LG Chem displays bright outlook after loss in first quarter

S.Korea’s No. 1 chemicals company reported a nearly 70% fall in profit in Q1 mainly due to continued loss in petrochemicals

By Apr 30, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

LG Chem Ltd., the parent of the world's second-largest battery maker LG Energy Solution Ltd., expects its business will improve in upcoming quarters on a recovery in demand for its high-value-added advanced material products after it reported a fall in operating profit in the first quarter of this year.

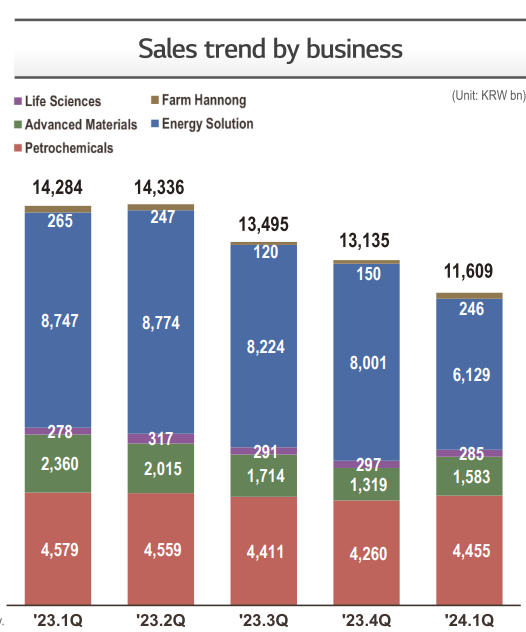

South Korea’s No. 1 chemicals company announced on Tuesday in a regulatory filing that its consolidated operating profit for the January-March quarter of this year shrank 67.1% from the same period of last year to 264.6 billion won ($178.4 million) but up 7% from the prior quarter.

Net profit for the quarter lost 48.9% on-year to 341.7 billion won on sales of 11.6 trillion won, down 18.7%.

The company attributed the disappointing earnings to the continued deficit in its petrochemicals business taking a hit from higher raw material costs amid growing geopolitical risks from the Middle East and fierce competition in the general-purpose chemicals market crowded with low-priced Chinese products.

It also suffered from the sluggish performance of its battery subsidiary LG Energy Solution, the operating profit of which n the same quarter fell 75.2% on-year to 157.3 billion won on sales of 6.1 trillion won, down 30%.

But the company pictures a rosier outlook for the upcoming quarter with improved profitability across the board, especially in the advanced materials business.

LG Chem shares on Tuesday ended up 1.8% at 402,500 won, extending gains for the third straight session.

RECOVERY IN THE BATTERY SECTOR

Its mainstay petrochemicals business reported an operating loss of 31.2 billion won in the first quarter, extending its losing streak for two months in a row. But the deficit was narrowed from the previous quarter's 117 billion won loss.

The main culprit for the deficit was hikes in raw materials costs driven by geopolitical risks.

LG Chem expected profitability in the petrochemicals business would improve in the current quarter as the home appliance market is set to enter the peak season, and new manufacturing lines for high-value-added products are scheduled to begin.

In the first three months, its advanced materials sales stood at 1.5 trillion won, down 32% from a year ago but up 20% from the previous quarter. The division’s operating profit fell 34% on-year to 142 billion won but grew nearly threefold from the previous quarter.

Sales of battery materials recovered in the January-March quarter from three months ago and its profitability in the upcoming months is expected to improve on gains in cathode shipments and stable metal prices, the company said.

Its high-value-added products’ share in the overall advanced materials sales is on the rise, with battery materials taking up 60% in the first quarter versus 55% a quarter ago.

Sales at its life science business stood at 285 billion won in the first quarter versus 278 billion won in the same period of last year. The gain was largely driven by solid demand for its diabetes and growth hormone products.

In early January, the company also announced a deal to license out its rare genetic obesity drug candidate in phase 2 clinical trials to Rhythm Pharmaceuticals Inc., a US biotech company, for up to $350 million.

Under the term, the Korean company will receive a $100 million upfront fee from Rhythm Pharmaceuticals to license its oral small molecule melanocortin-4 receptor (MC4R) agonist LB54640.

LG Chem will continue to reorganize its business around the three new growth engines – battery materials, eco-friendly materials and life sciences – to enhance its overall business competitiveness, the company said.

Write to Hyung-Kyu Kim at khk@hankyung.com

Sookyung Seo edited this article.

-

BatteriesLG Chem, Korea Zinc JV to mass-produce EV battery materials

BatteriesLG Chem, Korea Zinc JV to mass-produce EV battery materialsApr 17, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringLG Chem reshuffles R&D unit to turn into EV materials maker

Corporate restructuringLG Chem reshuffles R&D unit to turn into EV materials makerMar 18, 2024 (Gmt+09:00)

2 Min read -

Chemical IndustryLG Chem, CJ CheilJedang to launch eco-friendly bio-nylon joint venture

Chemical IndustryLG Chem, CJ CheilJedang to launch eco-friendly bio-nylon joint ventureFeb 15, 2024 (Gmt+09:00)

2 Min read -

BatteriesLG Chem sees up to 25% battery sector growth in 2024: report

BatteriesLG Chem sees up to 25% battery sector growth in 2024: reportJan 18, 2024 (Gmt+09:00)

2 Min read -

Bio & PharmaLG Chem to start phase 3 for head, neck cancer drug in US

Bio & PharmaLG Chem to start phase 3 for head, neck cancer drug in USJan 17, 2024 (Gmt+09:00)

1 Min read -

Bio & PharmaLG Chem out-licenses obesity drug candidate to US firm

Bio & PharmaLG Chem out-licenses obesity drug candidate to US firmJan 05, 2024 (Gmt+09:00)

2 Min read -