Corporate investment

Warren Buffett’s IMC to invest $98 million in Daegu for chip materials plant

The legendary Wall Street investor, called the Oracle of Omaha, has already invested twice in the city

By Feb 07, 2024 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

DAEGU – The IMC Group, owned by Warrant Buffett’s Berkshire Hathaway Inc., will invest 130 billion won ($98 million) to build a semiconductor materials plant in the South Korean city.

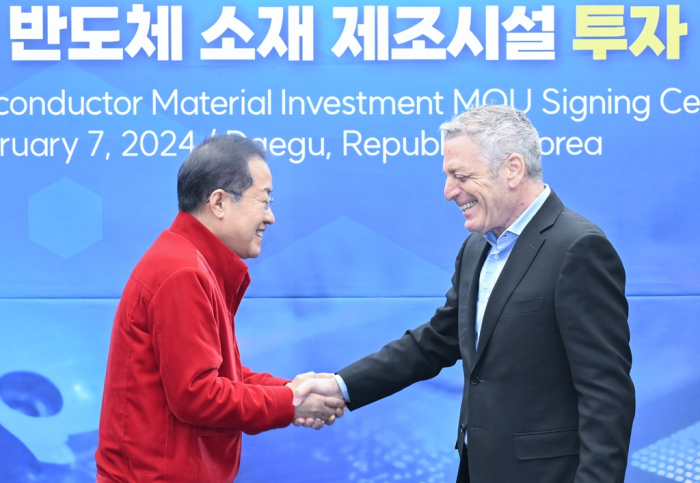

The Daegu Metropolitan Government said on Wednesday that Mayor Hong Joon-pyo signed an investment agreement with Ilan Geri, IMC Group president.

Under the deal, Israel-based IMC will invest in IMC Endmill, an aircraft parts and other equipment cutting tools maker, which with the fund will build a facility to produce tungsten powder, used in the production of special gases for semiconductors.

"With this investment, we aim to become a leading global supplier of semiconductor materials and supply tungsten powder to various industries,” said IMC Group President Ilan Geri.

IMC is one of the world’s leading manufacturers of metalworking products.

ORACLE OF OMAHA’S LOVE OF DAEGU

IMC is wholly owned by Berkshire Hathaway, a multinational investment firm headquartered in Omaha, Nebraska, and operated by Warren Buffett, a legendary Wall Street investor dubbed the “Oracle” or “Sage” of Omaha.

In 2008, IMC invested 100 billion won in TaeguTec Ltd., a milling and metal cutting tools maker, and 67.5 billion won in IMC Endmill in 2018.

With a rapid increase in demand for semiconductors from makers of artificial intelligence devices, autonomous vehicles, the Internet of Things (IoT) and data centers, the demand for tungsten powder is also rising rapidly.

"TaeguTec and IMC Endmill are success stories of foreign investments in our city. We will spare no administrative or policy support for the companies so they can grow as leaders in the global semiconductor materials market,” said Hong.

Write to Kyeong-Mook O at okmook@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSK Materials, Showa Denko to jointly seek US semiconductor gas business

Korean chipmakersSK Materials, Showa Denko to jointly seek US semiconductor gas businessJun 29, 2022 (Gmt+09:00)

2 Min read -

Corporate restructuringSK Group’s holding firm aims to become Korea’s Berkshire Hathaway

Corporate restructuringSK Group’s holding firm aims to become Korea’s Berkshire HathawayApr 21, 2021 (Gmt+09:00)

3 Min read -

IPOsKorea’s liquidity-driven IPO market sets slew of fresh records in 2020

IPOsKorea’s liquidity-driven IPO market sets slew of fresh records in 2020Dec 28, 2020 (Gmt+09:00)

4 Min read

Comment 0

LOG IN