Beauty & Cosmetics

Korean cosmetics beat Chanel, Lancôme to rank top in US, Japan

K-beauty exports reached a record $10.2 billion in 2024; Basic cosmetics lead in US, while color goods popular in Japan

By Jan 05, 2025 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

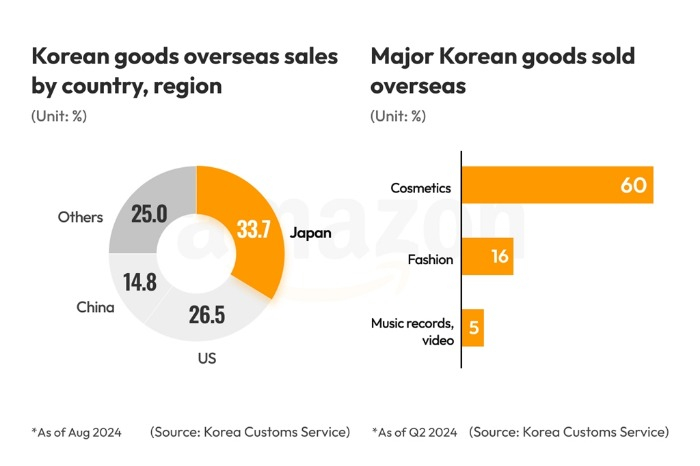

South Korea’s cosmetics products, also known as K-beauty, have gained global renown, overtaking French brands such as Chanel and Lancôme to emerge as the No. 1 imported beauty goods in the US and Japan.

According to industry and government data on Sunday, Korea has established itself as a “cosmetics powerhouse,” with Korean skincare dominating the US market while Korean color makeup goods drive growth in Japan.

Data from the US International Trade Commission showed that US imports of Korean cosmetics reached $1.41 billion from January to October 2023, as Korea overtook France's $1.03 billion to lead the US imported cosmetics market.

Korean cosmetics firms captured a 22.2% market share in the US, higher than French firms’ 16.3%, data showed.

In Japan, Korean beauty companies retained their top spot in the imported makeup goods market for a third consecutive year in 2024.

According to Japan’s Imported Cosmetics Association, 94.2 billion yen ($599 million) in Korean cosmetics were imported in the first nine months of 2024, followed by French makeup products worth 82.3 billion yen.

Korean firms held a 28.8% market share in Japan, while French firms held 25.1%.

RECORD K-BEAUTY EXPORTS

According to the Ministry of Trade, Industry, and Energy on Sunday, Korea's cosmetics exports soared to a record $10.2 billion in 2024, up 20.6% from the year prior.

Korea’s cosmetics exports previously peaked at $9.2 billion in 2021 before slowing to $8 billion in 2022 and $8.5 billion in 2023.

Data from the Korea Customs Service showed that skincare exports to the US rose more than threefold to $815.1 million in 2024 from $231.9 million in 2020. Color cosmetics exports to the US market more than doubled over the same period, to $267.8 million from $124 million.

Color makeup products to Japan rose by 1.6 times to $316.6 million from $196.9 million over the period, while exports of basic cosmetics to Japan increased by 1.3 times to $258.4 million from $202 million.

Analysts said the surging demand for Korean skincare products in the US reflects a growing interest in functional cosmetics such as anti-aging products.

Meanwhile, in Japan, K-pop idols have influenced MZ-generation consumers — those born between the early 1980s and early 2000s — to emulate the makeup styles of Korean female celebrities, they said.

TARGETING US MARKET

Korean cosmetic firms are increasingly targeting the US market, the world’s largest with a market size valued at $96.4 billion as of 2022, according to the Korea Health Industry Development Institute.

China ranked second with a market valuation of $71.1 billion, followed by Japan with $26.9 billion.

Amorepacific Corp., which reduced its reliance on China over the past few years to focus on the North American market, saw its US sales rise to 356.2 billion won ($242 million) in the third quarter of 2024 from 76.6 billion won in 2022.

LG H&H Co., formerly LG Household & Health Care, is launching products exclusively for the North American market.

In her New Year’s address, LG H&H Chief Executive Lee Jung-ae said she would strengthen the North American market lineup by boosting investments in the region.

INDIE BRANDS FLY OFF SHELVES ON AMAZON

The renewed popularity of K-beauty in the US and Japan is being led by indie brands with few or no offline outlets.

Their beauty products are often top picks on Amazon.com, eBay Japan, Shopee and other global e-commerce platforms, fueled by the growing popularity of K-beauty products worldwide.

Since last year, several K-beauty products have ranked at the top of cosmetics sales during Amazon's Prime Day event, with brands like Cosrx Inc. leading the way.

Other Korean bestsellers on Amazon include Beauty Selection, VT Co., Goodal, Tirtir, Anua, d'Alba and Beauty of Joseon.

REGULATORY CHANGES UNDER SECOND TRUMP TERM

However, potential regulatory changes under the second Trump administration, such as a proposed 10–20% universal tariff on imports, could impact the price competitiveness of K-beauty products in the US, where they are now duty-free.

To mitigate such risks, Korean original design manufacturers (ODMs) are beefing up their US production facilities.

Kolmar Korea, which operates a production plant in Pennsylvania, plans to build a second plant there in the first half of this year.

“We will also work closely with Korean indie brands to increase our ODM sales in the US market,” said a Kolmar Korea official.

Cosmax Inc., Korea's largest cosmetics ODM company, operates a factory in New Jersey.

Since the third quarter of last year, Cosmax has operated a sales office in the western US to strengthen sales of its products in cooperation with local indie brands.

Write to In-Soo Nam at isnam@hankyung.com

Joel Levin edited this article.

More to Read

-

Korean foodK-food, fashion, beauty to up ante on global push in 2025

Korean foodK-food, fashion, beauty to up ante on global push in 2025Dec 31, 2024 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platforms

Beauty & CosmeticsKorean cosmetics fly off shelves on Amazon, other e-commerce platformsSep 26, 2024 (Gmt+09:00)

4 Min read -

Beauty & CosmeticsKorean cosmetics, Amazon Prime Day’s top beauty products

Beauty & CosmeticsKorean cosmetics, Amazon Prime Day’s top beauty productsAug 02, 2024 (Gmt+09:00)

1 Min read -

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exports

Beauty & CosmeticsKorean cosmetics makers see record Q2 profits led by exportsJul 17, 2024 (Gmt+09:00)

3 Min read -

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands grow

Beauty & CosmeticsKorean cosmetics makers' profits soar as niche brands growJan 18, 2024 (Gmt+09:00)

2 Min read -

Beauty & CosmeticsKolmar Korea to enter $22 billion UAE Halal cosmetics market

Beauty & CosmeticsKolmar Korea to enter $22 billion UAE Halal cosmetics marketSep 08, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN