Business & Politics

S.Korea to pour $26 bn in UK’s renewables, infrastructure

Korea's sovereign wealth fund KIC, banks, Hanwha and other firms will back the investment package

By Nov 23, 2023 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

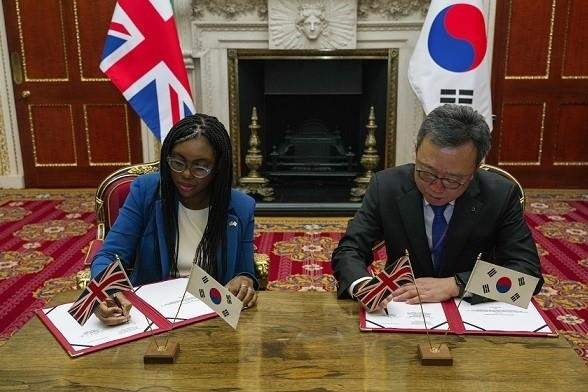

South Korea’s sovereign wealth fund, banks and other private sector companies plan to pour £21 billion ($26.3 billion) in renewables, infrastructure and financial services in the United Kingdom.

The British government announced the investment plan on Monday, the first day of Korean President Yoon Suk Yeol’s four-day state visit to the UK.

With foreign direct investment from Korea standing at £1.9 billion in 2021, the investment package shows the strength of the trading relationship between the two nations and will create more than 1,500 skilled jobs in the UK, its Department for Business and Trade stated.

Sovereign wealth fund Korea Investment Corporation (KIC) plans to invest £9.7 billion in the UK by 2033, focusing on renewable energy, fintech and life sciences, according to the statement.

State-owned Korea Development Bank (KDB) will deploy £3 billion through their operations in the UK over the next five years. The bank’s financial businesses there will include syndicated loans, project finance, fixed-income investments, trade finance, derivatives and venture capital.

KB Kookmin Bank will allocate £2 billion over the next three years for business expansion in the UK, while Hana Financial Group will invest £2.5 billion in project finance, green infrastructure, investment banking and securities in the country over the next five years.

Shinhan Bank signed a non-binding agreement with the UK to invest more than £1 billion in the infrastructure and environmental, social and governance (ESG) sectors in the European country over the next five years. Shinhan could increase the total investment to £2 billion via collaborations with its affiliates.

NongHyup Bank plans to open its first UK branch in London, of which assets are set to grow to £700 million over the next seven years. The new branch will be the bank's first overseas FX trading desk, according to the statement.

In addition, Korea’s Hanwha Aerospace Co. and Bristol-based Vertical Aerospace Ltd. will expand their partnership, expected to be valued at $1 billion.

The contract will include the engineering and manufacturing of advanced tilt and blade-pitch systems, essential components for Vertical’s flagship electric vertical take-off and landing (eVTOL) aircraft, the VX4.

Write to Bo-Hyung Kim at kph21c@hankyung.com

Jihyun Kim edited this article.

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN