Central bank

BOK takes another big step hike as weak won lifts prices

Governor Rhee Chang-yong says it is hard to say if the BOK will raise rates by 50 bps again, given the slowing economy, uncertainties

By Oct 12, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s central bank on Wednesday delivered its second 50-basis-point policy interest rate hike as the ailing won currency adds to inflationary pressure in Asia’s fourth-largest economy.

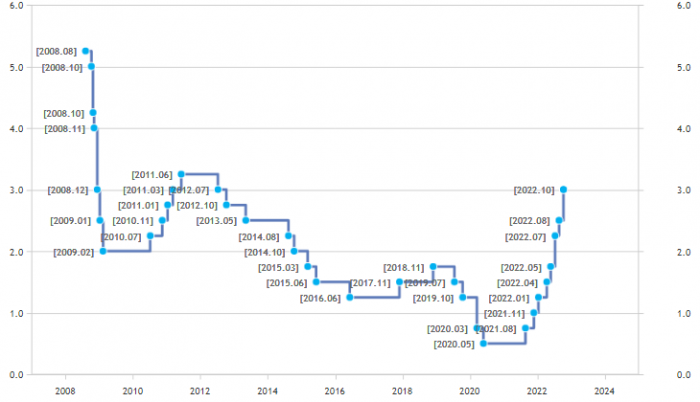

The Bank of Korea increased the base interest rate to 3.00%, the highest since October 2012, from the previous 2.50%. The decision was not unanimous with two members out of the seven monetary policy board members voting against the 50-bp raise.

It was the first time for the monetary authority to ramp up borrowing costs for five consecutive meetings, starting with the one in July when it delivered its first 50-bp rate hike.

“The board judges that the policy response should be strengthened, as additional inflationary pressures and the risks to the foreign exchange sector have increased affected by the rising Korean won to US dollar exchange rate, while inflation has remained high,” the BOK said in a statement, referring to its monetary policy board.

The won was the worst performer among emerging Asian currencies with a loss of 17.2% against the dollar so far this year.

INFLATIONARY PRESSURE FROM WEAKER WON

The BOK saw an upside risk to inflation due to the won’s depreciation although it maintained its inflationary forecasts of 5.2% in 2022 and 3.7% in 2023. The local unit’s weakness often raises import prices.

South Korea’s consumer prices grew 5.6% in September from a year earlier, although it slowed from 5.7% in August and a 24-year high of 6.3% in July.

“It is forecast that consumer price inflation will remain high in the 5-6% range for a considerable time as the impact of the rising Korean won to US dollar exchange rate acts as additional inflationary pressure,” the central bank said.

The won is likely to stay softer, given the US Federal Reserve’s hawkish stance to curb inflation in the world’s top economy.

Fed policymakers in September signaled the intention of continuing to raise federal funds rate after hiking the policy rate by 75 bps to a range of 3.00-3.25%. If the Fed delivers another 75-bp hike next month, the policy interest rate differential between the US and South Korea will widen to as much as 1 percentage point, not far from a record of 1.5 percentage points.

The Fed’s aggressive determination caused BOK Governor Rhee Chang-yong last month to indicate a 50-bp rate hike.

DIFFICULT TO SAY ON ANOTHER BIG STEP

Rhee, however, said on Wednesday that it is difficult to say whether the central bank will raise the policy rate by 50 bps again in the next meeting on Nov. 24, given a slowing economy and other uncertainties.

“It is hard to tell which direction we would take,” Rhee told reporters when asked if the possibility of another 50-bp hike is low, given the opposition of the two members.

“Most members agreed on the rate hike trend, but the board wants to see various factors and their impact on financial markets before the meeting in November.”

The BOK said the economy is expected to gradually slow on the global economic downturn and higher interest rates worldwide.

“GDP growth for this year will be generally consistent with the August forecast of 2.6%, but that for next year is projected to be below the August forecast of 2.1%,” it said.

The International Monetary Fund on Tuesday cut South Korea’s economic growth forecast for 2023 to 2% from the previous 2.1%.

Write to Mi-Hyun Jo at mwise@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

-

Central bankBOK chief signals another big step as Fed hike haunts won

Central bankBOK chief signals another big step as Fed hike haunts wonSep 22, 2022 (Gmt+09:00)

5 Min read -

EconomyKorea inflation slows, but BOK may still hike interest rates

EconomyKorea inflation slows, but BOK may still hike interest ratesSep 02, 2022 (Gmt+09:00)

2 Min read -

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike rates

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike ratesAug 02, 2022 (Gmt+09:00)

3 Min read -

Central bankBOK delivers first-ever 50-bp hike to curb inflation

Central bankBOK delivers first-ever 50-bp hike to curb inflationJul 13, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN