Carbon neutrality

Solar cells & modules, Hyundai Heavy’s hidden growth fuel

Hyundai Energy is expected to benefit from US Inflation Reduction Act of 2022; its stock price surges

By Aug 02, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

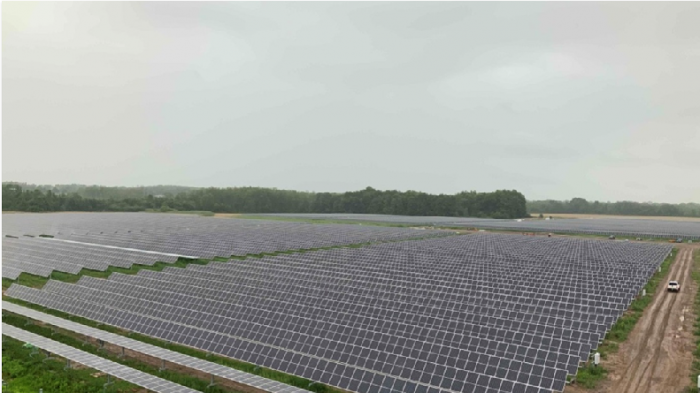

Hyundai Heavy Industries Group, the world’s top shipbuilder, secured another future growth engine from its solar cells and modules business on the growing interest in renewable energy worldwide.

Hyundai Energy Solutions Co., a subsidiary of the group’s intermediate holding company Korea Shipbuilding & Offshore Engineering (KSOE), reported record quarterly earnings on higher sales of solar modules and rising product prices.

Hyundai Energy’s operating profit soared 719.1% to 23.8 billion won ($18.2 million) in the second quarter from a year earlier with sales up 80.5% to 264.1 billion won, according to its filing to the Korea Exchange late last week. The profit was more than double analysts’ consensus forecast of 9.9 billion won.

The company, split from Hyundai Heavy Industries Co. in 2016, has been relatively unknown, compared with its bigger rivals including OCI.

TO BENEFIT FROM US INFLATION REDUCTION ACT

But its outlook is bright, especially as the Democrats in the US Senate are trying to pass the Inflation Reduction Act of 2022, which has allotted $369 billion for climate and energy provisions in the next decade, analysts said.

Reflecting such optimism, its stocks rose up to 3.6% to 52,300 won on Tuesday morning in South Korea’s main stock market when the Kospi fell as much as 0.8%. The share jumped 40.5% in July, far outperforming a 5.1% gain in the main index.

Hyundai Motor Securities analyst Kang Dong-jin nearly doubled its target price to 73,000 won from the previous 38,000 won by applying major Chinese players’ price-to-earnings ratio of 15 times.

Kang also forecast Hyundai Energy’s operating profit and net profit in 2022 at 74 billion won and 55 billion won, respectively, compared with an operating profit of 9.5 billion won and a net loss of 6.7 billion won last year.

Write to Ik-Hwan Kim at lovepen@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN