to break ground on purpose-built vehicle plant in 2023

AutomobilesKia set to break ground on purpose-built vehicle plant in 2023Mar 30, 2022 (Gmt+09:00)

2 Min read -

Future mobilityKia plans new Korea plant first time in 25 years for purpose-built vehicles

Future mobilityKia plans new Korea plant first time in 25 years for purpose-built vehiclesMar 24, 2022 (Gmt+09:00)

3 Min read -

Chief ExecutivesKia aims to become purpose-built vehicle market leader: CEO

Chief ExecutivesKia aims to become purpose-built vehicle market leader: CEOFeb 02, 2021 (Gmt+09:00)

4 Min read

Comment 0

LOG IN