SK Inc. in talks to sell Pharmteco’s US CDMO plant to Novo Nordisk

The move is part of SK Group’s business rebalancing to focus on growth sectors such as chips, batteries and AI

By Jun 25, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Inc., the holding and investment company of SK Group, South Korea’s second-largest conglomerate, is negotiating to sell a major asset of its contract drug-making unit SK Pharmteco Co. in the US to Novo Nordisk A/S, a Danish multinational pharmaceutical company.

SK is in final-stage talks to sell SK Pharmteco’s contract development and manufacturing organization (CDMO) factory in Petersburg, Virginia to Novo Nordisk, people familiar with the matter said on Tuesday.

Sources said that the deal’s value is estimated to be 300 billion won ($216 million).

The two sides aim to complete the deal by the end of August, they said.

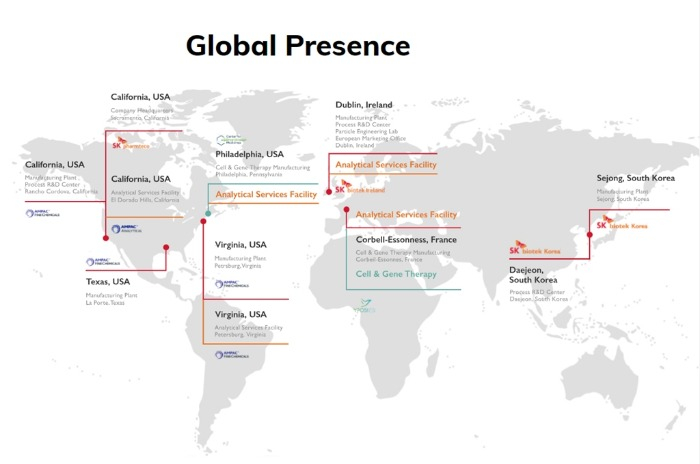

SK Pharmteco operates CDMO plants in California, Virginia and Texas.

Industry officials said the contract drug-making facilities boasted such high quality and yields that the US government picked SK Pharmteco as one of the strategic medical suppliers during the COVID-19 pandemic.

Known for Wegovy, a weight-loss medicine, Novo Nordisk is expanding its pharmaceutical business by purchasing companies with which it has worked under the contract manufacturing organization (CMO) scheme.

In February, its holding firm Novo Holdings A/S acquired Catalent Inc., a leading CDMO company, for $16.5 billion.

Novo plans to spend an extra $4.1 billion to enhance its presence in the US through mergers and acquisitions, according to media reports.

SK EXPECTS HANDSOME GAINS

If talks with Novo Nordisk go smoothly, SK Inc. is expected to make a profit at least 10 times its purchase price, sources said.

SK Pharmteco will likely use the sales proceeds to invest in its cell and gene therapy (CGT) business, they said.

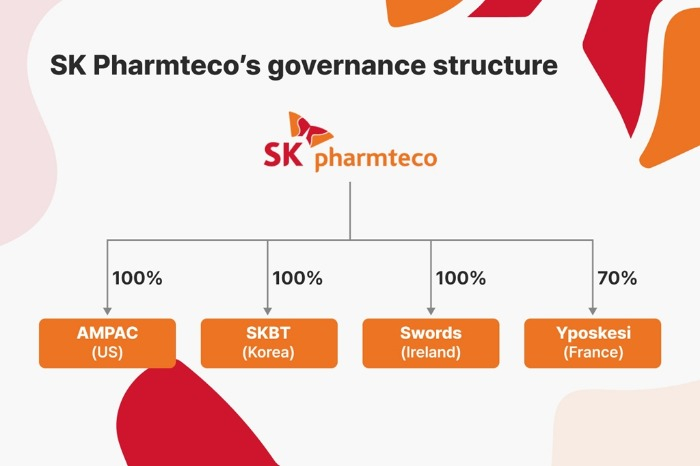

In 2021, SK Inc. purchased a 70% stake in Yposkesi, a French biopharmaceutical company, to advance into the cell and gene therapy business, from Genethon.

The following year, SK became the second-largest stakeholder in the Center for Breakthrough Medicines (CBM), a US-based cell therapy developer and CDMO, after investing $350 million.

In 2017, SK acquired Bristol-Myers Squibb (BMS)'s manufacturing facility in Ireland and in the following year, it took over California-based AMPAC Fine Chemicals, a CDMO.

SK Group established SK Pharmteco in 2019 to oversee its growing portfolio of pharma manufacturing facilities and businesses.

SK Pharmteco posted 89 billion won in operating losses on sales of 812 billion won in 2023.

BUSINESS REBALANCING

The sale of an SK Pharmteco plant comes as part of SK Group’s aggressive corporate restructuring to reduce the number of its affiliates and explore new growth drivers.

Industry sources said on Monday that SK is putting up for sale its 25% stake in Korea Superfreeze Inc., a cold chain logistics company jointly owned by EMP Belstar and Goldman Sachs.

The conglomerate is also seeking to combine SK Ecoplant Co., a construction engineering and waste management firm, with SK Materials Co., an industrial gas business unit, to create synergy.

Last week, sources said SK Group plans to merge SK Innovation Co., the parent of Korea’s largest oil refiner SK Energy Co. and battery maker SK On Co., with energy affiliate SK E&S Co.

The group is also seeking funds from the state-run Korea Development Bank (KDB) to finance its restructuring efforts.

Write to Hyung-Kyu Kim, Jeong-Min Nam and Ji-Eun Ha at khk@hankyung.com

In-Soo Nam edited this article.

-

Corporate restructuringSK Ecoplant seeks to absorb SK Materials' industrial gas units

Corporate restructuringSK Ecoplant seeks to absorb SK Materials' industrial gas unitsJun 24, 2024 (Gmt+09:00)

4 Min read -

Corporate restructuringSK puts shares in Goldman-backed Korea Superfreeze on market

Corporate restructuringSK puts shares in Goldman-backed Korea Superfreeze on marketJun 24, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringSK asks KDB for further funding before drastic restructuring

Corporate restructuringSK asks KDB for further funding before drastic restructuringJun 20, 2024 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growth

Mergers & AcquisitionsSK Innovation looks to merge with SK E&S for organic growthJun 20, 2024 (Gmt+09:00)

3 Min read -

Corporate restructuringSK embarks on business overhaul to focus on mainstays

Corporate restructuringSK embarks on business overhaul to focus on mainstaysMay 29, 2024 (Gmt+09:00)

4 Min read -

Corporate strategySK Innovation’s Ulsan plant goes smarter with AI, robot dog, AR tech

Corporate strategySK Innovation’s Ulsan plant goes smarter with AI, robot dog, AR techMay 26, 2024 (Gmt+09:00)

3 Min read -

Korean foodSK acquires 70% stake in Yposkesi to jump into cell, gene CMO business

Korean foodSK acquires 70% stake in Yposkesi to jump into cell, gene CMO businessMar 31, 2021 (Gmt+09:00)

2 Min read