Blockchain technology

Finhaven to launch world's first blockchain-powered exchange

By Dec 21, 2020 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

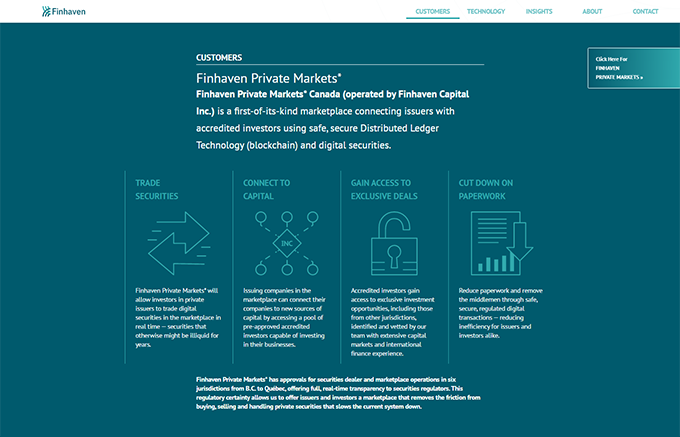

Canada-based fintech startup Finhaven is set to launch Finhaven Private Markets, the world's first blockchain-powered securities exchange using digital securities to receive government clearance.

Last month, the British Columbia Securities Commission (BCSC) gave the green light for Finhaven to operate its securities exchange powered by distributed ledger technology, according to the venture capital industry on Dec. 21.

This is owing to Canada-based financial regulators adopting a regulatory sandbox initiative to foster the blockchain industry. A regulatory sandbox system provides regulatory exemption for fintech startups to introduce and experiment with new technology over a period of time under regulatory supervision.

Finhaven was established in 2018 by Chief Executive Kim Do-hyung, a South Korean veteran in the financial arena given his years of experience at global investment bank Merrill Lynch.

In an era of digital securities, Finhaven simplifies the transaction process by using blockchain technology and providing peer-to-peer transactions.

Instead of collecting all of the transaction data into a single place, it uses distributed ledger technology, by which all of the participants share a piece of transaction data and thus simplifies the transaction structure between the buyer and the seller, with Finhaven as a witness to validate the transaction.

“In most Western developed countries, securities transactions rack up a considerable amount of fees since they involve various authorities – all of which were set up in the days of paper notes,” said CEO Kim.

According to Kim, Finhaven's technology offers a paperless custodial and settlement solution for all market participants, which drastically reduces transaction fees. It also automates the exchange of documents and certificates that have slowed down the current system.

Securities traded on Finhaven will be shares of non-listed companies, convertible bonds and bonds with warrants. Companies that need to raise funds can get listed on the exchange, and investors can trade the companies’ shares via negotiation. The investments will be determined based on the latest enterprise value updated in real time.

“It will help non-listed companies raise funds and also boost the exit market for existing investors,” Kim said.

Finhaven plans to open the exchange in the first quarter of next year. It aims to register around 30 companies by 2022, with each company’s trading volume ranging between 10 billion won ($9 million) and 15 billion won.

Finhaven is also preparing to launch Series B funding, which is likely to attract existing investors alongside various financial investment firms in Canada. The company plans to use the funds to expand its operations to overseas markets, including the UK.

In 2018, Finhaven raised $6 million in Series A funding from Dunamu, operator of Korea's largest cryptocurrency exchange Upbit, and venture capital firm Medici Investment.

Write to Jung-hwan Hwang at jung@hankyung.com

Danbee Lee edited this article.

More to Read

-

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google21 HOURS AGO

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN