S.Korea relies heavily on Samsung Elec for R&D spending: FKI

Korean companies invested $37.7 bn in R&D as of end-2021 versus US and China with $483.7 bn and $215.5 bn, respectively

By Jul 25, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

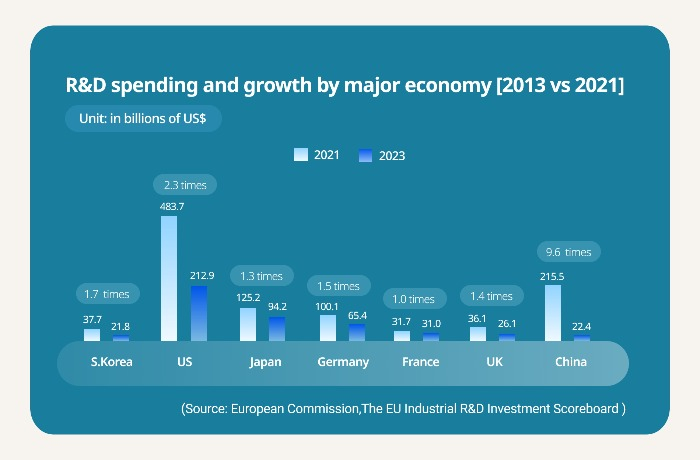

South Korea’s corporate expenditures on research and development grew 1.7 times from 2013 to 2021, much slower than such spending by the US and China, the world’s two largest economies, with Samsung Electronics Co. responsible for nearly 50% of Asia’s fourth-largest economy’s total R&D spending.

According to an analysis of the world’s top 2,500 conglomerates’ total R&D expenditures by the Federation of Korean Industries (FKI) on Tuesday, 53 Korean companies invested in R&D as of the end of 2021, ranking ninth.

The US topped the list with 822 companies accounting for 32.9% of the total 2,500 companies, followed by China with 678 companies commanding 27.1%.

Korean companies made up a mere 2.1%, mainly driven by Samsung Electronics’ R&D investment.

SAMSUNG LEADS KOREA’S TOTAL R&D SPENDING

The Korean tech tycoon was responsible for 49.1% of the country’s total corporate R&D spending, according to the FKI’s analysis of the 2021 data.

Together with SK Hynix Inc., LG Electronics Inc., Hyundai Motor Co. and LG Chem Ltd., Korea’s top five conglomerates accounted for 75.5% of the country’s total corporate R&D investment.

The biggest US R&D spender, Alphabet Inc., accounted for only 6.3% of the world’s largest economy’s total corporate R&D investment value, and Huawei Technologies Co.’s R&D spending took 10.0% of the world’s No. 2 economy’s total.

The combined R&D expenditures by the top five businesses in the world’s largest and second-largest economies also took 23.7% and 22.2%, respectively. Those in Japan represented 26.1%.

“Korea needs to create an R&D investment-friendly environment, such as more generous government incentives for corporate spending on R&D, to invigorate the country’s overall R&D investment and reduce its hefty reliance on a single company,” said Choo Kwang-ho, head of the FKI’s economic research division.

Samsung Electronics spent 24.9 trillion won ($19.5 billion) in R&D expenditures in 2022, according to the company’s fact sheet.

KOREA’S SLOWER R&D SPENDING EXPANSION

Asia’s fourth-largest economy also lagged far behind other major countries in total corporate R&D investment amount.

Total R&D expenditures of the global top 2,500 companies grew 16.9% to $1.2 trillion as of end-2021 from end-2020.

Of the total, the biggest $483.7 billion was spent by US corporations, representing 40.2%. Korean companies invested $37.7 billion, accounting for 3.1% and ranking sixth.

While Korean companies’ total R&D investment expanded 1.7 times from $21.8 billion at the end of 2013, US and Chinese companies’ total R&D expenditures jumped 2.3 times and 9.6 times over the same period, respectively.

China’s total corporate R&D spending reached $215.5 billion as of the end of 2021.

R&D investment made up 2.1% of Korea’s total gross domestic product (GDP) as of end-2021, 0.5 percentage points higher than that at end-2013.

China’s R&D spending in its total GDP increased by 1.2 percentage points over the same period, while the US and Germany each saw 0.8 percentage point gains.

The world's third-largest economy Japan’s R&D spending in terms of its GDP added 0.7 percentage point over the same period.

Korea was the world’s 13th-largest economy with a GDP of $1.7 trillion as of 2022, according to latest data from the International Monetary Fund. It ranked 10th in both 2020 and 2021.

Write to Jae-Fu Kim at khk@hankyung.com

Sookyung Seo edited this article.

-

Korean chipmakersS.Korean chips’ heavy reliance on China, US poses risk to national economy

Korean chipmakersS.Korean chips’ heavy reliance on China, US poses risk to national economyMay 29, 2023 (Gmt+09:00)

5 Min read -

EconomyS.Korea's economy no longer supported by China: BOK head

EconomyS.Korea's economy no longer supported by China: BOK headMay 22, 2023 (Gmt+09:00)

2 Min read -

FKI calls for further easing of new CVC rules to spur investment

FKI calls for further easing of new CVC rules to spur investmentAug 19, 2020 (Gmt+09:00)

2 Min read -

Korea’s reliance on semiconductor chips increases economic vulnerability: FKI

Korea’s reliance on semiconductor chips increases economic vulnerability: FKIAug 12, 2020 (Gmt+09:00)

3 Min read