China stocks

Korean money flows to China exceed investment in North America

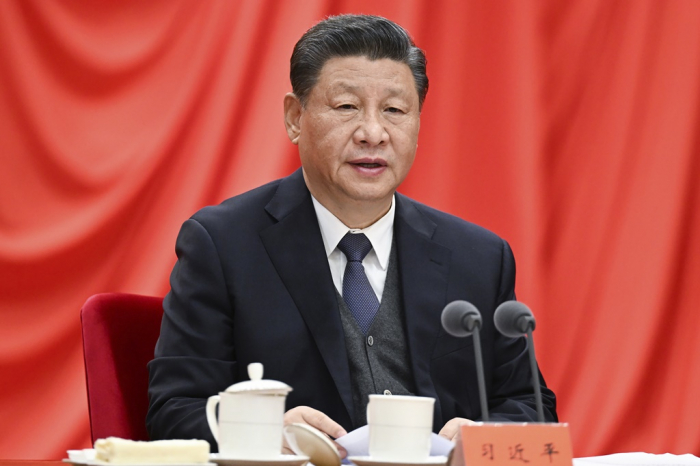

Hopes grow on President Xi Jinping’s third term despite concerns over regulations, US-China trade war

By Feb 14, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korean money inflows to Chinese stocks exceeded investment in North America as sluggish US shares spurred investors to bet on a recovery in the world’s second-largest economy.

Analysts recommended buying Chinese shares in advance on expectations of strong gains in the coming months, while some remained cautious, given the risks of Beijing’s regulations and sustained tensions with the US.

Funds for Chinese stocks in South Korea saw inflows of 932.1 billion won ($777.5 million) in January, exceeding funds of 858.3 billion won for North American shares, according to financial information provider FnGuide Inc. on Sunday.

That came as Chinese shares are expected to gradually rise from next month, analysts said.

“The stock markets are predicted to steadily strengthen from about the end of the first quarter when the policy direction takes shape after the Two Sessions in March,” said Lee Dong-yeon, an analyst at Korea Investment & Securities Co, referring to China’s annual parliamentary meetings. “Monetary policy easing that started in December of last year is also expected to gradually show the effect.”

XI JINPING’S THIRD TERM

China’s economy is forecast to expand 5.2% this year with growth to bottom out in the first quarter and gradually improve, Lee said.

He advised paying attention to the metaverse that has yet to grow, renewable energy that the government is trying to develop, and the consumer electronics sector that is expected to benefit from relevant policies.

Mirae Asset Securities analyst Park Hee-chan expects a pickup in the economy in the second half.

“China’s economy is forecast to grow about 4% in the first half and show some signs of a slight recovery in the second,” Park said. “The authorities are likely to maintain a tough stance on regulations ahead of President Xi Jinping’s third term and slightly relax the stance around the Party Congress in the autumn.”

NH Investment & Securities analyst Park In-geum predicted momentum from China’s policies to gather pace from the third quarter, saying “risks of the government’s regulations on internet platform companies may have peaked out.”

Some analysts, however, remained cautious on Chinese stocks, saying the flows to South Korean funds for the markets are just a “statistical illusion.”

Few of the funds saw significant inflows, except the TIGER China Electric Vehicle Solactive exchange traded fund (ETF), indicating South Koreans’ investment in Chinese stocks has yet to heat up.

“It is better to use any rebound as a chance to cut weight, given the possibility of increasing external uncertainties, although the potential expansion of supporting measures after the Beijing Winter Olympics and the National People’s Congress meeting in March is expected to provide some bullish factors,” said Samsung Securities analyst Chun Jong-kyu.

The markets still face the risks of China’s regulations, as well as escalations of the Sino-US trade war.

HONG KONG BETTER THAN MAINLAND

NH Investment & Securities recommended buying Hong Kong stocks that have been under pressure from regulation risks rather than shares from the mainland.

“Hong Kong market’s valuations are currently around historical troughs but earnings of companies listed on the Hang Seng Index and the Hang Seng China Enterprises Index are expected to improve from the lows in 2021,” NH’s Park said.

“Increasing inflows of funds from other countries and the mainland are also positive for Hong Kong shares.”

The South Korean brokerage house selected TIGER China Hang Seng Tech ETF and Fidelity China Fund, as well as Tencent Holdings Ltd.

Write to Jae-Won Park at wonderful@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stake

Shipping & ShipbuildingHanwha Ocean shares sink after KDB's sale of 4.2% stakeApr 29, 2025 (Gmt+09:00)

-

EnergySouth Korea nears Czech nuclear deal; Doosan, related stocks fly high

EnergySouth Korea nears Czech nuclear deal; Doosan, related stocks fly highApr 25, 2025 (Gmt+09:00)

-

-

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talks

Business & PoliticsSeoul, Washington agree on July tariff deal framework in '2+2' trade talksApr 25, 2025 (Gmt+09:00)

-

Comment 0

LOG IN