Central bank

South Korea, odd one out in new global gold rush

The Bank of Korea’s gold reserves have remained unchanged since 2013 despite other central banks' recent runs on gold

By Mar 13, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea has remained muted to a new gold rush fueled by various central banks across the world gobbling up the precious metal, raising concerns that Asia’s fourth-largest economy is one of a handful of nations missing out on the great profit-making opportunity.

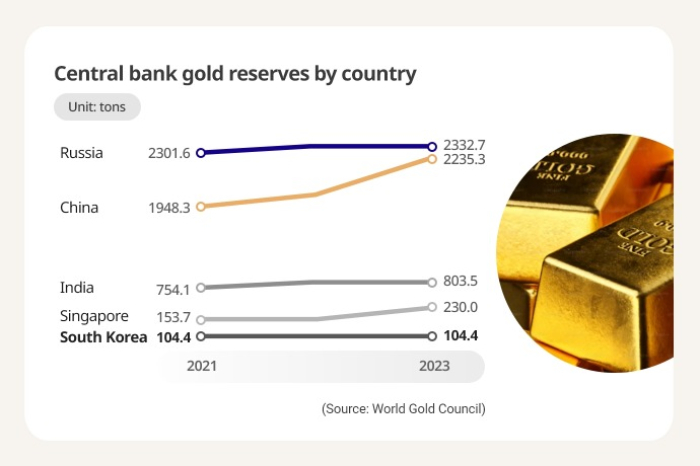

According to the World Gold Council on Tuesday, total gold holdings by central banks across the globe added 39 tons in January, extending the latest gold run after reaching 1,037.4 tons in 2023 and 1,081.9 tons in 2022.

Over the past two years, the total net purchase of gold by foreign central banks exceeded 2,000 tons, with China leading the pack.

The world’s second-largest economy has added 300 tons of the precious metal to its foreign reserves since the People’s Bank of China renewed buying it in October 2022. As of the end of 2023, the central bank’s gold reserves amounted to 2,235.3 tons.

Its counterpart in India also upped its gold reserves to 803.5 tons in 2023 from 754.1 tons in 2021, while the National Bank of Poland shoveled in 130 tons of the precious metal between April and November of last year.

Thanks to the revived global appetite for gold, its price hit a new record of $2,195.15 per troy ounce on March 8. Gold prices retreated to the $1,600 level at the end of 2022 from $1,800 earlier that year but started to rebound last year.

Considering the latest price hikes, foreign central banks stockpiling gold are estimated to have enjoyed about a 30% return from their gold holdings.

Korea’s central bank, however, has not joined the recent gold rush, with its gold reserves unchanged at 104.4 tons since 2013.

TOO LATE TO JUMP ON THE BANDWAGON

The main reason that the Bank of Korea is hesitant to up its gold stock is the current price of gold, which could be at its peak after the recent rally.

Korea's central bank bought 90 tons of gold from 2011 to 2013 at an average price of $1,629 per troy ounce. But soon after the gold price plummeted, hovering between $1,100 and $1,300 from 2014 to 2018.

The BOK was estimated to have logged about a 1.8 trillion won ($1.4 billion) loss from its gold holdings in 2015 due to the price drop.

The bank also cites the difficulty of cashing out gold because this safe-haven asset is considered a country’s last resort to safeguard against a severe national economic meltdown. The sudden disposal of gold is often seen as a red flag for a country’s economy.

Another excuse to distance itself from the latest gold fever is the lower return on gold investment than other assets.

According to the Bank of Korea, the risk-adjusted annual return of gold investment has averaged 0.26% since 1973, lower than that of US treasury investment at 0.96% and stock investment at 0.44%.

ROOM TO GROW

Still, some economists argue that the Korean central bank should consider jumping on the latest gold bandwagon as the most precious metal is forecast to extend its rally.

“The price of gold, a typical safe-haven asset, is expected to climb higher once the US starts cutting interest rates, and uncertainty over the global economy grows after the US presidential election later this year,” said Seok Byoung-hoon, professor at the Department of Economics of Ewha Womans University.

“It is time for the Bank of Korea to rebalance its asset portfolio.”

Gold made up only 1.7% of the Asian country’s foreign exchange reserves.

But earlier this year, the bank's official said Korea’s central bank does not have an imminent plan to buy more gold.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

More to Read

-

EconomyKorea’s inflation rebounds, BOK to keep interest rates in H1

EconomyKorea’s inflation rebounds, BOK to keep interest rates in H1Mar 06, 2024 (Gmt+09:00)

1 Min read -

Central bankBOK likely to keep base rate unchanged until June: chief

Central bankBOK likely to keep base rate unchanged until June: chiefFeb 22, 2024 (Gmt+09:00)

2 Min read -

Central bankSouth Korean central bank not to increase gold reserves

Central bankSouth Korean central bank not to increase gold reservesJan 19, 2024 (Gmt+09:00)

1 Min read

Comment 0

LOG IN