Corporate strategy

Plant, machinery maker Doosan seeks future from chips, robots

The S.Korean SMR maker will actively consider producing new competitive models by buying stakes in other companies in the sector

By Mar 02, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

BARCELONA -- South Korea’s plant and machinery powerhouse Doosan Group is seeking its future growth engines from the semiconductor and robot sectors as the conglomerate has been working on digital transformation (DX) across the group after surviving a liquidity crisis through sales of key affiliates.

The group aims to list Doosan Robotics Inc., its robot unit, this year to expand the business, Vice Chairman Park Geewon said in an exclusive interview with The Korea Economic Daily on Tuesday in Barcelona, Spain.

“The semiconductor is a core focus of the group’s new businesses,” Park said on the sidelines of MWC Barcelona, the world’s largest mobile technology event. Park is in charge of its investments in new businesses while heading the group’s power plant builder Doosan Enerbility Co.

“We do not plan to manufacture semiconductors such as DRAM or NAND flash chips but look for projects in the back-end process sectors such as packaging and tests that chipmakers often outsource within the entire supply chain,” Park said.

South Korea is the home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

Doosan Group is redefining its identity based around DX after overcoming a liquidity crisis by selling key affiliates such as construction equipment maker Doosan Infracore Co., which is now Hyundai Doosan Infracore Co., and electric battery materials manufacturer Solus Advanced Materials.

EYE ON NEW HIGH TECHNOLOGY

The group is focusing on digitalization as every product is equipped with hundreds of semiconductor sensors, Park said.

“We are increasing the added value of the existing businesses through digitalization while continuously mulling new businesses centered on new technology.”

Park spent almost the whole day visiting MWC booths of high-tech companies such as Samsung, SK Telecom Co., Huawei Technologies Co., Microsoft Corp. and NTT Docomo Inc.

“I closely looked at artificial intelligence and telecom-related technology as it was necessary to check the level of commercialization of 5G and 6G technology for remote control and unmanned systems.”

Park is known for his enthusiasm for new technology. Doosan was South Korea’s first heavy industry company to participate in CES, showcasing its future construction and mobility products at the world’s largest tech event in 2020. Park has visited the show in Las Vegas every year since 2018.

EXPANSION OF ROBOT UNIT THROUGH POSSIBLE LISTING

The group is considering a plan for an initial public offering of Doosan Robotics later this year as the conglomerate highly evaluates the future value of the business, Park said.

“We may expand the business to robots for service industries such as fast food restaurants and even personal robots in the future from the existing robotic arms in factories,” he explained, adding the group may also cooperate with other sectors including the gripper segment.

“The robot business needs a lot of money for investments, so fundraising through a listing would be the best, although we need to consider various factors such as market conditions,” he said.

The country’s IPO market remains sluggish as investor sentiment deteriorated on the growing risk of a recession in Asia’s fourth-largest economy and rising interest rates.

Given such conditions, Park said the group is not mulling IPOs of other unlisted units.

EYEING FURTHER SMR INVESTMENTS

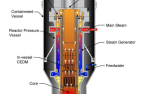

Doosan, one of the global leaders in the small module reactor (SMR) industry, is set to buy stakes in other companies in the sector, Park said.

“We have a vision to play the role of a semiconductor industry foundry but in the SMR sector,” he said. “We will actively consider manufacturing new competitive models through investments in stakes.”

The group already purchased stakes in US SMR makers – NuScale Power LLC. and X-Energy Reactor Co.

Park, the younger brother of group Chairman Park Jeongwon, has meanwhile ruled out the possibility of acquiring Westinghouse Electric Corp., a US nuclear power plant equipment maker, which has been on sale for some time.

“Westinghouse is not working on the SMR business and we are already manufacturing the AP1200,” he said, referring to a nuclear power plant designed by Westinghouse.

Meanwhile, Doosan Enerbility aims to turn around this year, the vice chairman said.

The company reported a net loss of 460.4 billion won ($350.8 million) in 2022, swinging from a profit of 645.8 billion won the previous year, although its operating profit and sales jumped 27.4% and 40.5%, respectively.

It expects orders to grow 13.5% to 8.6 trillion won this year.

Write to Seo-Woo Jang at suwu@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EnergyDL E&C, Doosan to invest $25 mn in SMR developer X-Energy

EnergyDL E&C, Doosan to invest $25 mn in SMR developer X-EnergyJan 18, 2023 (Gmt+09:00)

2 Min read -

-

-

Mergers & AcquisitionsHyundai Heavy seals $757 mn stake purchase in Doosan Infracore

Mergers & AcquisitionsHyundai Heavy seals $757 mn stake purchase in Doosan InfracoreFeb 05, 2021 (Gmt+09:00)

1 Min read -

Doosan Group inks sale of copper foil maker to PEF SkyLake for $588 mn

Doosan Group inks sale of copper foil maker to PEF SkyLake for $588 mnSep 04, 2020 (Gmt+09:00)

4 Min read

Comment 0

LOG IN