Bond issues

Korean firms rush to tap bond market ahead of rate hikes

By Feb 24, 2021 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Companies are flooding the debt market as market interest rates have been on an upward trend since late August amid rising inflationary pressure, combined with upcoming government debt sales to fund supplementary budgets.

“The consensus view is that market interest rates should increase from here. Companies are in a rush to borrow money during the first half of this year to not to miss out on the chance of raising capital at record-low rates,” said a leading Korean brokerage company’s debt capital executive.

So far this year, a majority of corporate debt issuers in the domestic market have sold bonds in the 1% range and for larger amounts than had been planned.

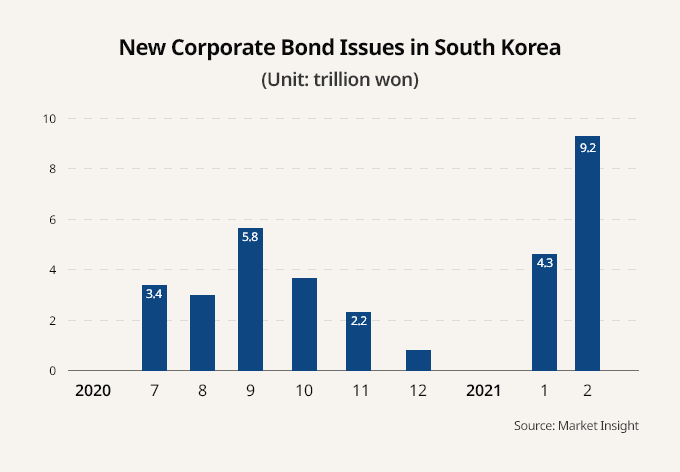

The February issuance value included both issued bonds and those scheduled to hit the market later this month, according to data compiled by Market Insight, the capital market news arm of The Korea Economic Daily, on Feb. 23.

The February tally is more than double the January number and is the greatest amount since the domestic debt market introduced the bookbuilding system in April 2012. The number eclipsed the 9 trillion won recorded for February of last year.

Hyundai Motor Co., Naver Corp. and LG Chem Ltd. are among the 33 companies that issued bonds, or are slated for February debt sales.

Next month, 15 companies, including Kia Corp., Coway Co and Hyundai Heavy Industries Co., are set to float new bonds to raise more than 5 trillion won in aggregate.

Previously, March was a slow month for the primary bond market because companies tended to focus on annual reports and general shareholder meetings.

HEAVILY SUBSCRIBED

Last week, LG Chem raised 1.2 trillion won in a new bond sale, marking the largest won-denominated bond sale by a Korean company. The company doubled its bond issue amount in response to heavy demand.

SK Materials Co., an electronic components maker, decided to double the amount of its bond sale to 300 billion won this month from its earlier plan, in what is set to become its largest-ever debt issuance. The new bonds yielding around 1% were 10 times oversubscribed. SK Materials plans to use the debt proceeds to repay its maturing three-year debt, which the company had sold at an annual rate of 2.827%.

Of the 33 companies that have already issued or are slated to sell new bonds this month, 29 firms decided to boost the size of their debt sales. The February's tally of 9.2 trillion won is a 74% jump from their earlier planned 5.3 trillion won.

In total, their bond sales raked in a combined 30 trillion won during the bookbuilding process, the highest amount for a single month in the domestic corporate debt market.

Yields on three-year corporate bonds rated double A-minus averaged 1.299% on Jan. 29, and have been hovering in the 1.3% range since then. Their spread with the treasury bonds tightened to 30 basis points, after the three-year treasury yield bounced back above 1% earlier this month, for the first time in 10 months.

The spread between double A-minus corporate debt and the treasury bond with a maturity of three years has narrowed to 31.8 basis points, close to the 2019 level when the corporate debt market boomed, compared with 77.7 basis points in June of last year.

Domestic companies are also scurrying to the short-term funding market. The outstanding value of commercial papers came to 64.8 trillion won as of February 22, up 25.6% from early last year.

Meanwhile, the Bank of Korea is widely expected to keep its benchmark interest rate at a record low of 0.50% at a monthly monetary policy meeting on Thursday, but it is expected to bump it up later this year.

Write to Jin-Seong Kim at jskim1028@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Bond issuesLG Chem to issue over $1 bn in bonds; largest amount ever

Bond issuesLG Chem to issue over $1 bn in bonds; largest amount everFeb 15, 2021 (Gmt+09:00)

2 Min read -

-

Platform investmentNaver plans over $1 bn bond issue in H1 to finance platform investment

Platform investmentNaver plans over $1 bn bond issue in H1 to finance platform investmentJan 31, 2021 (Gmt+09:00)

2 Min read -

EV batterySK's US battery arm sells $1 bn green bonds at lower rates

EV batterySK's US battery arm sells $1 bn green bonds at lower ratesJan 20, 2021 (Gmt+09:00)

2 Min read -

ESG bondsHyundai Steel receives $1.9 bn in orders for green bonds

ESG bondsHyundai Steel receives $1.9 bn in orders for green bondsJan 19, 2021 (Gmt+09:00)

1 Min read -

ESG bondsKia to issue green notes as part of $500 mn global bonds for future mobility

ESG bondsKia to issue green notes as part of $500 mn global bonds for future mobilityJan 18, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN