SK Hynix sees robust chip demand; Q4 profits jump y/y

By Jan 29, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

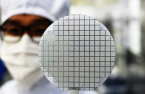

SK Hynix Inc., the world’s second-largest DRAM maker, reported stronger-than-expected quarterly earnings on Friday and expected the DRAM market for server and mobile products to grow by more than 20% this year.

The stay-at-home trend in the pandemic era boosted demand for chips used in laptops and gaming computers, while prompting online-based IT giants such as Google Inc. and Amazon.com to increase their server storage capacity.

But the South Korean chipmaker saw a modest increase in capital expenditures from last year's 9.9 trillion won ($8.8 billion), amid concerns that parts shortages could disrupt the memory chip industry supply chain, its executives said during a conference call on the quarterly results.

“We will take a cautious approach to facility investment this year. The growth in our facility investment will be limited,” said SK Hynix Chief Financial Officer Kevin Noh.

Its operating profits quadrupled to 966 billion won ($864 million) in the fourth quarter of 2020 from a year earlier, with an operating margin of 12%, led by robust chip demand for mobile gadgets. Fourth-quarter sales were up 15% on the year at 7.97 trillion won on a consolidated basis.

The company expected the DRAM chip market for server products, which account for about 40% of the global DRAM sales, to grow by more than 30% this year. Chip demand for mobile devices is likely to increase by more than 20%, driven by brisk sales to 5G smartphone manufacturers.

DRAM prices plummeted in the second half of last year because clients delayed placing additional orders after stockpiling them in the first half, leading server companies to cut back on investments.

The chip price falls and the weaker dollar led to a 26% drop quarter-on-quarter in SK Hynix's operating profits in the October-December quarter, with the margin declining by 4% points, despite steady sales. The weaker dollar reduced the translation gains.

In all of 2020, the chipmaker's operating profits shot up by 84.3% year-on-year to 5.01 trillion won, with sales up 18.2% to 31.9 trillion won.

NAND CHIP PRICE SEEN TO REBOUND IN H2, 2021

The increasing adoption of high-performance mobile devices and the strong demand for solid-state drives (SSDs) for data centers are expected to push NAND chip demand higher. But SK Hynix said the current high inventory levels at electronic goods makers would delay a rebound in the NAND chip price to the second half of this year.

SK Hynix is expected to become the world’s second-largest player in the NAND market, after it acquired Intel Corp.'s NAND memory chip business for $9 billion last year.

Earlier on Thursday, Samsung posted a 26.4% jump in fourth-quarter operating profit to 9.04 trillion won from a year earlier, while revenue increased 2.8% to 61.55 trillion won. The world's top memory chipmaker said a drawdown in chip inventories at its clients would boost the DRAM price this year.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Yeonhee Kim edited this article.

-

[Exclusive] DealsSK Hynix push for takeover of Key Foundry to boost foundry production

[Exclusive] DealsSK Hynix push for takeover of Key Foundry to boost foundry productionMay 17, 2021 (Gmt+09:00)

2 Min read -

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial plan

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial planMay 13, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry business

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry businessApr 22, 2021 (Gmt+09:00)

2 Min read -

SSD competitionSamsung, Hynix in intensifying competition for solid-state drives

SSD competitionSamsung, Hynix in intensifying competition for solid-state drivesJan 18, 2021 (Gmt+09:00)

2 Min read -

M&AsChinese PE firm pays $1.4 bn to take over Magnachip Semiconductor

M&AsChinese PE firm pays $1.4 bn to take over Magnachip SemiconductorMar 28, 2021 (Gmt+09:00)

2 Min read -

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plant

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plantFeb 01, 2021 (Gmt+09:00)

2 Min read -

Bond issuesSK Hynix to issue $2.5 bn worth of global bonds; largest amount ever

Bond issuesSK Hynix to issue $2.5 bn worth of global bonds; largest amount everJan 14, 2021 (Gmt+09:00)

3 Min read -

SemiconductorsSamsung overtakes TSMC as top chipmaker by market cap

SemiconductorsSamsung overtakes TSMC as top chipmaker by market capDec 27, 2020 (Gmt+09:00)

4 Min read -

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chips

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chipsDec 17, 2020 (Gmt+09:00)

3 Min read -

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash deal

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash dealOct 20, 2020 (Gmt+09:00)

3 Min read