US beats China to become S.Korea’s No.1 export destination in 2022

Asia’s fourth-largest economy also logged its highest-ever current account surplus with the world’s biggest economy last year

By Jun 22, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea last year exported most to the US thanks to brisk sales of the country’s cars in the world’s No. 1 economy, whereas trade with its biggest trading partner China dipped into the red for the first time in about two decades.

Korea’s goods exports to the US in 2022 amounted to $139.31 billion, up 22.1% from the year prior on strong demand for Korean cars, according to data from the Bank of Korea (BOK) on Thursday.

On the contrary, Korea's value of goods exports to China shrank 9.8% to $123.22 billion over the same period due to weak chip demand.

It is the first time in 18 years that goods exports to the US have exceeded China's to become Korea’s largest export destination. The US was Korea’s leading goods export stop until 2004 when it yielded to China.

By trade balance data from Korea Customs Service, China is still Korea’s biggest export partner as of 2022 but the US has replaced China in terms of goods exports based on data from the central bank.

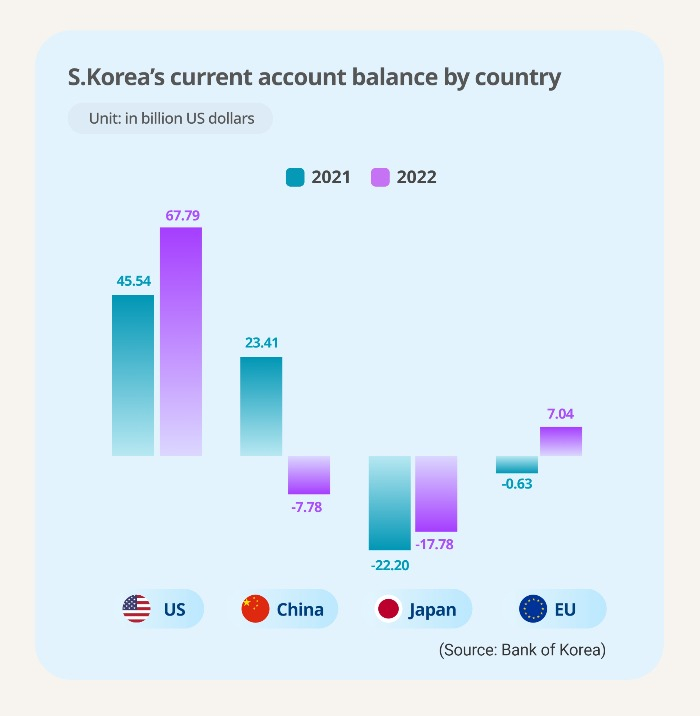

Coupled with handsome dividend income, brisk Korean car sales in the US drove Seoul’s current account surplus with Washington in 2022 to its highest-ever $67.79 billion, breaking the previous record of $45.54 billion in 2021, the BOK data showed.

This is a stark contrast to the country’s total current account balance for last year, which more than halved to a $29.83 billion surplus from $85.23 billion a year ago. In the first four months of this year, the country even logged a $5.37 billion current account deficit.

The current account is the broadest measure of Korea’s trade with the rest of the world.

The strong demand for Korean cars lifted Korea’s goods account surplus with the US to a record high of $56.38 billion last year.

The Asian country’s primary account surplus with its close Western ally also soared to the biggest-ever $13.79 billion from $9.24 billion over the same period, while its service account deficit with the US narrowed to $2.02 billion, the lowest since 2005.

The primary account tracks the wages of foreign workers and dividend payments overseas.

MADE IN KOREA LOSES STEAM IN CHINA

Korea’s outstanding trade score against the US comes at the cost of losing its appeal to China.

The country ran a current account deficit of $7.78 billion with China in 2022, swinging from a surplus of $23.41 billion in the previous year. This is Seoul’s first current account deficit with Beijing since 2001 when it dipped to a shortfall of $760 million.

Korea’s goods account balance with China had a deficit of $10.06 billion last year due to a fall in exports of machinery, precision tools and petroleum products to the world’s second-largest economy coupled with a rise in raw materials imports from the country.

Korea’s service account balance with China dipped to a loss of $590 million, while the primary income account swung to a shortfall partly due to a drop in dividend income.

KOREA’S GROWING RELIANCE ON THE US

Korea’s reliance on the US in trade is deepening amid the ongoing trade and political rows between Washington and Beijing, which have broadly segmented the world into two economic blocs.

According to trade data from the Korea International Trade Association, the value of exports to China accounted for 19.5% of Korea’s entire export value in the first three months of this year. This was the first time that exports to China’s share dipped below 20% since 2005. Korea’s exports to China made up 22.8% last year.

Korean goods have been losing ground in China partly due to the plummeting chip exports to the world’s No. 2 economy in line with a plunge in dynamic random access memory chip prices. Semiconductors took about 30% of Korea’s entire exports to China in the last three years.

The US has been filling the vacuum left by China, with Korea's exports to the world’s No. 1 economy in the first three months of this year accounting for 17.7% of Korea’s total exports -- near the level last seen two decades ago.

Of Korea’s top 10 export destinations, the US is the only trading partner that has upped shipments from Korea over the last five years largely thanks to strong demand for Korean vehicles that more than offset weak chip demand.

Meanwhile, Korea’s current account deficit with Japan narrowed to $17.78 billion from $22.20 billion over the same period, while its current account balance with the EU turned around to a surplus of $7.04 billion from the previous year’s $630 million shortfall, the BOK data showed.

Korea’s current account deficit with the Middle East, however, swelled to $88.05 billion from $47.98 billion over the cited period.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

-

EconomyKorea’s current account swings to deficit, four-month figures worsen

EconomyKorea’s current account swings to deficit, four-month figures worsenJun 09, 2023 (Gmt+09:00)

2 Min read -

AutomobilesS.Korea’s January-April car exports at record high of $23.2 bn

AutomobilesS.Korea’s January-April car exports at record high of $23.2 bnMay 16, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea in March posted first current account surplus in 3 months

EconomyS.Korea in March posted first current account surplus in 3 monthsMay 11, 2023 (Gmt+09:00)

1 Min read -

EconomyS.Korea logs biggest-ever current account deficit in Jan on export slump

EconomyS.Korea logs biggest-ever current account deficit in Jan on export slumpMar 10, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea returns to current account surplus in Dec but faces export slump

EconomyKorea returns to current account surplus in Dec but faces export slumpFeb 08, 2023 (Gmt+09:00)

1 Min read