Economy

S.Korea’s exports drop for 5th straight month in Feb on plunging chip sales

The country has reported a trade deficit for 12 consecutive months, its longest loss-making on the trade front in 25 years

By Mar 02, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s exports shrank 7.5% year over year in February on a plunge in shipments of its mainstay export item semiconductors amid the global economic slowdown, extending the losing streak for the fifth month in a row and leading the country to report a trade deficit for 12 straight months.

According to monthly trade data released by the Ministry of Trade, Industry and Energy on Wednesday, Korea’s exports in February stood at $50.1 billion, off 7.5% from the year prior. It was the first time the country logged losses in exports for the fifth month in a low since the early stage of the COVID-19 pandemic between March and August 2020.

The fall in exports eased somewhat from January with a 16.6% on-year retreat.

However, the country’s trade stayed in the red for 12 consecutive months, marking the longest losing streak in 25 years since the consecutive loss-making between January 1995 and May 1997 after imports increased 3.6% from a year ago to $55.4 billion in February.

Korea’s trade deficit of $5.3 billion in the month plus the deficit of $12.6 billion in January means the trade deficit in the first two months of this year hit $18 billion, already equivalent to nearly one-third of the country’s worst trade deficit of $47.5 billion last year.

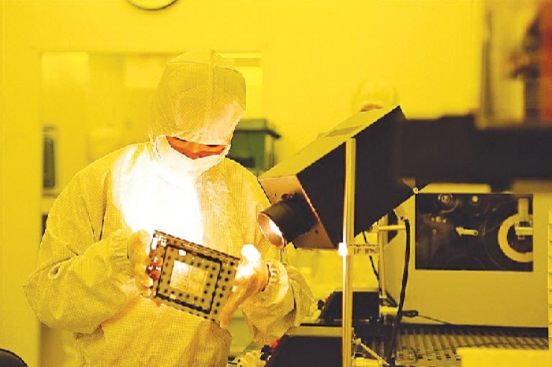

The trade ministry blamed weak global chip demand, which led the country’s semiconductor shipments to tumble more than 40% on-year for the second straight month in February, for the overall decline in exports.

Imports exceeded exports mainly due to a rise in energy imports especially gas for heating in the winter, according to the ministry.

SEMICONDUCTORS LEAD THE FALL

Korea shipped out $5.9 billion worth of semiconductors in February, down 42.5% from the same period last year. It was the second month in a row the country saw chip exports drop more than 40% due to a drop in dynamic random-access memory chip prices stemming from the economic slowdown-driven fall in chip demand.

The country’s and world’s two largest memory chip makers Samsung Electronics Co. and SK Hynix Inc. are reported to have logged massive losses in the memory business in February. The trade ministry forecast memory prices to continue falling for a while, boding ill for the country’s exports.

Asia’s fourth-largest economy saw nine out of its 15 mainstay export items post losses in outbound shipments last month, with computer, display, petrochemical and steel products down 66.4%, 40.9%, 18.3% and 9.8%, respectively, from a year ago.

Automotive exports, however, jumped 47.1% on-year in February thanks to brisk sales of electric vehicles and eased chip supply shortages.

EV exports soared 82.9% over the same period, and secondary battery shipments grew 25.1%.

Brisk auto and secondary battery sales led Korea’s exports to the US and the EU to expand 16.2% and 13.2%, respectively, over the same period. The country logged a surplus of $2.97 billion and $630 million in trade with the US and the EU. Its shipments to the Middle East also added 20.2%.

But the country’s exports to China dropped 24.2% on-year in February to $9.88 billion, partly due to the falling chip exports. It was the ninth consecutive month that Korea’s shipments to its biggest trading partner fell. Korea logged a loss of $1.14 billion in trade with China in the month, marking the fifth trade deficit in a row.

Its shipments to ASEAN member countries also shrank 16.1%, falling for the fifth month in a row despite a trade surplus of $1.51 billion.

Korea imported $15.3 billion worth of crude oil, gas and coal in February, up 19.7% from a year ago and exceeding its average monthly energy imports for February between 2013 and 2022 by $5.6 billion. Especially gas purchases in the month surged 73.2% to $6.2 billion due to the country’s high heating demand in the wintertime.

GROWTH VERSUS POLICY RATE

The Bank of Korea on Thursday last week kept the country’s base interest rate unchanged at 3.50% as expected. It was the first time that the central bank has held the policy rate steady since February last year, snapping its first-ever seven-straight-month tightening move.

The bank attributed the domestic economic slowdown and expectations for lower inflation to the latest monetary policy decision.

But the BOK remains in dilemma over its rate decision because a series of the latest US economic data suggest its US counterpart Federal Reserve would continue to hike the policy rate for the world’s largest economy, which could widen the interest rate gap between the two countries. The Fed is projected to raise the rate to as high as 5.1% in 2023.

Following the BOK’s latest rate decision last week, foreign capital flight has accelerated, leading the country’s currency Korean won to weaken sharply against the US dollar.

The Korean won ended at 1,315.30 per US dollar on Thursday versus 1,297.10 on Feb. 23 when the BOK kept the rate flat.

The trade ministry will go all out to reinvigorate the country’s exports, the key to its growth, by enhancing the competitiveness of the country’s mainstay export items like semiconductors and new growth engines such as secondary batteries and EVs, Industry Minister Lee Chang-yang said in a press release on Wednesday.

The country will also groom the nuclear power, defense, agricultural and digital industries as its new export drivers, which also could help the country reach its export target of $685 billion for this year, according to the ministry.

Write to So-Hyeon Kim at alpha@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Central bankBOK sees interest rate as tight amid continued drop in exports

Central bankBOK sees interest rate as tight amid continued drop in exportsFeb 21, 2023 (Gmt+09:00)

3 Min read -

EconomyS.Korea’s trade outlook dismal in Feb with stagnant exports

EconomyS.Korea’s trade outlook dismal in Feb with stagnant exportsFeb 13, 2023 (Gmt+09:00)

2 Min read -

EconomyS.Korea likely to suffer recession as Jan exports tumble

EconomyS.Korea likely to suffer recession as Jan exports tumbleFeb 01, 2023 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN