Corporate investment

S.Korea's high-tech firms flood to US with heavy spending plans

Household names such as Samsung, Hyundai and SK are at the forefront of the trend

By Feb 06, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s large business groups are flooding to the US, with their pledged investments there exceeding $100 billion for the next two years.

Their massive spending is spurred mainly by Washington’s shift toward protectionism.

But most importantly, the Biden administration’s hefty tax credits for high-tech industries such as semiconductor, electric vehicles and rechargeable batteries are becoming a black hole for investments from Korean conglomerates.

Household names such as Samsung Electronics Co., Hyundai Motor Group, LG, Hanwha and CJ have pledged to put in a combined $103.2 billion to build manufacturing plants in the US, or to buy stakes in American companies, according to a poll conducted by The Korea Economic Daily on Feb. 5.

The figure is based on their announcements made between 2021 and January of this year.

Of the total, direct investment plans, or building factories, amounted to $84.1 billion for 27 cases.

It is more than double the $30.5 billion inward foreign direct investment (FDI) to South Korea for all of 2022, including $8.7 billion from US companies.

By comparison, indirect US investment pledges such as equity purchases or buyouts took the remainder, representing 47 cases.

Over the past two years, South Korean companies have spent a combined $18.6 billion to buy shares in US companies. Including undisclosed deals, the tally is estimated at over $20 billion.

CAUGHT IN THE MIDDLE

The rise of nationalism, or America first policies, have pushed Korean conglomerates to move to the US as Washington is determined to resuscitate its manufacturing industry and create jobs.

“Caught in the middle of US-China tensions and America first policies, Samsung and SK Hynix cannot help but build semiconductor plants in the US,” said a Korean company official.

“EV plants are moving to the US. Rechargeable battery and battery materials producers are following suit.”

The Inflation Reduction Act (IRA), signed into law last year, has forced EV makers to build US plants as well. Under the IRA, EVs using domestically produced battery materials are eligible for tax credits.

“Direct investment is an effective way not only to overcome trade barriers such as tariffs but also to hedge against the uncertain trade environment,” said Heo Yoon, an international trade professor at Sogang University.

“It is now important to customize business strategies to each country, abandoning globally standardized strategies.”

SK Group is at the forefront of such trends. It accounted for half of the 44 US investments recently executed by Korean companies.

In July of last year, SK Group Chey Tae-won disclosed a $22 billion US investment plan during his visit to the White House.

The figure excludes the group’s previously announced spending plan of $7 billion.

In aggregate, the petrochemical-to-telecom giant will likely pour a total of $29 billion into building or expanding facilities in the US during Joe Biden’s presidency.

Back in 2021, Chey said the group would spend $52 billion on US investment through 2030.

Its investments will span a broad range of sectors from memory chips, EV batteries, hydrogen energy and artificial intelligence to biotech, gene therapy, alternative proteins and small modular reactors.

In 2021, the country’s second-largest conglomerate acquired Intel Corp.’s NAND memory and storage business for $9 billion. It marked the single biggest equity deal for a South Korean company.

The same year, SK E&S Co., a city gas supplier, and SK Inc., the group’s holding company, purchased a majority stake in Plug Power Inc., a US-based hydrogen producer, for $1.6 billion.

Additionally, SK E&S bought a $400 million stake in North America-focused REV Renewables from LS Power.

Hanwha Group has significantly ramped up US investment in the past two years, with a focus on the solar energy and defense businesses.

Last year, Hanwha Solutions Co., an energy and petrochemical company, became the largest shareholder of Norway-based polysilicon manufacturer REC Silicon with a 21.34% stake for $204 million. REC Silicon produces solar modules, using US-made polysilicon.

In the e-commerce sector, Naver Corp., South Korea’s largest internet portal, completed the purchase of US customer-to-customer fashion platform Poshmark for $1.6 billion this month.

TRIANGULAR ZONE

The US has overtaken China and Vietnam as Korean companies' top investment destination.

Still, South Korea lags other countries in terms of US investment, coming 12th with $72.5 billion, according to the International Monetary Fund.

The US ranked top in terms of inward direct investment in 2021, drawing a record $5 trillion FDI. It was an increase of $351 billion from the year prior.

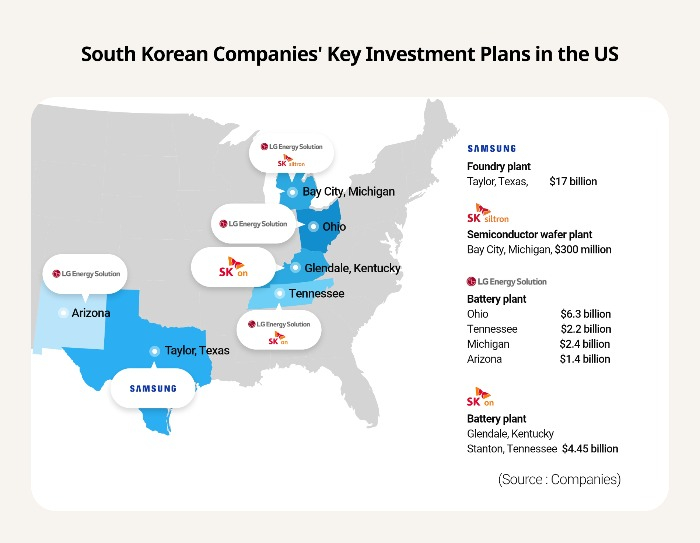

Samsung Electronics, the world's largest memory chip maker, has earmarked $17 billion to build a foundry plant in Taylor, Texas. Hyundai Motor Group is building EV factories in Georgia and other US states for $10.5 billion.

Once those plants are completed, Korean companies will have production lines in the so-called triangular zone, stretching from the north to the west and south of the US, or from Michigan to Texas and Georgia.

Their plants will also be located in Kentucky, Ohio and Indiana, which offer generous subsidies and business-friendly policies. Wage levels and land availability in these states are attractive for Korean companies as well.

The recent investment spree draws a distinction from previous trends. Previously, home appliances and automobile companies had led outward FDI intending to penetrate overseas markets and avoid tariffs.

Now high-tech industries, key pillars for South Korea's economic growth, are leading South Korea's outbound deals.

Such trends will likely continue and erode the competitiveness of the country’s key growth engines, industry officials warned.

Particularly, small and medium-sized enterprises (SMEs) will be the hardest hit.

But company executives said a ramp-up in their US investment is not a matter of choice, but of survival.

Against this backdrop, Asia's fourth-largest economy needs to position itself as the region's manufacturing hub, attracting companies fleeing from China, said Kang In-soo, a professor of economics at Sookmyung Women’s University.

South Korea also needs to shift its business focus from manufacturing to design and technology, while prioritizing SMEs for government policies, said Jung Eun-Mi, a senior research fellow of the Korea Institute for Industrial Economics and Trade.

Write to Jae-Fu Kim and Seo-Woo Jang at hu@hankyung.com

Yeonhee Kim edited this article

More to Read

-

EarningsHyundai vows $8.5 billion investment after record 2022 sales, profit

EarningsHyundai vows $8.5 billion investment after record 2022 sales, profitJan 26, 2023 (Gmt+09:00)

3 Min read -

Chemical IndustryLG Chem completes acquisition of US biotech firm AVEO

Chemical IndustryLG Chem completes acquisition of US biotech firm AVEOJan 19, 2023 (Gmt+09:00)

2 Min read -

-

-

BatteriesLG Energy, Honda to build $4.4 billion battery plant in Ohio

BatteriesLG Energy, Honda to build $4.4 billion battery plant in OhioJan 13, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN