Economy

Average household debt in South Korea exceeds $69,000 so far this year

Statistics Korea, under the Ministry of Economy and Finance, announced that household debt jumped 4.2% jump on-year

By Dec 01, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

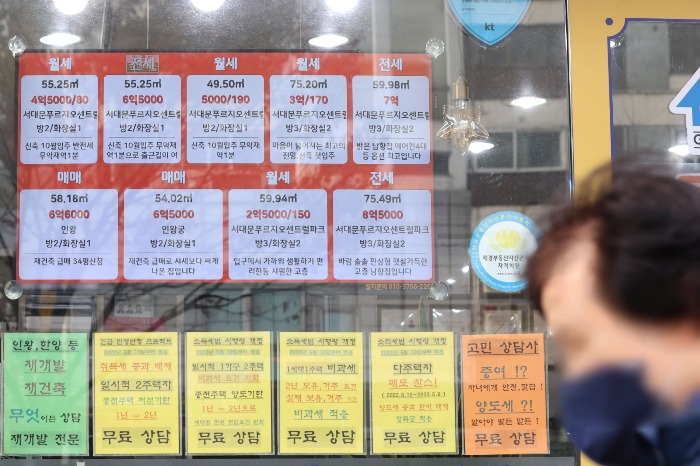

The average household debt in South Korea has exceeded 90 million won ($69,284). While the figure appears to be high by Korean standards, average household debt in the United States stands currently stands at $96,371.

Statistics Korea, under the Ministry of Economy and Finance, announced Thursday that the household debt as of late March reached 91.7 million won, a 4.2% jump from the same month last year.

It is the first time household debt has exceeded the 90 million won mark since the Korean government began compiling the numbers in 2012.

Household debt typically includes home mortgages, home equity loans, auto loans, student loans, and credit cards.

By age group, those aged under 29 accumulated 50.1 million won in household debt, a 41.2% surge on-year. Of that number, financial liabilities increased by 35.4% to 45.8 million won.

The survey is conducted on paid labor force over the age of 15.

Household debt for those in their 50s and 60s rose by 6.8% and 6% respectively.

Koreans in their 30s and 40s saw the lowest rate of increase in their household debts, which hovers around just 1%.

“We found that those under the age of 29 have proactively applied for and received mortgages this year, resulting in the rapid increase in the amount of debt for people in their 20s,” Lim Kyung-eun, Director of the Welfare Statistics Division at Statistics Korea said.

In other words, more twenty-somethings than before applied for mortgage loans late last year and early this year when housing prices started to skyrocket. Experts say the Gen-Z population appears to have bet on continued price hikes in the domestic housing market.

The asset disparity grew larger.

The number of households with more than 10 billion won in net assets increased from 9.4% of the total household in 2021 to 11.4% this year. But the number of households that have more debt than assets also climbed from 7.8% of the households to 9% of the total this year.

Anxiety about retirement remained.

Only 8.7% of the surveyed families where the head of the household has yet to retire answered they are prepared for his or her retirement.

More than half of the respondents said their households are not prepared for the main breadwinner's retirement.

Write to Jung-hwan Hwang at jung@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stake

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stakeApr 29, 2025 (Gmt+09:00)

-

EnergySouth Korea nears Czech nuclear deal; Doosan, related stocks fly high

EnergySouth Korea nears Czech nuclear deal; Doosan, related stocks fly highApr 25, 2025 (Gmt+09:00)

-

-

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talks

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talksApr 25, 2025 (Gmt+09:00)

-

Comment 0

LOG IN