Central bank

BOK delivers fourth straight rate hike as inflation persists

The S.Korean central bank revised up its 2022 inflation forecast to 5.2%, the highest since 1998, while lowering its growth forecast

By Aug 25, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

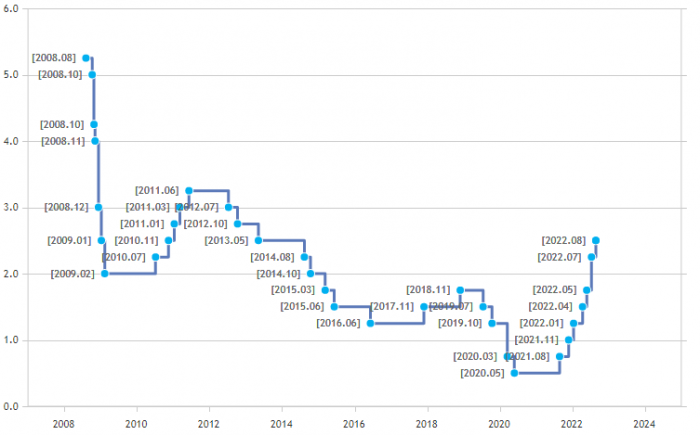

South Korea’s central bank on Thursday delivered its fourth interest rate hike in a row for the first time in its history as the monetary authorities expected inflation in Asia’s fourth-largest economy to accelerate to the highest point since the 1997-98 Asian financial crisis.

The Bank of Korea raised its benchmark policy rate by 25 basis points (bps) as expected to 2.50% in a unanimous decision.

“The board judges that the policy response to prevent the entrenchment of high inflation should be continued as inflationary pressures and inflation expectations have remained high, although economic downside risks have increased at home and abroad,” the BOK said in a statement.

The central bank ramped up its inflation forecast for this year to 5.2%, the highest since 1998 when consumer prices surged 7.5%, from the previous 4.5%. Consumer prices in July grew 6.3% in July from a year earlier, the fastest pace in nearly 24 years.

Last month, the BOK took the most aggressive measure with a 50-bp policy interest rate hike for the first time in its history to bring rampant inflation under control.

GROWING DOWNSIDE RISKS

The BOK lowered its economic growth forecast for this year to 2.6% from the prior 2.7%.

“The downside risk is greater than before as export growth slowed due to weakening economic growth in major countries, although the domestic economy remained on a recovery path given improving consumption,” BOK Governor Rhee Chang-yong told reporters after the rate hike. Rhee said concerns over a global economic slowdown have grown amid sustained inflation in major developed countries, the war in Ukraine and steep hikes in policy interest rates.

South Korea reported a trade deficit of $10.2 billion in the first 20 days of this month as shipments of key products such as semiconductors fell, more than double a shortfall of $4.8 billion in all of July, customs data showed earlier this month.

Rhee said it is appropriate to raise borrowing costs by the usual 25 bps, given such risks, reiterating his earlier stance.

“It still looks reasonable to expect the benchmark interest rate to rise to 2.75-3% by the end of the year,” he said.

The BOK is scheduled to hold two more rate-setting meetings in 2022 – on Oct. 12 and on Nov. 24.

The latest interest rate hike removed the interest rate gap between South Korea and the US, but borrowing costs of the Asian country are forecast to fall short of those of the world’s largest economy next month when the Federal Reserve is expected to tighten its monetary policy.

The US central bank is predicted to raise the target federal fund rate in the current range of 2.25-2.50% by at least 50 bps at the Federal Open Market Committee meeting to be held Sept. 20-21.

Global investors are keeping an eye on Fed Chair Jerome Powell’s speech at the annual global central bankers' conference in Jackson Hole, Wyoming, for fresh clues on how aggressive the central bank will be to curb inflation. The conference starts later in the day.

CURRENCY INTERVENTION

The South Korean won currency has softened to the weakest level since the 2008-09 global financial crisis on the Fed’s hawkish stance and other bearish factors such as the mounting trade deficit and the slowing Chinese economy.

Rhee expected the latest interest rate hike to help stabilize the won, the worst performer among emerging Asian currencies with around an 11% loss against the dollar so far this year.

He also confirmed that foreign exchange authorities have sold dollars to curb the won’s weakness.

“There has been intervention in the past few weeks as the won’s weakness was steeper than major currencies,” he said without offering any detail, making a rare confirmation on such operations by a top policymaker.

The local currency strengthened 0.6% Thursday to reach 1,333.9 versus the dollar.

Write to Mi-Hyun Jo at mwise@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EconomyKorea’s mounting trade deficit knocks won to 13-year low

EconomyKorea’s mounting trade deficit knocks won to 13-year lowAug 22, 2022 (Gmt+09:00)

4 Min read -

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike rates

EconomyKorea inflation hits highest point since 1998 crisis, BOK to hike ratesAug 02, 2022 (Gmt+09:00)

3 Min read -

Central bankBOK delivers first-ever 50-bp hike to curb inflation

Central bankBOK delivers first-ever 50-bp hike to curb inflationJul 13, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN