SK Hynix posts record Q1 sales buoyed by Solidigm, may build another fab

The world’s second-largest memory maker has a positive industry outlook, citing robust server demand

By Apr 27, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Hynix Inc., the world’s second-largest memory chipmaker, said on Wednesday it is considering building another chip fabrication line after posting record sales in the first quarter.

The South Korean chipmaker also forecast that strong chip demand from server clients will offset slower growth from personal computers and mobile phones amid persistent industry uncertainties.

“We’re internally reviewing the need to expand our chip fabrication facility in addition to the one currently under construction at the chip cluster in Yongin. We’ll reveal our position at an appropriate time,” said an SK Hynix executive.

The possible construction of an additional fab followed the company’s announcement that its sales in the January-March period rose 43% from a year ago to 12.16 trillion won ($9.6 billion), a record for the first quarter, a traditionally low season.

The figure, which beat market expectations, was higher than the 8.72 trillion won revenue in 2018 when the semiconductor industry was booming.

Operating profit more than doubled to 2.86 trillion won, the second-best performance for the first quarter. The operating profit margin stood at 24%, up eight percentage points from the year-earlier period.

Net profit doubled to 1.98 trillion won from 992.6 billion won.

“A smaller-than-expected fall in memory chip prices and the addition of the business results of Solidigm, incorporated as SK Hynix’s subsidiary at the end of 2021, contributed to the earnings,” the company said in a statement.

San Jose-based Solidigm launched last December following the completion of the first phase of its $9 billion acquisition of Intel Corp.’s NAND and SSD business.

SK Hynix’s first-quarter results reflected 380 billion won in one-off quality control costs related to the weak performance of its DRAM products sold previously.

POSITIVE OUTLOOK

The company said it expects the memory chip industry to continue to grow this year on robust server demand, as the industry's volatility and cyclicality appear to have lessened.

“As demand for server chips is on the rise, the memory business will improve into the second half,” said Chief Marketing Officer Noh Jong-won.

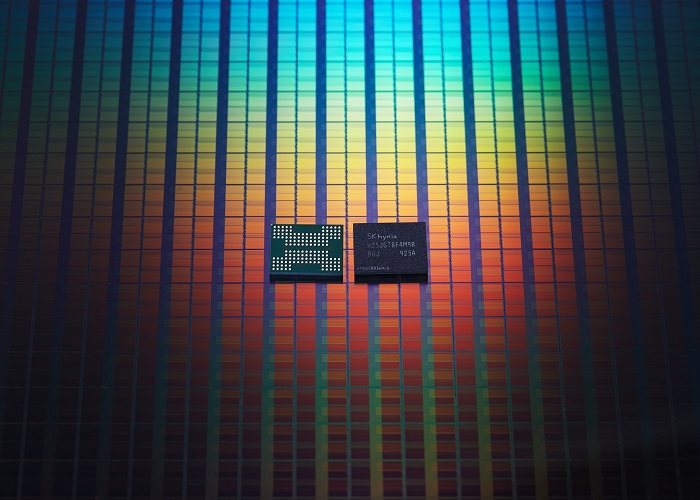

The company said it is improving the yield rate of its fourth-generation 10-nanometer products, dubbed 1anm DRAM, and the 176-layer 4D NAND, while increasing their production volume.

Meanwhile, the company said it has revised its internal regulations on the committee responsible for the nomination of non-executive director candidates with an aim to strengthen the independence and diversity of the board.

“We’re stipulating a strengthened procedure to verify outside director candidates and stepping up efforts to increase the number of candidates and appointments of female outside directors,” it said.

Write to Nam-Young Kim at nykim@hankyung.com

In-Soo Nam edited this article.

-

Korean chipmakersSK Hynix, Solidigm unveil SSD for data centers

Korean chipmakersSK Hynix, Solidigm unveil SSD for data centersApr 05, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersGoldman sees Samsung, SK Hynix shares up 50% over next 12 mths

Korean chipmakersGoldman sees Samsung, SK Hynix shares up 50% over next 12 mthsMar 11, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix develops memory chip with computing capabilities

Korean chipmakersSK Hynix develops memory chip with computing capabilitiesFeb 16, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSK Hynix to benefit from Western Digital production disruption

Korean chipmakersSK Hynix to benefit from Western Digital production disruptionFeb 11, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chips

Korean chipmakersSamsung, SK Hynix ahead of rivals in 200-plus-layer NAND chipsFeb 04, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix makes industry’s highest density 24Gb DDR5 DRAM chip

Korean chipmakersSK Hynix makes industry’s highest density 24Gb DDR5 DRAM chipDec 15, 2021 (Gmt+09:00)

2 Min read