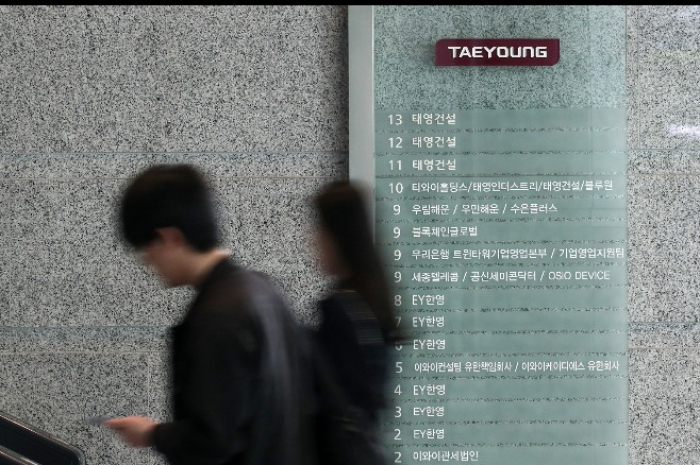

Taeyoung E&C lets chairmen go as part of restructuring

South Korea’s debt-ridden midsize construction firm will also cut executives’ salaries by up to 35%

By Apr 19, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Belt-tightening Taeyoung Engineering & Construction Co. (Taeyoung E&C), the 16th-largest construction company in South Korea and undergoing debt restructuring, will sack over 20 executives, including its founder and chairman, and cut employee salaries.

The plan includes the dismissal of Taeyoung Group founder and Honorary Chairman Yoon Se-young and Taeyoung E&C Chairman Yoon Suk-mynn, as well as the layoffs of 20 other executives.

“The two chairmen stepped down from Taeyoung E&C board last month, leaving all their titles behind,” said an official from TY Holdings Co., the holding company of Taeyoung Group.

But the two from the group’s owner family will hold their honorary chairman and chairman titles at TY Holdings.

Honorary Chairman Yoon was appointed as TY Holdings’ board chair last month to hold him accountable for the ongoing debt restricting of Taeyoung E&C. His son, Suk-mynn, however, was removed from a registered director position at the holding company.

Taeyoung E&C’s latest staff downsizing effort has come in the middle of a debt restructuring process starting mid-January for the cashless construction company.

In mid-January, more than 95% of its creditors approved the proposed debt workout for the country’s 16th-largest construction company, making it the first Korean construction company to undergo debt restructuring in a decade.

BELT-TIGHTENING ACROSS THE BOARD

According to the latest self-rescue plan, the construction company will also cut executives’ wages – by 35% for presidents and above, 30% for vice presidents, 20% for senior managing directors, 15% for managing directors and 10% for assistant managing directors.

It will also freeze salaries for the remaining employees from 2024 to 2026.

The company will also reduce operational spending from marketing to workforce training.

With the new streamlining efforts, Taeyoung E&C plans to save sales, general and administrative expenses by 295 billion won this year from last year’s 126.4 billion won.

Its personnel expenses are also expected to decrease to 38.2 billion won this year from last year’s 45.7 billion won.

Taeyoung E&C’s latest self-rescue plan, which focuses mainly on cuts in SG&A spending, comes ahead of its creditors’ verdict on the company’s corporate workout plan, including a 100-to-1 capital reduction and 1 trillion won in recapitalization, on April 30.

Since late last year, Taeyoung Group, controlling logistics, media and construction businesses, has offered a series of plans to rescue the construction arm, including offering up its stakes in TY holdings and a lucrative terrestrial TV station.

Despite such efforts, Taeyoung E&C has dipped into complete capital erosion, with its stock trading suspended since March 14.

Write to Hanjong Choi at onebell@hankyung.com

Sookyung Seo edited this article.

-

Corporate restructuringTaeyoung becomes 1st Korean builder in debt workout in decade

Corporate restructuringTaeyoung becomes 1st Korean builder in debt workout in decadeJan 12, 2024 (Gmt+09:00)

2 Min read -

Corporate restructuringTaeyoung’s fresh measures raise hope for debt workout

Corporate restructuringTaeyoung’s fresh measures raise hope for debt workoutJan 09, 2024 (Gmt+09:00)

4 Min read -

Corporate restructuringTaeyoung files for debt workout; offers to sell stake in KKR JV

Corporate restructuringTaeyoung files for debt workout; offers to sell stake in KKR JVDec 28, 2023 (Gmt+09:00)

3 Min read -

ConstructionKKR expected to buy 100% stake in Taeyoung Industry

ConstructionKKR expected to buy 100% stake in Taeyoung IndustryOct 25, 2023 (Gmt+09:00)

3 Min read