BOK chief says rate cut premature despite slower growth

Gov. Rhee says downward pressure on the Korean won may ease as major central banks cease rate hikes

By May 03, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s central bank chief on Wednesday said it is too early to suggest starting to cut interest rates as inflation remains above its target, defying expectations of monetary policy easing despite slowing growth in Asia’s fourth-largest economy.

“It would be a bit premature to talk about a pivot at this moment,” Bank of Korea Governor Rhee Chang-yong said in an interview with CNBC on the sidelines of the Asian Development Bank’s annual meeting in Incheon, South Korea.

“I think that given it’s above the target, we have to wait and see.”

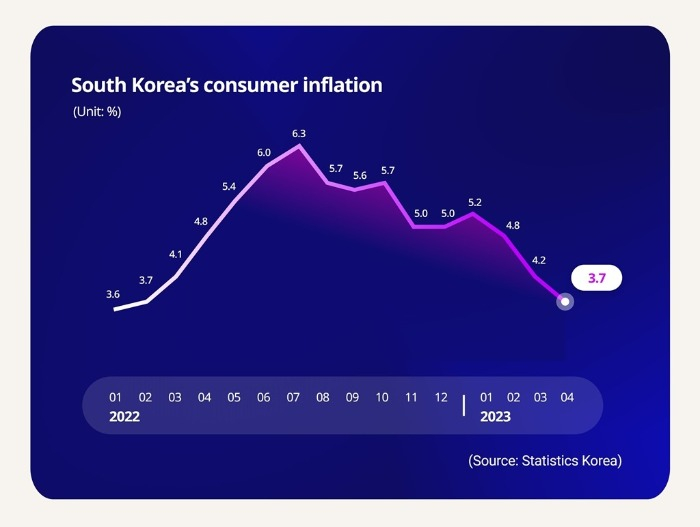

South Korea’s consumer inflation eased to a 14-month low of 3.7% in March, which is still far above the central bank’s long-term target of 2%, according to government data on Tuesday. The rate has been slowing since last July when it soared to as high as 6.3%, the highest level since the 1997-98 Asian financial crisis.

The slowing inflation caused some analysts to expect the BOK to start lowering its policy interest rate this year to support the economy.

Rhee, however, has repeatedly denied such forecasts, given growing uncertainties over inflation.

PAUSE TO ASSESS IMPACT OF RATE HIKES

The BOK kept the base interest rate at 3.50% for a second straight meeting last month in order to monitor the impact of its tightening campaign since August 2021, Rhee told CNBC.

“We paused our interest rate (hikes) in the last two meetings because we increased our interest rate by 300 basis points over one and a half years, a very fast pace,” Rhee said.

“And we think it’s the right time for us to assess what is the accumulated impact from this rapid increase.”

Rhee reiterated the possibility of a cut in economic growth forecast for this year from the current 1.6%, given a slower-than-expected economic recovery in China, South Korea’s largest overseas market.

WON’S WEAKNESS

The downward pressure on the South Korean won is likely to ease as central banks in developed countries such as the US Federal Reserve are expected to end their rate hike campaigns, Rhee said.

“I think the tightening cycle in advanced economies seems close to an end,” he said, adding that he thinks central banks in those countries cannot continue their rapid hikes, given financial stability issues in the US and Europe.

The Fed is forecast to raise the fed funds rate to a range of 5.00-5.25% later in the day and pause its tightening cycle, according to foreign media reports.

The won has lost 5.5% against the dollar so far this year, underperforming other Asian currencies.

Rhee said the South Korean currency was under more downward pressure than other regional units in April from increasing dollar demand linked to corporate dividend payments to foreign investors.

“We are not very concerned about everyday changes in the exchange rate, but we definitely have to be careful about large volatility,” he said.

Write to Jin-gyu Kang at josep@hankyung.com

Jongwoo Cheon edited this article.

-

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook dark

Foreign exchangeKorean won near 5-month low despite weak dollar; outlook darkApr 21, 2023 (Gmt+09:00)

4 Min read -

EconomyKorean economy unlikely to rebound in H2; BOK may keep rate

EconomyKorean economy unlikely to rebound in H2; BOK may keep rateApr 13, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief says tightening not over after rate freeze

Central bankBOK chief says tightening not over after rate freezeApr 11, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief defies rate cut calls amid sustained inflation

Central bankBOK chief defies rate cut calls amid sustained inflationMar 08, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK sees interest rate as tight amid continued drop in exports

Central bankBOK sees interest rate as tight amid continued drop in exportsFeb 21, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike rates

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike ratesAug 02, 2022 (Gmt+09:00)

3 Min read