Earnings

Samsung Biologics posts record 2024 sales, operating profit as it goes global

With its cumulative orders worth $17 billion, the drugmaker is now focusing on the profitable ADC business

By Jan 22, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea's Samsung Biologics Co., the world’s largest contract drugmaker, on Wednesday posted its largest-ever annual sales and operating profit, driven by a steady stream of profitable drug-making contracts for pharmaceutical firms.

The biotechnology unit of Korea’s top conglomerate Samsung Group said in a regulatory filing that it posted 1.32 trillion won ($919 million) in operating profit last year on a consolidated basis, up 18.5% from 1.11 trillion won the previous year.

Its net profit rose 26.3% to 1.08 trillion won.

Its consolidated 2024 sales were 4.55 trillion won, up 23% from 3.69 trillion won.

With its 2024 revenue, Samsung became the first Korean biopharmaceutical firm with annual sales surpassing 4 trillion won.

In the fourth quarter of 2024, its net profit rose 10.6% on-year to 321.5 billion won while its operating profit fell 6.9% to 325.7 billion won. Quarterly sales gained 17% to 1.26 trillion won.

The company said in the regulatory filing that it aims to achieve sales revenue of 5.57 trillion won in 2025.

CUMULATIVE ORDERS AT ALL-TIME HIGH

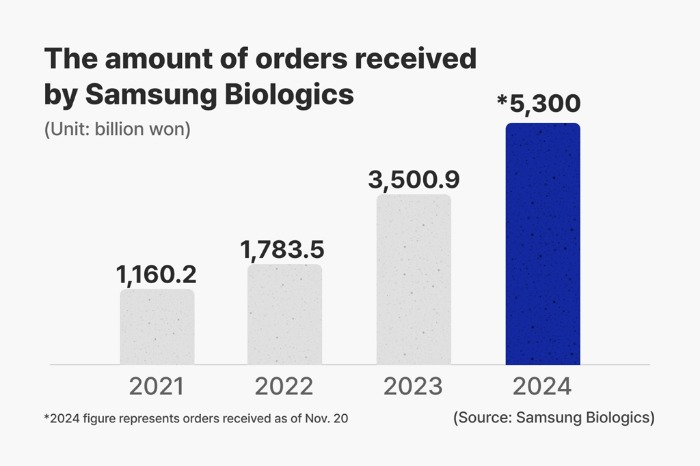

The company’s contract value for 2024 stood at 5.4 trillion won, a record annual high. That compares with 3.5 trillion won worth of orders in 2023.

Since its founding in 2011, its cumulative orders have exceeded 25 trillion won.

Samsung Biologics said it has partnered with 17 of the world’s top 20 pharmaceutical companies to make medicines for them under contract in the antibody drug segment, including cancer treatment, autoimmune disease therapies and biosimilars.

Samsung said it has contracts with virtually all major pharmaceutical companies, as the remaining three firms are biosimilar makers, meaning partnerships with them would create a conflict of interest.

For over a decade, the company has focused on manufacturing drugs for others in an arrangement known as a contract manufacturing organization (CMO).

Last week, Samsung signed a $1.4 billion CMO deal — its single largest contract — with an unidentified European biopharmaceutical firm.

It now aims to solidify its leadership in the contract development and manufacturing organization (CDMO) market, which involves cooperation starting at the more profitable drug development stage.

Samsung has been ramping up its facilities to meet growing client demand.

Most biopharma companies such as Pfizer, Moderna, AstraZeneca, and Janssen, Johnson & Johnson’s pharmaceutical division, focus on R&D while outsourcing production to contract drugmakers.

In terms of capacity, Samsung Biologics is already the world’s largest contract manufacturer, followed by Swiss rival Lonza AG and Germany’s Boehringer Ingelheim.

Samsung broke ground in April 2024 on its 5th plant with a 180,000 liter production capacity, which is slated to be completed by this April, further cementing its leadership as the world's top CDMO player.

Once the latest factory comes online, Samsung will have a total capacity of 784,000 liters.

FOCUS ON ADC BUSINESS

Samsung is now focusing on antibody-drug conjugates (ADCs), a promising area of oncology.

Last December, the company completed a dedicated ADC production plant in Incheon, a four-story building with a 500-liter conjugation reactor and one purification line.

ADC therapy has emerged as a promising cancer treatment despite its high technological barriers. ADC drugs have shown excellent clinical efficacy against various cancers such as breast cancer and gastric cancer as well as urothelial carcinoma.

ADCs, consisting of antibodies, payloads and linkers, are dubbed biological missiles: The antibody guides the payload, or small-molecule drugs that act as a warhead, and the linker connects the antibody with the payload.

The global ADC therapy market is forecast to expand from $7.7 billion in 2023 to $38.7 billion by 2029 at an average annual growth rate of 23.7%, according to data compiled by the Korea Drug Development Fund.

Earlier this month, Samsung signed a preliminary agreement with LigaChem Biosciences Inc., a Korean biotech startup, to jointly develop and produce ADC products.

Write to In-Soo Nam at isnam@hankyung.com

Joel Levin edited this article.

More to Read

-

Bio & PharmaSamsung Biologics signs $1.4 bn CMO deal with European pharma

Bio & PharmaSamsung Biologics signs $1.4 bn CMO deal with European pharmaJan 14, 2025 (Gmt+09:00)

1 Min read -

Bio & PharmaSamsung Biologics signs initial deal with LigaChem Bio on ADC production

Bio & PharmaSamsung Biologics signs initial deal with LigaChem Bio on ADC productionJan 09, 2025 (Gmt+09:00)

2 Min read -

Bio & PharmaSamsung Biologics wins $668 million CDMO deal with European pharma

Bio & PharmaSamsung Biologics wins $668 million CDMO deal with European pharmaNov 20, 2024 (Gmt+09:00)

4 Min read

Comment 0

LOG IN