Shinsegae to raise $2 bn in secured loan for eBay Korea

Real estate held by E-Mart will be offered as collateral

By Jun 11, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

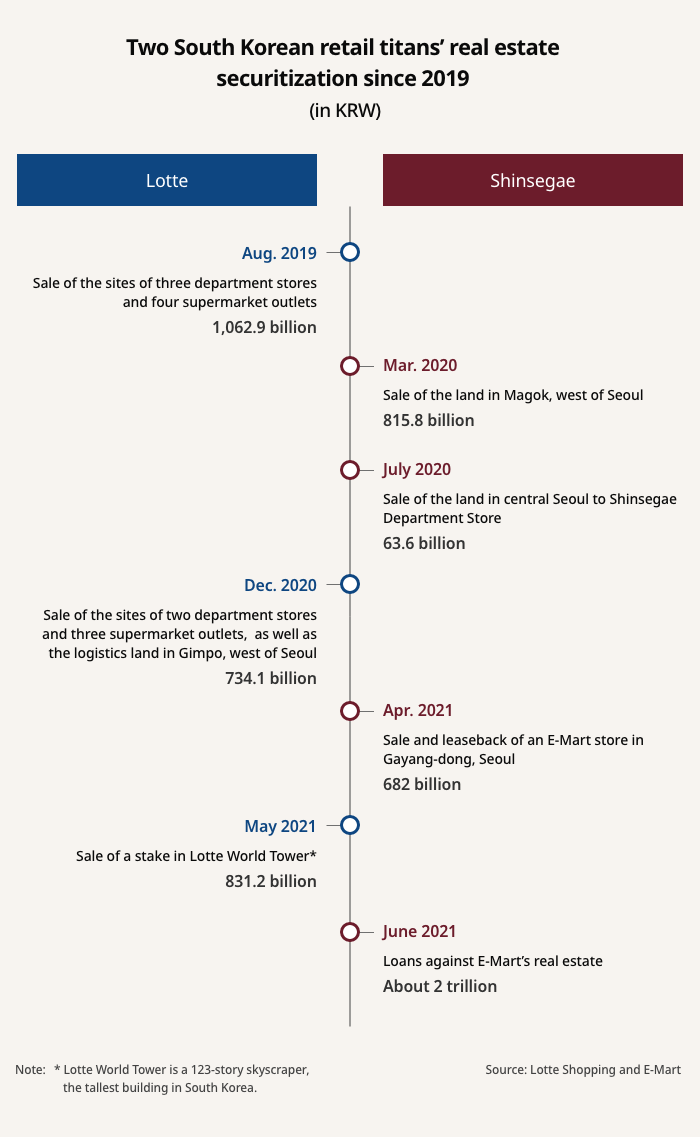

South Korea's Shinsegae and Lotte groups, the two final contenders for eBay Korea, are hurrying to securitize their assets, even offering core real estate to secure new cash.

Shinsegae Group is currently in talks to borrow as much as 2 trillion won ($1.8 billion) from domestic banks to fund its possible acquisition of eBay Korea worth over 3 trillion won, according to investment banking sources on June 10.

"Typically, M&A financing is secured against the shares in the company to be acquired and its assets," said one of the sources. "E-Mart's latest fundraising seems aimed to sharply lower funding costs by using its core real estate as collateral."

Additionally, Shinsegae is understood to be bringing forward the initial public offering of the e-commerce brand SSG.COM to next year. The new loan and IPO proceeds will add to the some 2 trillion won E-Mart has already raised by selling the sites of its 13 stores and idle land since October 2019.

"In the medium to long term, all our stores, including our headquarters building, are subject to securitization," said an E-Mart official.

Its aggressive efforts to raise new cash stoked market speculation that it might be preparing for other expansionary steps beyond the eBay Korea deal.

LOTTE RAISES CASH VIA REIT

With the upcoming sale of the country's third-largest e-commerce player expected to trigger industry-wide disruption, its archrival Lotte Group is also bolstering its war chest.

Lotte has secured about 3 trillion won through asset securitization, including selling the site of Lotte Department Store's branch in Gangnam District, or southern Seoul, to Lotte REIT in 2019.

An asset management industry source said that Lotte REIT, in a recent presentation for institutional investors, shared its plan to package the department store's head office and data centers of Lotte Data Communication Co. into a portfolio for asset securitization.

Shin has recently called on its executives "not to lose a battle on the metaverse platform." Lotte, even with a broader presence in the offline retail segment than Shinsegae, has been lagging the latter and even startups such as Coupang Corp. in the e-commerce area.

Investment bankers said the eBay Korea deal whet established retailers' appetite for M&As, shifting from their organic growth-oriented strategies of the past decade.

Additionally, loss-making Coupang's spectacular New York listing in March of this year changed the retailers' mindsets. Online portal Naver Corp.'s all-out efforts to boost e-commerce business stimulated them to take the offensive against online startups as well.

Since the acquisition of Walmart Korea in 2006, Shinsegae had focused on organic growth until it took over the online fashion platform W-Concept for 265 billion won in April of this year.

"After taking over eBay Korea, we will roll out an integrated membership programs by combining Gmarket, Auction, Shinsegae Department Store, E-Mart and SSG.Com, as well as Naver, to maximize their synergy," said a Shinsegae Group official.

Gmarket and Auction belong to eBay Korea. Shinsegae teamed up with Naver for the competition.

"A couple of years ago, Lotte Group had seriously considered buying TMON, but it pulled out after the selling side abruptly raised the price," said an e-commerce industry source.

TMON Inc., a Korean e-commerce platform, is majority-owned by KKR & Co. and Anchor Equity Partners.

To raise its chance of winning the bid, Lotte's M&A team was said to have recently visited the head office of the US e-commerce giant eBay and outlined its post-acquisition plan. Both Lotte and Shinsegae have written down similar prices for the online retailer.

But given the wide price gap between the seller and the bidders of over 1 trillion won, industry observers warned of a possible collapse in the eBay Korea sale.

"Now that Lotte and Shinsegae are armed with billions of dollars, they may look for other M&A targets," said one of the sources.

Their next targets could be fashion platforms or other specialized online retailers, or forming a business alliance with the country's top mobile carrier SK Telecom Co. that owns 11Street, an online retailer, they added.

Write to Dong-hui Park at donghuip@hankyung.com

Yeonhee Kim edited this article.

-

[Exclusive] E-commerceNaver, Shinsegae in talks to team up for eBay Korea

[Exclusive] E-commerceNaver, Shinsegae in talks to team up for eBay KoreaMay 19, 2021 (Gmt+09:00)

4 Min read -

MBK girds for eBay Korea deal as competition heats up

MBK girds for eBay Korea deal as competition heats upMar 25, 2021 (Gmt+09:00)

3 Min read -

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay Korea

[Exclusive] E-commerceKakao to buy fashion app, pushing aside eBay KoreaApr 08, 2021 (Gmt+09:00)

3 Min read -

Share swapShinsegae, Naver ink $221 mn share swap to rival Coupang in e-commerce

Share swapShinsegae, Naver ink $221 mn share swap to rival Coupang in e-commerceMar 16, 2021 (Gmt+09:00)

3 Min read -