Central bank

BOK sees more uncertainty in rate cut timing, ups growth forecast

BOK raises its economic growth forecast to 2.5% from the previous 2.1% while maintaining its 2.6% inflation prediction

By May 23, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

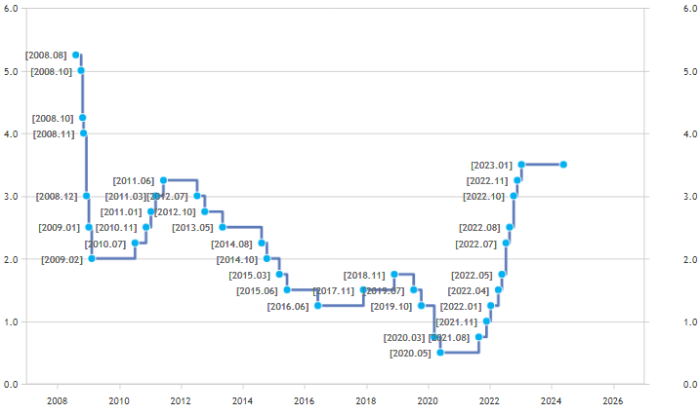

The Bank of Korea said on Thursday it has grown more uncertain about when to cut interest rates despite expectations of easing the monetary policy given the growing upside risks to inflation and as the central bank raised its growth forecast for Asia’s fourth-largest economy.

“We need more time to be confident that inflation will converge on the target as upside risks to the inflation outlook have increased since April,” BOK Governor Rhee Chang-yong told reporters after the central bank kept its policy interest rate at 3.50% in a unanimous decision for the 11th straight meeting as widely expected.

“The uncertainties over the timing of a rate cut increased,” Rhee said. “There are expectations of a cut in the second half, but it is uncertain.”

South Korea’s consumer inflation slipped to a three-month low of 2.9% in April but price pressure remained elevated given still-high agricultural product and global oil costs. Headline inflation was also much higher than the central bank’s long-term target of 2%.

The BOK said its monetary policy board plans to keep the policy tight “for a sufficient period” until the board is confident that inflation is heading to the target.

RAISES GROWTH FORECAST

The central bank ramped up its economic growth forecast for this year to 2.5% from the previous 2.1%, saying the recovery gained momentum on strong exports and that domestic demand is likely to gradually improve.

“Healthy exports are predicted to drive the recovery of the overall economy thanks to the spread of demand for AI and the revival in the global manufacturing sector,” the BOK said in its economic report, referring to artificial intelligence.

“Domestic demand including consumption is expected to gradually recover from the second half on the back of improved household income conditions due to slower inflation and higher corporate profitability."

Despite the better outlook, the BOK maintained its 2024 inflation forecast at 2.6% as the upside risks to price pressure are unlikely to be strong enough for an upward revision to the annual prediction.

The government’s measures to ease price growth are also predicted to cap inflation, the central bank added.

RATE CUT IN H2?

Rhee said the BOK revised the average monthly inflation forecast for the second half to 2.4% from the previous 2.3%, which was not high enough to tweak the annual prediction.

“We may consider a rate cut if the trend of consumer inflation falling to 2.3-2.4% is assured,” he said. “It does not necessarily mean to slash the rate in the second half as we will mull a cut only when inflation is heading to the expectations.”

Earlier this month, Rhee said the central bank will go back to square one on monetary policy given stronger-than-expected economic growth in the first quarter and delayed rate cuts in the US.

The BOK is expected to remain hawkish until policymakers see clearer signs of cooling inflation, ING said.

“We expect inflation to drop more significantly from 3Q 2024 when the BOK's tone should move dovish,” it said in a note. “We expect the BOK to deliver its first rate cut in October.”

Rhee said one policymaker out of six excluding himself said BOK needs to keep the door open to lower the base interest rate in the next three months while others supported a freeze.

“The member said the BOK should consider a cut in a pre-emptive manner as a recovery in domestic demand is likely to be relatively slow and inflation is expected to ease despite growing inflationary pressure,” Rhee said.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyBOK's rate policy back to square one after GDP, Fed comments

EconomyBOK's rate policy back to square one after GDP, Fed commentsMay 03, 2024 (Gmt+09:00)

3 Min read -

EconomyKorea’s headline inflation dips below 3% in April but erratic

EconomyKorea’s headline inflation dips below 3% in April but erraticMay 02, 2024 (Gmt+09:00)

3 Min read -

Central bankBOK likely to keep base rate unchanged until June: chief

Central bankBOK likely to keep base rate unchanged until June: chiefFeb 22, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN