Business & Politics

KoreaŌĆÖs trade deficit with China runs deep; chip support required

Active government support for key sectors is critical to tipping the balance toward a surplus, analysts say

By Jun 29, 2023 (Gmt+09:00)

3

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

UAE to invest up to $1 bn in S.Korean ventures

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

US multifamily market challenges create investment opportunities

Just like its neighboring countries in Asia, South KoreaŌĆÖs economic growth has long been swayed by the ups and downs of China, which heavily relies on cheap labor while importing advanced technologies from other countries for growth.

Recent history showed Korea has for years benefited from its trade with China as the smaller nation largely posted a surplus by exporting expensive goods, including advanced semiconductors and batteries, to its much bigger neighbor.

With ChinaŌĆÖs strengthened resource nationalism and its tech gap with Korea narrowing fast, however, the tide of the bilateral trade war is turning against Korea.

According to the Korea Economic Research Institute (KERI), affiliated with the Federation of Korean Industries, KoreaŌĆÖs trade deficit with China is running deep, widening at a fast pace recently.

After posting a record trade surplus of $62.8 billion in transactions with China in 2013, Korea has since witnessed its business dealings with the neighbor worsening.

Data showed KoreaŌĆÖs exports to China began precipitating after the fourth quarter of 2022, posting a trade deficit of $5.2 billion between May and December of that year as imports from China were rising rapidly.

The shortfall widened further to $11.8 billion in the first six months of this year.

While KoreaŌĆÖs overall trade account has been mired in the red for 15 straight months as of May, KoreaŌĆÖs accumulated trade deficit with China over the past year stood at $17 billion, according to government data.

China accounted for 43.2% of KoreaŌĆÖs total trade deficit last month, up sharply from 12.8% a year earlier.

STATE SUPPORT FOR CHIPS, BATTERIES REQUIRED

The KERI said in a recent research report that KoreaŌĆÖs export structure, heavily concentrated on a few key industries, is the main cause of the worsening trade situation with China.

While petrochemical products accounted for 89% of KoreaŌĆÖs overall exports, shipments of such products to China fell 24% in May from a year-earlier period.

Electronics goods, including semiconductors, bound for China fell the most with a 29% year-on-year decrease, followed by steel, which declined 23%.

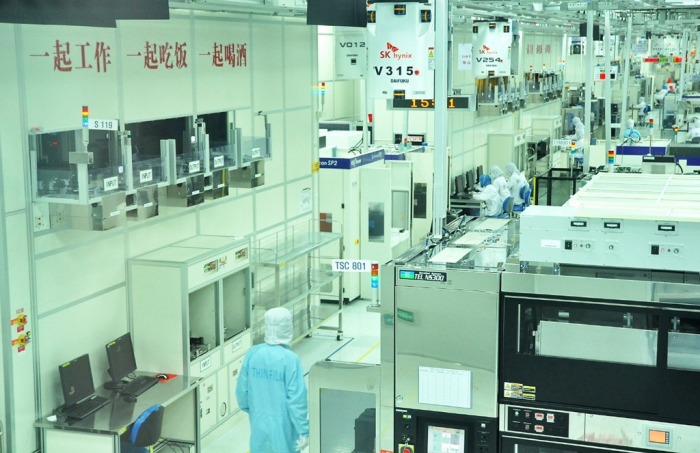

Korea is home to the worldŌĆÖs two largest memory chipmakers ŌĆō Samsung Electronics Co. and SK Hynix Inc. It also has leading battery makers such as LG Energy Solution Ltd., SK On Co. and Samsung SDI Co.

Given ChinaŌĆÖs rapid technological advancement, with some sectors already surpassing their Korean counterparts, the institute said it would be difficult to improve the situation without aggressive government support for growth sectors such as chips and batteries where Korean companies have a tech edge.

According to the Korea Institute of Science & Technology Evaluation and Planning (KISTEP), of 11 key technology sectors critical to the Fourth Industrial Revolution, Korea is behind China in five, including information and communication technology and software.

ŌĆ£Compared with the US and Europe, KoreaŌĆÖs technological advancement in major sectors is more than eight years behind,ŌĆØ said KISTEP researcher Lee Seung-suk.

ŌĆ£In the long term, export item diversification is necessary. But for now, it makes more sense to focus on those sectors where local companies have a competitive edge if the country wants to run a surplus in trade with China.ŌĆØ

Write to Mi-Sun Kang at misunny@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EconomyUS beats China to become S.KoreaŌĆÖs No.1 export destination in 2022

EconomyUS beats China to become S.KoreaŌĆÖs No.1 export destination in 2022Jun 22, 2023 (Gmt+09:00)

4 Min read -

EconomyKoreaŌĆÖs current account swings to deficit, four-month figures worsen

EconomyKoreaŌĆÖs current account swings to deficit, four-month figures worsenJun 09, 2023 (Gmt+09:00)

2 Min read -

-

Business & PoliticsSouth Korea officially asks US to ease chip rules on China expansion

Business & PoliticsSouth Korea officially asks US to ease chip rules on China expansionMay 24, 2023 (Gmt+09:00)

4 Min read -

EconomyChinese weak domestic demand causes S.Korean trade deficit: report

EconomyChinese weak domestic demand causes S.Korean trade deficit: reportApr 27, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN