LabGenomics plans to buy 4 to 5 more CLIA labs in US by 2027

The S.Korean molecular diagnostics developer acquired a major US CLIA lab in July to sell its products in the US from 2024

By Aug 02, 2023 (Gmt+09:00)

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

UAE to invest up to $1 bn in S.Korean ventures

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

US multifamily market challenges create investment opportunities

LabGenomics Co. will advance into the US diagnostics market with laboratories regulated by the countryŌĆÖs Clinical Laboratory Improvement Amendments (CLIA) under an initial plan to rake in about $130 million in sales in the US next year.

The South Korean molecular diagnostics developer will buy one more CLIA-licensed lab in the US this year and three to four more CLIA labs by 2027, Lee Jong-hoon, co-chief executive officer of LabGenomics, said at the companyŌĆÖs press briefing on Monday.

ŌĆ£We also consider setting up our own CLIA lab in the US in the long term,ŌĆØ Lee added.

LabGenomics last week acquired QDx Pathology Services, a US-based anatomical, molecular and clinical pathology lab regulated by the CLIA with an annual revenue of about 70 billion won ($54.1 million).

Before the acquisition, the company injected 76 billion won into its US operation LabGenomics USA in early July to buy the CLIA lab, according to the company's separate press release.┬Ā

In the US, in vitro devices (IVDs) are regulated and approved by the US Food and Drug Administration (FDA), while laboratory-developed tests (LDTs) are under the oversight of the CLIA program, which regulates private labsŌĆÖ testing performance on patient specimens to ensure accurate and reliable test results.

Because diagnostics developed by CLIA-licensed labs do not require extra FDA approval, it is faster and cheaper for foreign diagnostics companies to make inroads into the US via CLIA labs.

ŌĆ£Fees for medical services are higher in the US than in Korea, and the countryŌĆÖs CLIA labs expedite the commercialization of (diagnostics) products,ŌĆØ said Lee. ŌĆ£This is why we must foray into the US diagnostics market.ŌĆØ

GOAL TO EARN $130 MILLION IN THE US

LabGenomics has focused on the US market as part of its post-COVID-19 strategy since its largest shareholder was changed to Luha Private Equity Inc., a Korean PEF, in August last year.

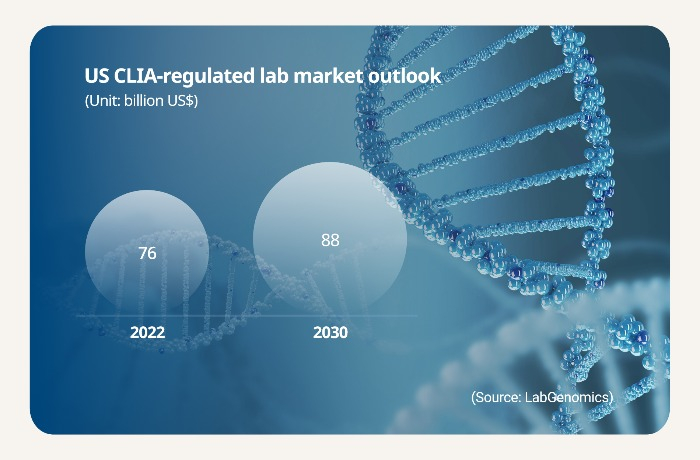

The Korean company projects the US CLIA lab market to grow to $88 billion in 2030 in $76 billion in 2022. There are over 300,000 CLIA labs in the country.

ŌĆ£We have signed memorandum of understanding contracts with various companies since January,ŌĆØ added Lee. ŌĆ£We have secured a diverse collection of products to meet different needs.ŌĆØ

The company will focus on high-value-added diagnostics products such as NGS services, Lee said.

ŌĆ£We plan to offer our services at about 30% cheaper prices and design our business model to allow patients and insurance companies to enjoy the benefits,ŌĆØ said Lee.

Founded in 2002, LabGenomics develops genetic analysis devices and diagnostic products including DNA clips, PCR kits, POCT, medical devices and NGS-based diagnostics.

Its shares were trading at 9,030 won apiece, up 0.9%, in the morning session on Wednesday.

Write to Jeong Min Nam at peux@hankyung.com

Sookyung Seo edited this article.

-

Beauty & CosmeticsLabGenomics, Amorepacific sign gene testing service supply deal

Beauty & CosmeticsLabGenomics, Amorepacific sign gene testing service supply dealApr 17, 2023 (Gmt+09:00)

1 Min read -

-

Bio & PharmaLabGenomics unites with Humanscape on Asia, US genetic testing biz

Bio & PharmaLabGenomics unites with Humanscape on Asia, US genetic testing bizDec 20, 2022 (Gmt+09:00)

1 Min read