SK Hynix push for takeover of Key Foundry to boost foundry production

By May 17, 2021 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

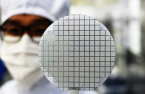

SK Hynix Inc. is taking the first steps to take over South Korea-based Key Foundry, a move in line with recent remarks from Park Jung-ho, the SK Hynix vice-chairman, who recently shared plans to expand the company's foundry production capacity.

According to the investment banking industry on May 16, SK Hynix has reached out to the new foundry firm to begin talks on the potential acquisition. Key Foundry has also hired advisors to oversee the process.

Key Foundry was established in September last year after Magnachip Semiconductor Corp. sold its Cheongju-based foundry facility for 510 billion won ($450 million) to a consortium led by domestic PE firms Alchemist Partners and Gravity Private Equity in March 2020.

At the time, SK Hynix, the world’s second-largest memory chipmaker, also participated in the deal indirectly by investing around 207.3 billion won in the PE fund established by the consortium, with the Korean Federation of Community Credit Cooperatives becoming the largest investor holding a 50 percent stake plus one share.

SK Hynix is expected to inject over an additional 400 billion won to take over the Magnachip spin-off considering the required rate of return from its investors.

SK HYNIX JOSTLES TO HOLD POSITION

According to the semiconductor industry, SK Hynix's decision to take over Key Foundry came sooner than expected, likely on account of its foundry business settling in in China alongside concerns of increased bidders next year given the growing shortage of 8-inch foundry facilities.

Currently, SK Hynix operates its foundry business through its subsidiary SK Hynix System IC, which recently relocated its 8-inch wafer facilities from the Cheongju plant in Korea to Wuxi, China. The foundry produces around 100,000 wafers monthly.

Meanwhile, Key Foundry's production capacity is around 82,000 wafers monthly, making it an attractive asset for SK Hynix in its foundry business expansion plans.

Also, SK Hynix holds an advantageous position in terms of post-merger integration compared to bidders abroad since Key Foundry shares some resources, such as industrial water and power, with SK Hynix’s Cheongju-based factory.

However, the sell-side and the buy-side are expected to lock horns in negotiations. As the sell-side needs to maximize the sale price, it is uncertain if they will agree to SK Hynix's takeover bid. Instead, they may opt for a public deal.

Meanwhile, the fact that SK Hynix did not mention Key Foundry when outlining its M&A opportunities and foundry expansion has been interpreted as a strategic move by SK Hynix to garner an edge in takeover negotiations.

Write to Jun-ho Cha and Jung-soo Hwang at chacha@hankyung.com

Danbee Lee edited this article.

-

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial plan

Global chip competitionSamsung to invest $151 bn in foundry by 2030, up 28.5% from initial planMay 13, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortage

Foundry expansionSK Hynix mulls foundry expansion, advances capex to ease chip shortageApr 28, 2021 (Gmt+09:00)

3 Min read -

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry business

Foundry expansionSK Hynix co-vice chairman hints at expanding foundry businessApr 22, 2021 (Gmt+09:00)

2 Min read -

SSD competitionSamsung, Hynix in intensifying competition for solid-state drives

SSD competitionSamsung, Hynix in intensifying competition for solid-state drivesJan 18, 2021 (Gmt+09:00)

2 Min read -

M&AsChinese PE firm pays $1.4 bn to take over Magnachip Semiconductor

M&AsChinese PE firm pays $1.4 bn to take over Magnachip SemiconductorMar 28, 2021 (Gmt+09:00)

2 Min read -

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plant

DRAM chip plantSK Hynix completes construction of its largest $3.14 bn chip plantFeb 01, 2021 (Gmt+09:00)

2 Min read -

Quarterly earningsSK Hynix sees robust chip demand; Q4 profits jump y/y

Quarterly earningsSK Hynix sees robust chip demand; Q4 profits jump y/yJan 29, 2021 (Gmt+09:00)

2 Min read -

Bond issuesSK Hynix to issue $2.5 bn worth of global bonds; largest amount ever

Bond issuesSK Hynix to issue $2.5 bn worth of global bonds; largest amount everJan 14, 2021 (Gmt+09:00)

3 Min read -

SemiconductorsSamsung overtakes TSMC as top chipmaker by market cap

SemiconductorsSamsung overtakes TSMC as top chipmaker by market capDec 27, 2020 (Gmt+09:00)

4 Min read -

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chips

Foundry dealsSamsung clinches 2nd deal to make Nvidia’s latest gaming chipsDec 17, 2020 (Gmt+09:00)

3 Min read -

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash deal

Memory chipsSK Hynix to buy Intel’s NAND business in $9 bn cash dealOct 20, 2020 (Gmt+09:00)

3 Min read