Economy

S.Korean inflation rises at slowest rate in 10 months in February

A fall in petroleum prices slowed the country’s inflation but utility prices jumped nearly 30% on-year

By Mar 06, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

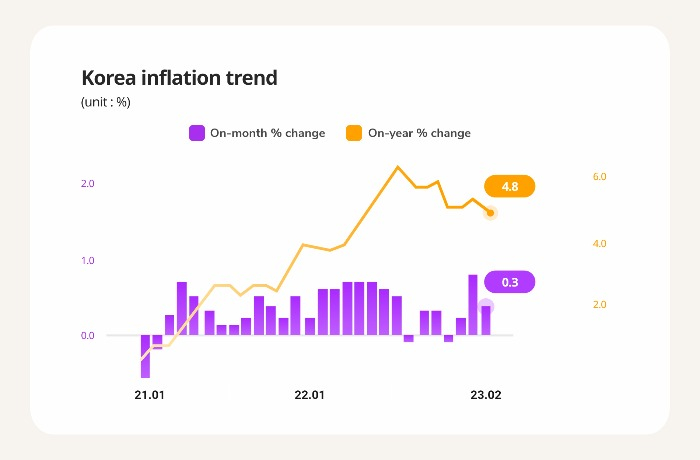

South Korea’s headline inflation gain eased in February, rising at the slowest pace in 10 months on a drop in oil product prices but utility prices jumped at the fastest-ever rate, casting doubt on whether the country’s disinflation trend could continue.

According to data released by Statistics Korea on Monday, Korea’s consumer price index in February climbed 4.8% year over year in February to 110.38, easing from January’s 5.1%. This is the first time the country’s inflation has slowed below 5% since April last year when it gained 4.8%.

After the country’s inflation peaked in July last year at 6.3%, it stayed at the 5% level until January.

The eased inflation last month was largely credited to a fall in petroleum product prices, according to the data. The oil product price index retreated 1.1% on-year in February, the first drop since February 2021.

But the country’s inflation could pick up speed again after electricity, gas and water prices jumped 28.4% on-year last month, the biggest gain since related data began to be compiled in January 2010. Power and city gas bills soared 29.5% and 36.2%, respectively, over the cited period.

This is expected to trigger price hikes in other products coming from heavy energy-using sectors.

The country’s inflation would stay at the 4% level if there is no external shock, the country’s finance ministry forecast on Monday. But food and service prices could swing for some time due to the prolonged rally in international commodity prices, it added.

“The government will continue to go all out to further tame still-high inflation,” Finance Minister Choo Kyung-ho said during a meeting with economy-related ministers on Monday.

The government will try to keep utility prices stable at the current levels through the first half of this year to ease the financial burden on the public, added Choo.

STILL EARLY FOR BOK RATE CUT

Of oil products, gasoline prices declined 7.6% on-year last month following the fall in international oil prices.

The price index for agricultural, fisheries and livestock products added 1.1% on-year in February, but livestock prices fell 2.0%, their first drop since September 2019.

Industrial product prices, however, jumped 5.1% on-year last month mainly due to higher bread and diesel prices that rose 17.7% and 4.8%, respectively.

Prices of personal services gained 3.8% over the same period.

Core inflation excluding volatile food and energy prices gained 4.0% on-year in February versus a 4.1% rise in January.

The Bank of Korea last month kept the policy rate unchanged at 3.5% as expected, citing the economic slowdown and the gradual decrease in inflation.

But the country’s central bank left the door open for a further hike, given sustained price pressure. BOK Governor Rhee Chang-yong also said the central bank would not cut the base rate unless it is confident that inflation is heading to its 2% target.

Write to Eui-Jin Jeong at justjin@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Central bankBOK holds rates as it lowers growth, inflation forecasts

Central bankBOK holds rates as it lowers growth, inflation forecastsFeb 23, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea’s inflation picks up 5.2% in January on high utility prices

EconomyKorea’s inflation picks up 5.2% in January on high utility pricesFeb 02, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea inflation at 7-mth low; BOK may slow rate hike pace

EconomyKorea inflation at 7-mth low; BOK may slow rate hike paceDec 02, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN