Construction

S.Korean builders feel tailwind from Middle East

Hyundai E&C is closing in on a $5 billion order from Saudi Aramco

By Jun 23, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean construction companies, struggling with soaring raw material prices and higher interest rates, are poised to bounce back with a string of orders from the Middle East, for which the Korean government vowed all-out support to help them win new projects.

Earlier this year they failed to bag high-profile orders from abroad, which an industry official blamed on the country’s failure to catch up with a new trend in the global construction market.

Foreign companies placing orders are shifting toward builders with the capability to finance, build and operate the projects under public and private partnerships.

To keep pace with the new trend, the South Korean government is expanding its diplomatic channels with Middle Eastern countries and mustering the support of state-run banks to fund their construction projects in partnership with domestic companies.

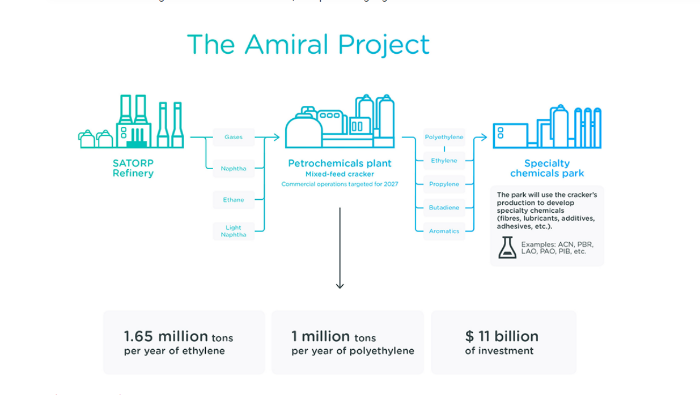

Hyundai Engineering & Construction Co. is near securing a $5 billion order from Saudi Aramco for the Amiral Project to build a chemicals production facility, according to people familiar with the matter on Friday.

The facility will be located in the petrochemical complex next to the SATORP refinery in AI Jubail on the eastern coast of Saudi Arabia.

If secured, the contract will mark the largest-ever order clinched by a South Korean company from Saudi Arabia and help Hyundai achieve its goal of 5.7 trillion won ($4.3 billion) in overseas orders this year.

“The global construction market has been riding the oil project boom wave on the back of rising oil prices after COVID-19 hit,” said a Hyundai Engineering official.

“There will be more remarkable results later this year.”

Up to now, the biggest order received from Saudi Arabia for a domestic company was the $3.39 billion project bagged by Doosan Enerbility Co., formerly Doosan Heavy Industries Co., in September 2010 to build a Rabigh 2 thermal power plant in Makkah.

This year, Hyundai also submitted a bid for the second stage of the Jafurah gas processing facilities project in Saudi Arabia. In 2021, it landed an order for the project of about 2 trillion won to build sulfur recovery units and utility and offsite facilities for about 2 trillion won in a consortium with Hyundai Engineering Co.

It is now preparing bids for two other Saudi Arabian projects: the Safaniya oil field development and the Fadhili gas complex.

HANWHA TO RENEW IRAQ PROJECT

Hanwha Corp.’s construction arm looks set to resume a $10 billion project to build a Bismayah new city in Iraq.

It suspended the project after it failed to receive payments for years, totaling as much as 823 billion won, from the Iraqi government.

But there is now hope that the issue might be resolved. The unreceived payment will be discussed at a joint committee meeting between South Korea and Iraq, which is scheduled to resume after a six-year hiatus, according to industry sources.

“We have been in negotiations (with Iraq) since signing an MOU to resume the project in January (of this year),” said a Hanwha construction division official.

“The Iraqi government is actively coming to the negotiating table, so we are considering resuming the project.”

Daewoo Engineering & Construction Co. is bidding for the Al Faw Grand Port project in Iraq. In 2021, Daewoo secured the first-stage engineering project for $2.63 billion.

AL FAW GRAND PORT

“About 30 companies from around the world are competing for the Al Faw Grand Port project,” said a Ministry of Land, Infrastructure and Transportation official. “We are trying to provide all-out support to our companies to win deals for the project.”

The country is also bidding for the estimated $500 billion Neom megacity project in Saudi Arabia.

Neom is to be a smart city fully run on renewable energy such as solar power and green hydrogen as well as cutting-edge technologies, including 5G networks, the Internet of Things, cloud computing and robotics.

In Southeast Asia, South Korean builders are preparing to bid for the project of Indonesia’s capital relocation to the island of Borneo.

Until now, domestic builders logged a total of $8.79 billion in overseas orders, down 23% from a year earlier, according to the International Contractors Association of Korea.

The figure falls far short of the government’s goal of at least $35 billion this year.

Looking on the bright side, a construction industry official said South Korean builders are now chasing an increasing number of global projects in more and more countries in which they are building their foothold.

Write to Oh-Sang You and Eun-Ji Shim at osyou@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Business & PoliticsS.Korea-Iraq Joint Committee resumes operations after six years

Business & PoliticsS.Korea-Iraq Joint Committee resumes operations after six yearsJun 20, 2023 (Gmt+09:00)

1 Min read -

Korean SMEsS.Korea bets on 2nd Middle East boom for SMEs, startups

Korean SMEsS.Korea bets on 2nd Middle East boom for SMEs, startupsJun 15, 2023 (Gmt+09:00)

2 Min read -

ConstructionHanwha E&C abandons Bismayah project in Iraq; $581 mn loss expected

ConstructionHanwha E&C abandons Bismayah project in Iraq; $581 mn loss expectedOct 09, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN