Earnings

SK Innovation logs record profit in Q1 on strong refining biz

Hyundai Oilbank, S-Oil’s earnings hit all-time high in Q1; GS Caltex is expected to have reported healthy quarterly profit

By Apr 29, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Innovation Co., South Korea’s top refiner, enjoyed the record quarterly earnings on strong crude prices and margins, joining the list of domestic peers with profits at all-time highs.

SK Innovation said on Friday its operating profit nearly tripled to 1.6 trillion won ($1.3 billion) in the first quarter on a consolidated basis from 584.4 billion won a year earlier. Sales jumped 72.9% to 16.3 trillion won.

Its refining unit reported an operating profit of 1.5 trillion won in the January-March period, almost a quadruple of 416.1 billion won in the same period of 2021, as refining margins surged.

“Product cracks saw a significant strength as key countries lifted COVID curbs prompting demand recovery for middle distillates and as concerns grew over Europe’s tightening supply amid low global stock levels due to high reliance on Russian energy,” the company said in an earnings statement.

Diesel cracks, or refining margins, jumped 71.4% to $21.6 per barrel in the first quarter from the previous three months, while gasoline cracks grew 17.1% to $15.1.

HEALTHY MARGINS IN Q2

Refining margins of overall petroleum products rose further in the second quarter. The benchmark Singapore gross refining margin against Dubai soared to a record $18.7 last week, according to industry sources.

SK Innovation ramped up exports of refined products to take advantage of higher margins. It shipped 31 million barrels of fuels to overseas markets in the first quarter, up 57% on-year.

The company raised runs of its Ulsan refining complex, the country-largest with a crude processing capacity of 840,000 barrels a day to a two-year high of 83% in the first quarter.

Its smaller domestic competitors also reported strong earnings in the January-March period. Hyundai Oilbank Co. logged an all-time high operating profit of 704.5 billion won with record sales of 7.2 trillion won. S-Oil Corp., Saudi Aramco’s refining unit in South Korea, said its operating profit more than doubled to a record 1.3 trillion won from 629.2 billion won a year earlier. Its sales also jumped 73.8% to an all-time high of 9.3 trillion won.

GS Caltex was estimated to have earned 1.2 trillion won in operating profit based on sales of low-13 trillion won during the period, according to analysts.

SK INNOVATION’S BATTERY UNIT SALES JUMP

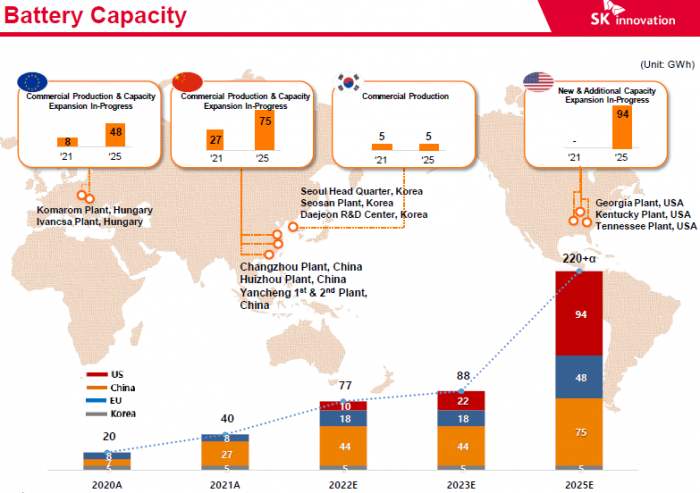

Sales of SK Innovation’s battery business more than doubled to 1.3 trillion won in the first quarter from 526.3 billion won a year earlier thanks to strong demand in Europe and rising product prices.

The unit’s sales were likely to jump to mid-7 trillion won this year from 3 trillion won in 2021 as new plants in the US and Hungary started mass production, the company forecast.

In the first quarter, the company commenced commercial productions of the No. 1 factory in the US with an annual capacity of 9.8 gigawatt hours (GWh) and the No. 2 plant in Hungary with a capacity of 10 GWh. Its global battery production capacity is scheduled to rise to 77 GWh this year once its plant in Yancheng, China, begins commercial operations.

The capacity is expected to jump to more than 220 GWh by 2025 as other factories such as ones in the US built by BlueOvalSK, a joint venture with Ford Motor Co., are set to start commercial productions in stages.

Write to Jeong Min Nam at peux@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EarningsS-Oil logs record earnings in Q1 on high crude, margins

EarningsS-Oil logs record earnings in Q1 on high crude, marginsApr 28, 2022 (Gmt+09:00)

1 Min read -

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JV

BatteriesSK Innovation, Ford to invest $11.4 billion to build largest EV battery JVSep 28, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN