Samsung Biologics to spin off biosimilar unit Samsung Bioepis

Group-wide restructuring aims to resolve business conflicts while enhancing the CDMO drug development focus

By 3 HOURS AGO

South Korea’s Rznomics inks $1.3 bn out-licensing deal with Eli Lilly

In China’s waterway city Hangzhou, K-beauty redefines ‘shuiguang'

Korea’s aesthetic medicine enjoys golden era with surge in foreign spending

When in S. Korea, it’s a ritual: Foreigners make stops at CU, GS25, 7-Eleven

Kumho Tire shuts Gwangju plant after fire, derailing record sales run

Samsung Biologics Co., the world’s largest contract drugmaker, will undergo a strategic split to separate its contract development and manufacturing organization (CDMO) business from its biosimilar and novel drug development business, currently undertaken by its wholly owned Samsung Bioepis Co.

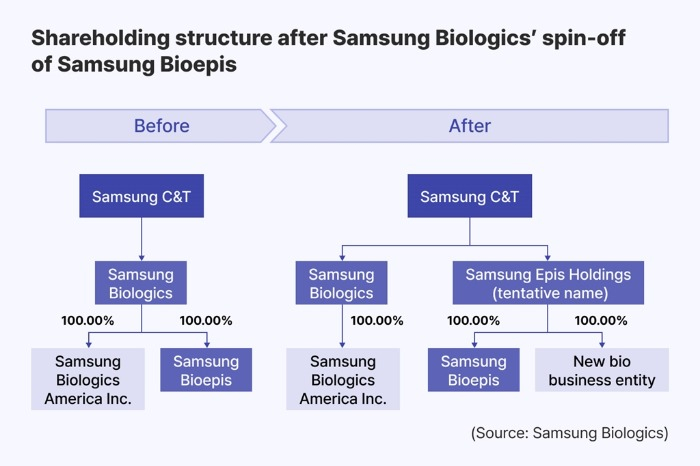

Samsung Biologics, the biotechnology unit of South Korea’s top conglomerate Samsung Group, said in a regulatory filing on Thursday that it will establish a new holding company – tentatively named Samsung Epis Holdings – to oversee Samsung Bioepis and other biosimilar and new drug development businesses.

Analysts said the move is intended to clarify the business structure, unlock corporate value and reinforce Samsung Group’s presence in the high-margin pharmaceuticals sector.

The separation comes as part of a broader restructuring aimed at eliminating the conflict of interest between Samsung Biologics and Samsung Bioepis, which develops biosimilars and is increasingly pivoting into novel drug development.

RELISTING SCHEDULE

The new holding company will be created via a spin-off scheme, with shareholders of Samsung Biologics receiving proportional stakes in both the existing CDMO-focused entity and the new firm.

Following the spin-off, Samsung Bioepis will become a wholly owned unit of Samsung Epis Holdings, which is expected to be officially established on Oct. 1.

The spin-off will be subject to shareholder approval at a general meeting scheduled for Sept. 16, following the filing of a securities registration on July 29, according to Samsung Biologics.

Under the proposed restructuring, shareholders will receive 0.65 shares in Samsung Biologics and 0.35 shares in the new Samsung Epis Holdings per share currently held.

Shares of Samsung Biologics will be suspended from trading between Sept. 29 and Oct. 28. Shares of the two new companies will start trading on the Kospi bourse on Oct. 29.

SAMSUNG BIOLOGICS AS A PURE CDMO PLAY

Samsung Biologics will remain a pure-play CDMO entity, while Samsung Epis Holdings will be dedicated to developing biosimilars and novel biologics.

Samsung Biologics said the split will enhance each entity’s strategic focus and reduce potential concerns over intellectual property conflicts – a longstanding issue among multinational pharmaceutical clients wary of Samsung’s parallel activities in biosimilar development.

Major clients who entrust Samsung Biologics with the production of pharmaceuticals include Pfizer, MSD (Merck & Co.), Roche, AstraZeneca, Novartis, GSK and Eli Lilly.

Industry watchers said one of the biggest obstacles when they entrusted contract drug-making to Samsung Biologics was Samsung Bioepis, which develops biosimilars.

“By evolving into a dedicated CDMO player, Samsung Biologics will be able to double down on its core growth strategy of expanding production capacity, diversifying its portfolio and strengthening its global footprint,” said a company official. “This includes deeper investments in advanced biologics platforms such as antibody-drug conjugates (ADCs), adeno-associated virus (AAV) vectors and prefilled syringe (PFS) technologies.”

SAMSUNG BIOEPIS TO FOCUS ON BIOSIMILARS, NOVEL DRUGS

Samsung Bioepis, which has over 20 biosimilar assets under development, has also entered clinical stages for several gene therapy candidates and ADC-based cancer treatments.

Chief Executive Kim Kyung-ah will concurrently serve as CEO of its parent Samsung Epis Holdings.

John Rim, CEO of Samsung Biologics, said: “The separation enables both entities to respond swiftly and decisively to the fast-evolving global biotech environment. By focusing on their respective strengths, both can secure leading positions in their fields.”

SAMSUNG GROUP ALSO SET TO BENEFIT

For Samsung Group, the benefits of the spin-off extend beyond business clarity.

Analysts said the spin-off will improve the valuation prospects of Samsung Biologics and Samsung Bioepis, while also boosting the value of their parent, Samsung C&T Corp.

Samsung Biologics’ corporate value stands at 78.3 trillion won ($56.9 billion) – more than 3.3 times that of Samsung C&T.

Samsung Biologics trades at a price-to-book ratio of 7.18, compared to a multiple of 0.73 for its parent.

Given Samsung Group’s ongoing challenges in the semiconductor business, led by Samsung Electronics Co., some analysts view the biopharma business among the most valuable growth engines within the conglomerate.

Write to Dae-Kyu Ahn at powerzanic@hankyung.com

In-Soo Nam edited this article.

-

Bio & PharmaKorean court rules in favor of Samsung Bioepis over Regeneron’s Eylea

Bio & PharmaKorean court rules in favor of Samsung Bioepis over Regeneron’s EyleaFeb 21, 2025 (Gmt+09:00)

2 Min read -

Korean stock marketSamsung Biologics shares fly high to be Korea’s third most valuable firm

Korean stock marketSamsung Biologics shares fly high to be Korea’s third most valuable firmFeb 07, 2025 (Gmt+09:00)

2 Min read -

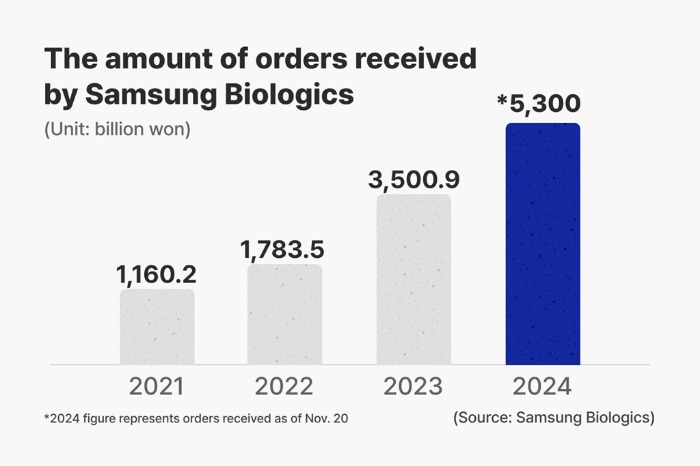

EarningsSamsung Biologics posts record 2024 sales, operating profit as it goes global

EarningsSamsung Biologics posts record 2024 sales, operating profit as it goes globalJan 22, 2025 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Biologics signs initial deal with LigaChem Bio on ADC production

Bio & PharmaSamsung Biologics signs initial deal with LigaChem Bio on ADC productionJan 09, 2025 (Gmt+09:00)

2 Min read -

Bio & PharmaSamsung Biologics wins $668 million CDMO deal with European pharma

Bio & PharmaSamsung Biologics wins $668 million CDMO deal with European pharmaNov 20, 2024 (Gmt+09:00)

4 Min read -

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with Epysqli

Bio & PharmaSamsung Bioepis to enhance biosimilar presence with EpysqliJun 12, 2023 (Gmt+09:00)

3 Min read -

Bio & PharmaSamsung Bioepis sees greater market for Byooviz eye disease biosimilar

Bio & PharmaSamsung Bioepis sees greater market for Byooviz eye disease biosimilarJul 18, 2022 (Gmt+09:00)

2 Min read -

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plans

PharmaceuticalsSamsung Bioepis to double biosimilars, may resume Nasdaq listing plansFeb 24, 2022 (Gmt+09:00)

3 Min read