Earnings

Korean firms' Q4 earnings seen to jump, led by exporters

By Dec 28, 2020 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Their earnings growth, seen at a faster pace than in the previous three months, was attributable to export growth and a low base effect, with domestic consumption and facility investment showing little signs of recovery.

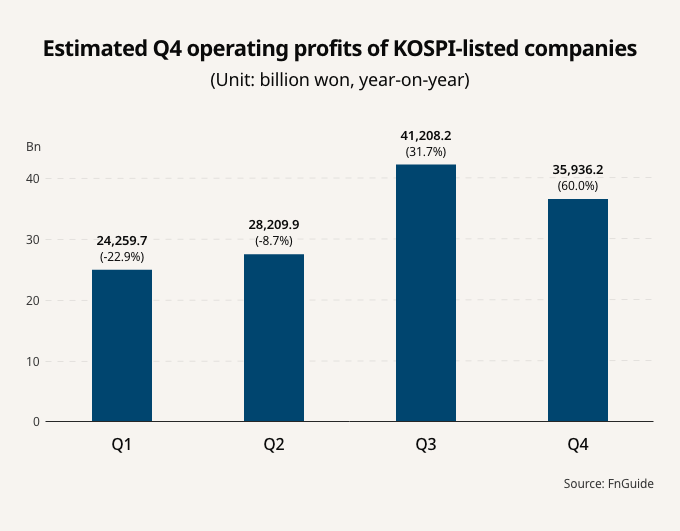

Combined operating profits of 259 Korean companies, for which consensus estimates are available, are projected to have leapt by 60% to 35.9 trillion won ($32.7 billion) year on year in the fourth quarter, according to FnGuide on Dec. 27.

The estimates compared with their third-quarter earnings of 41.2 trillion won, which represented a 31.7% rise on the year and a turnaround from declines in the first and second quarters of this year. They are set to report fourth-quarter results next month.

“Since the pandemic struck, government subsidies have boosted consumption in developed countries, but that led to inventory drawdowns with factories operating below capacity,” said NH Investment & Securities research head Oh Tae-dong.

“Until the first half of next year, production, rather than consumption, will likely lead earnings growth. The forthcoming Chinese lunar new year holiday will add to the upward momentum of production recovery,” he added.

Among companies, Samsung Electronics, the world's top memory chipmaker, is tipped to report a 39% increase on the year to 9.95 trillion won in October-December operating profit.

SK Hynix Inc. is likely to post a 270% jump to 873.4 billion won in fourth-quarter operating profit, slightly above the estimated 812.8 billion won at LG Chem, which would represent a 4,200% year-on-year surge.

Samsung SDI, an electric vehicle battery maker, is seen to flag a 1,480% jump to 318.1 billion won in quarterly operating profit.

Among automobile-related companies and chemical and steel products makers, Kia Motors Corp., Mando Corp. and Hyundai Mobis Co., as well as steel giant POSCO and POSCO Chemical are projected to have swung to profits in the current quarter. They had posted year-on-year earnings declines in the previous three consecutive quarters.

By contrast, casino operator Kangwon Land and cinema chain company CJ CGV are estimated to have turned to shortfalls in the current quarter. Other domestic consumption-focused companies – Shinsegae, Hyundai Department Store and Hotel Shilla – are expected to report a double-digit drop in fourth-quarter earnings.

“To prepare against economic uncertainty next year, banks and other companies are likely to take a big bath in the current quarter, booking part of this year’s earnings as potential losses,” said Shinhan Investment research head Yoon Chang-yong.

Write to Byeong-Hun Yang at hun@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN